The Chinese e-commerce giant announced its results on Friday, saying it planned to invest further in the AI sector but did not provide an exact figure at the time—a result that has been largely ignored compared to recent macro events. BABA integrates AI into its e-commerce, cloud computing (Alibaba Cloud), and logistics businesses for subscribers unfamiliar with the business. It also launched Tongyi Qianwen, a ChatGPT-like AI model, as it strives to become an AI powerhouse in the years ahead.

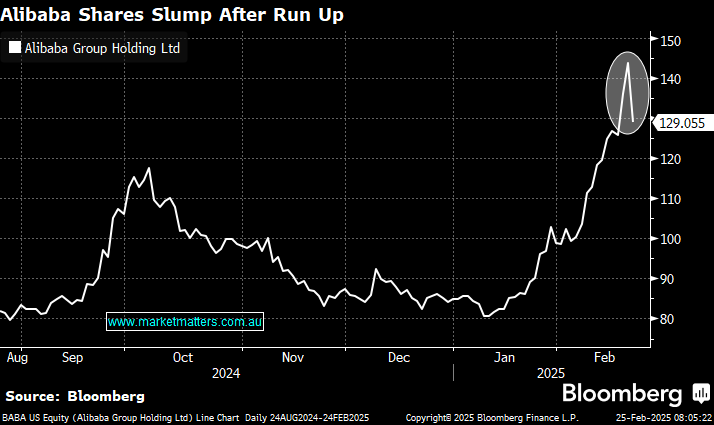

BABA shares tumbled over 10% on Monday night in US trading, their biggest drop since 2022, as President Trump’s latest executive order stoked fears about deepening trade tensions between the US and China. The sell-off halted a strong advance by Chinese tech stocks in 2025, which had seen BABA surge over 75% in weeks, helped by fresh, friendly dialogue between Jack Ma and Xi Jinping. However, over the weekend, Trump directed the Committee on Foreign Investment in the US to limit Chinese spending on technology and other strategic US sectors. It feels that post-DeepSeek Trump is concerned that China could take the lead from the US regarding AI.

Ironically, at the same time, BABA has committed to spending ~$US53bn on AI infrastructure over the next three years, making the company one of the country’s top spenders in the sector. We expected Trump to cause short-term stock gyrations, and he’s undoubtedly delivering. However, as we’ve flagged since his victory in November, these will often provide opportunities, and we believe that’s the case with BABA, especially with Beijing supporting stocks – “Shawn’s Trading Ideas” is watching this one carefully.

- We like the risk/reward ratio for BABA below $US130. MM owns BABA in its International Equities Portfolio.