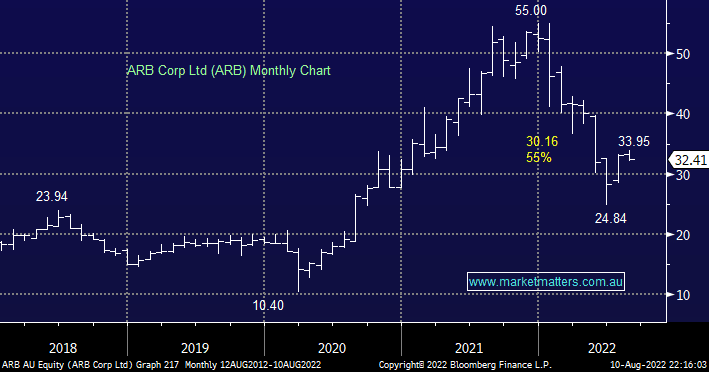

This 4-wheel drive accessories business has now corrected 55% from its late 2021 high, further than we were expecting. The company has struggled on a number of different operating fronts but as people tighten their belts it might get a touch worse before it gets better – all may be revealed when the company reports its full-year results on the 23rd although in May they’ve already delivered a tough update which sent the stock sharply lower.

MM continues to believe this is a quality company and with it already trading on 21x FY22 earnings, compared to a 5-year average of 27.5x, we feel like a lot of bad news is built into the stock.

- Back in June MM said we “liked ARB under $30” which has proved ok to-date but we can see a better opportunity on the horizon.