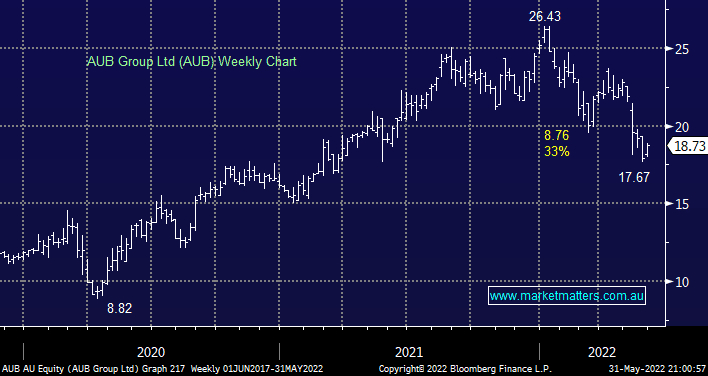

Insurance broker AUB successfully raised $350mn last month from institutions at $19.50 to fund the acquisition of Tysers for $880mn, approx. 18 million new shares have been issued under the raise leaving the business now capitalised at $1.685bn. In April AUB announced net profit up 17% to $30mn for the half-year, MM believes the stock’s 33% decline through 2022 and especially since the cap raise is providing some decent value for investors aided by a forecasted 3.1% fully franked yield.

The company has a good track record for executing acquisitions such as Tysers i.e. the purchase should be earnings accretive yet it’s currently depressing the share price.