AAL is “in play” as BHP, and potentially its rivals, weigh up how much they want its copper assets. The synergies for BHP are strong from both a geographical and commodity mix perspective while Anglo has been poorly managed, leaving a lot of ‘fat’ within a bloated operation. BHP has close to 25,000 employees in Chile, where it mines copper, and two of Anglo’s best copper assets are also in Chile where they have ~4000 staff on the ground – a merger should deliver obvious initial synergies with staff and haulage.

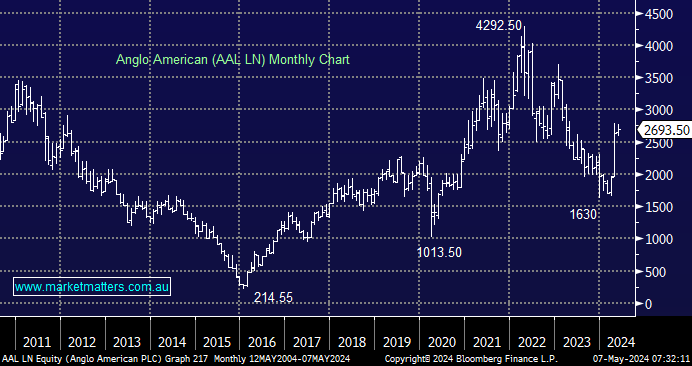

- We believe BHP is a strong favourite to buy AAL, with a likely increased bid over the coming days/weeks, the AAL share price is expecting such a move.

NB BHP’s bid for AAL is all-scrip, and BHP has fallen around 6% since the initial bid. It needs to sweeten the deal, but not too much, or the stock will fall further.

This morning, we’ve briefly looked at some of the potential players in this fascinating M&A play.