ANG -1.19%: a choppy day for the mining equipment company, Austin came in near the top of recent guidance on the 1H. Revenue grew 26% to $143.6m, while EBIT jumped 82% to $16.8m on higher margins. We spoke to the company today, some key takeaways:

- The company has added capacity and demand is filling the new supply

- Maintec acquisition is performing well

- Guidance for FY24 Rev $310-330m & NPAT $31-33m, around 7% & 12% above consensus at the respective midpoints.

- Order book at record levels provides clear visibility for near-term earnings.

- Dividends have been reinstated, paying 0.4cps fully franked. ANG is confident they will be debt free in this FY.

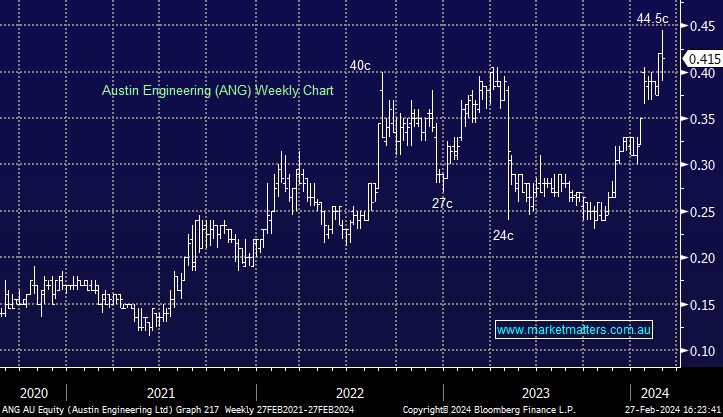

A very good result from Austin, shares were strong leading into the report though which meant a lot of it was in the price. This is one we continue to like but want to see some heat come out first.