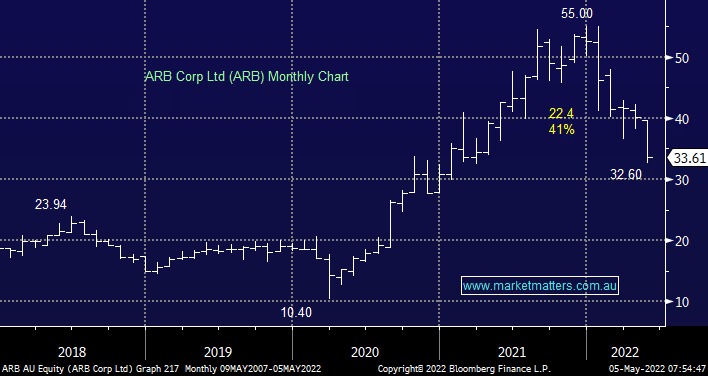

On Wednesday 4-wheel drive accessories business ARB disappointed investors with its latest trading update which showed a slowdown in sales over the 3rd quarter. The company is struggling with staff like many businesses post COVID plus the huge and mounting new car back-log looks set to see sales growth slow further, lastly for good measure the increase costs of commodities is squeezing materials and margins i.e. when it rains it pours! We like ARB – it’s close to being my favourite retailer – but as we’ve seen recently stocks that deliver weak results continue to slide, hence a little more downside wouldn’t surprise. From a valuation perspective, it’s now on 21.9x FY22 earnings which is cheap compared to it’s 5 year average of 27.5x.

scroll

Question asked

Question asked

Question asked

Gerrish: The correction is done, we’re positioning for what comes next

Gerrish: The correction is done, we’re positioning for what comes next

Close

Close

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Close

Close

Friday 9th May – Dow up +254pts, SPI up +3pts

Friday 9th May – Dow up +254pts, SPI up +3pts

Close

Close

MM is neutral ARB here, but would become interested ~$30

Add To Hit List

Related Q&A

ARB Corp Ltd (ARB)

NWL, ARB, HUB

What’s the best ‘car stock’ to buy?

Relevant suggested news and content from the site

Video

WATCH

Gerrish: The correction is done, we’re positioning for what comes next

The Market Matters lead portfolio manager talks the recent recovery, Trump, gold, and why he thinks there's plenty of opportunities.

Video

WATCH

A discussion with Geoff Wilson – Wilson Asset Management & James Gerrish – Market Matters

Recorded Monday 31st March

Podcast

LISTEN

Friday 9th May – Dow up +254pts, SPI up +3pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.