AMP has just absorbed Nano Digital Home Loans as the fintech-enabled home loan business failed to secure enough money to expand – Nano added $400mn in loans increasing AMP’s book by over 15% in the process. AMP is transforming its business as it expands its home loan operations switching focus to banking and wealth management as they move out of asset management. We believe this and likely similar moves are good for AMP as smaller lending businesses struggle as cash rates surge higher which has created an environment that favours the large players.

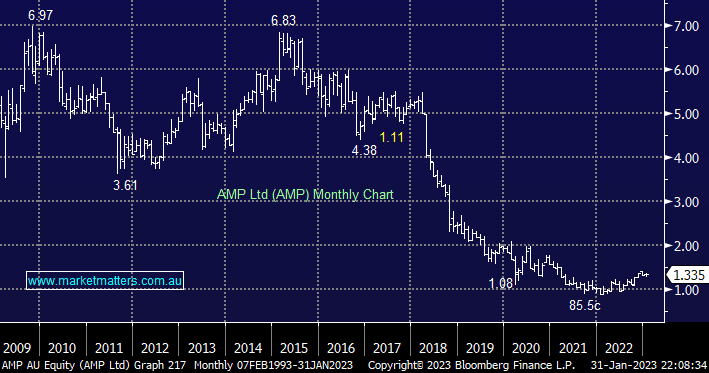

AMP has unfortunately been one of the market’s worst performers over the last 15 years but it rallied +30% in 2022, while we don’t believe it’s now overly cheap back above $1.30 the risk/reward looks good into dips, especially with the market still neutral at best the business i.e. the stocks trading on 0.95x Price to book for the last quarter. It might actually surprise some subscribers to know that we believe AMP has become a conservative investment around the $1.20 area.

The Market Matters Website shows i.e. 4 holds, 3 sells and 1 strong buy illustrating that brokers take time to forget regular misses. AMP Broker Calls – https://marketmatters.com.au/company/amp-ltd-amp/

- We have considered AMP on a number of occasions over the last 12 months but other stocks have ultimately received our vote however we believe AMP’s business is slowly but surely strengthening itself.