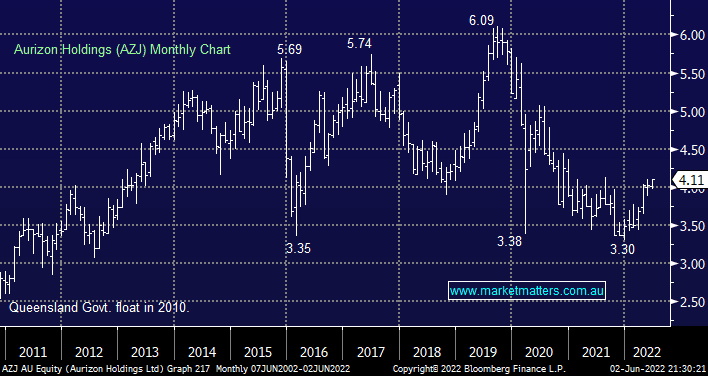

Rail freight business AZJ rallied 2% yesterday in a falling market as its recognition as a defensive stock helped it add to its strong performance through 2022. The stock remains fairly cheap following a woeful few years, it’s trading on an Est. P/E of 15.2x for 2022 while a projected 5.7% yield over the next 12-months is very attractive, although it’s only partly franked. This Australian industrial company has paid a solid dividend in good and bad times including right through the pandemic making it a prime candidate for MM when we migrate our portfolios further down the risk curve.

scroll

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Close

Close

Thursday 3rd July – Dow -10pts, SPI off -11pts

Thursday 3rd July – Dow -10pts, SPI off -11pts

Close

Close

MM is bullish AZJ medium-term

Add To Hit List

Related Q&A

View on AZJ (Aurizon Holdings)

MM’s thoughts on PGC & AZJ?

Updated view on AZJ

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Thursday 3rd July – ASX -42pts, PME, NWH, GLF

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 3rd July – Dow -10pts, SPI off -11pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.