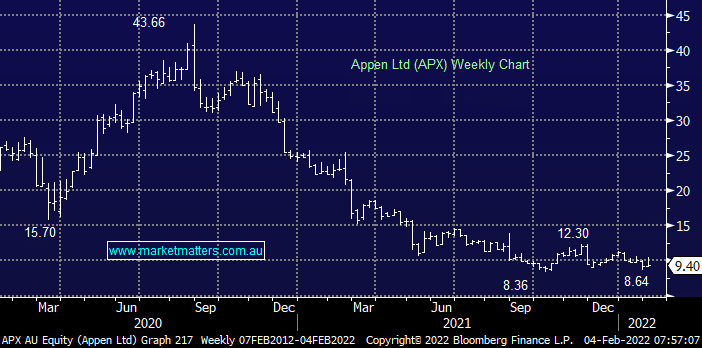

AI business APX has been a local casualty of a tech stock failing to deliver, we took an aggressive position in mid-November and even that’s now underwater as its peers crushes sentiment across the growth space. However we do believe the next 20% is up for APX and its tempting to average into weakness, not exactly following our “buy quality” mantra but as a short-term 1-3 month foray it feels correct, especially if the tech indices reach our targets and APX can hold the mid $8 region.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Tuesday 1st July 2025 – Dow +275pts, SPI down -6pts

Tuesday 1st July 2025 – Dow +275pts, SPI down -6pts

Close

Close

Monday 30th June – Dow up +432pts, SPI up +5pts

Monday 30th June – Dow up +432pts, SPI up +5pts

Close

Close

MM thinks APX is looking for a low

Add To Hit List

Related Q&A

McMillan Shakespeare Ltd (MMS)

NEC and APX

Appen and Nuix

MCMILLAN SHAKESPEARE LIMITED

Appen Ltd (APX)

Thoughts on MMS?

Pullback on MMS and SIQ

Thoughts on Appen (APX) and CSR

Thoughts on mff

MMS view going forward

Sigma and Chemist Warehouse merger

Any thoughts on Meteoric Resources (MEI)?

Thoughts on MMS and SIQ share price movements

MM call to ‘Cut Losers’ like MFG, KGN, APX

Does MM prefer MMS or SIQ?

Updated view on few battered up stocks?

Appen (APX)

New CBA Hybrid + APX & CSL

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Tuesday 1st July 2025 – Dow +275pts, SPI down -6pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Monday 30th June – Dow up +432pts, SPI up +5pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.