The most recent addition to the Emerging Companies Portfolio closed at long-term highs yesterday, trading up strongly in the past week following an update on demand coming out of their Chilean business. Austin, a company that designs and manufactures mining equipment including dump truck trays and buckets, has seen growing demand for new products which also dovetails into an increase in recurring revenue from repairs. The custom-designed trays used across iron ore (~30%), coal (~25%), copper (~15%) and gold (~15%) mining with ~55% of revenue coming from Asia Pacific (including Australia). Their product is up to 10% lighter than competitors which leads to significant cost savings in use by mining companies.

Last week the company flagged an increase in activity in Chile with an order for a customized dipper bucket worth over $2.5m while we expect to see further growth in the region on the back of a stronger copper price driving an increase in mining volumes. This order followed a $7m deal that was announced earlier this year to be delivered in FY24, a contract that is likely to grow in FY25. The company also flagged growth in rebuilds and repairs, 35 repairs have already been completed in FY24 in Chile alone, with an additional 6 currently with the company.

While Austin reiterated FY24 guidance last week, the numbers look conservative based on the recent news flow. Both margins and volumes have been growing thanks to additional capacity coming on ahead of demand, while Austin has successfully integrated their FY23 acquisition of Maintec which is starting to contribute to organic growth. Consensus expectations are nearer to the lower end of earnings guidance as well, ~$30.5m profit vs $30-33m guided, expected to grow earnings ~75% in FY24 and ~17% in FY25 on an expected FY24 PE of less than 10x.

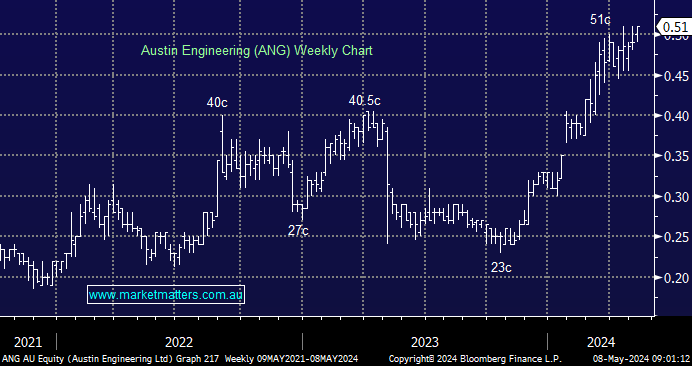

- Austin saw an inflection point in FY22/23, we expect earnings to grow strongly through FY24-FY26 while the company is conservatively priced.