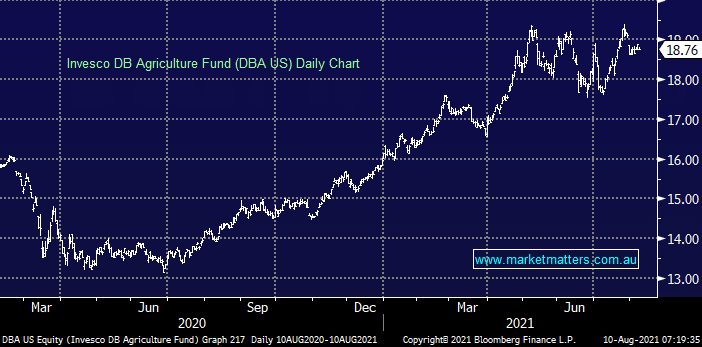

The price of commodities which makes up much of our foodstuffs have rallied strongly over the last year e.g. Wheat +17% and Corn +14%. In our opinion this is the start of rising inflation following mass economic stimulus but there’s no hurry to force this view on markets, although the increase is slowly paying dividends for our Agriculture Fund ETF (DBA US) held in our Global Macro ETF Portfolio i.e. this ETF tracks 11 of the main agricultural commodities and its up around 50% since June 2020.

If the price of food products are going to rise then obviously producers will be looking “to make hay when the sun shines” as it becomes even more cost effective to increase the assistance with efficiencies towards production e.g. fertilizers increase productivity. The fertilizer industry is understandably benefiting from strong demand and pricing for crop nutrients such as potash and phosphate. The backdrop is simple to comprehend: the strength of the agricultural market and rising crop prices is driving up the demand for fertilizers across the globe.

Today we’ve taken a quick look at often ignored stocks in the ASX200 who operate in this space to see if any value has emerged.