China-facing equities have started to recover, and overnight, we saw results from Tencent and Alibaba, two important companies. Alibaba reported Q4 results broadly in line with expectations, although the core e-commerce and cloud units showed single-digit growth, which was slightly underwhelming, and the stock pulled back after a good run. Tencent, on the other hand, was stronger on the back of video ad growth, a theme we like more broadly.

- Importantly, Chairman Joe Tsai said Alibaba sees early signs of the Chinese consumer spending again, which is an important takeaway from a broader context.

For those not familiar with Alibaba, it is a very interesting company and very much a ‘canary’ for the Chinese consumer. It’s not a retailer in the traditional sense, it’s more a place where all the functions associated with retail meet. For example, if you combined eBay, PayPal, Google, FedEx, all of the wholesalers, and a good portion of manufacturers in the U.S. + of course, a big payments/financial services division and put them all in one place, you’d get something like Alibaba. It’s essentially a data-driven ecosystem that is faster, smarter, and more efficient than traditional business infrastructures.

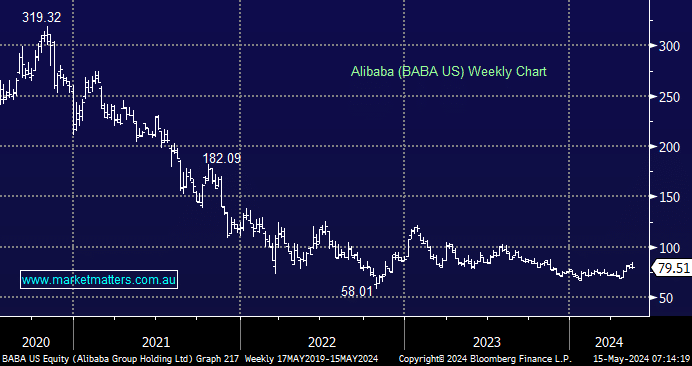

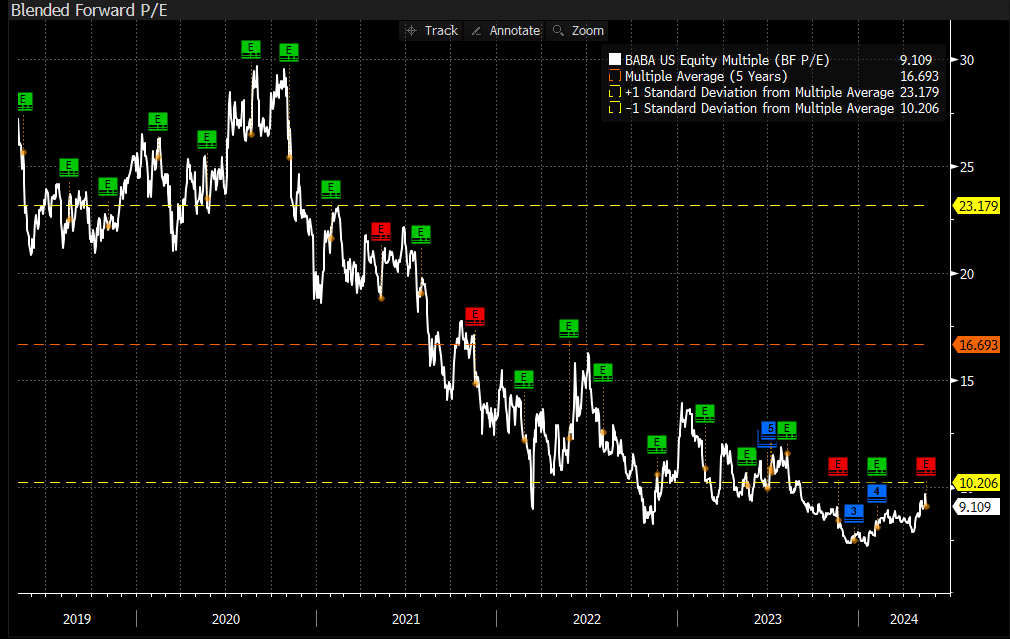

It was one of the biggest IPOs back in 2014, but in the last few years, many China-facing stocks have experienced a double whammy of regulatory pressures & soft demand. Chinese authorities tried to rein in control at a time when the Chinese economy was struggling, which put pressure on consumers. Because of these two factors, Alibaba has completely re-rated and trades on a PE of just 9.25x, as shown below, which is incredibly cheap.

The re-rate in the earnings multiple the market is prepared to pay for Alibaba has foundation. We mustn’t forget the risk associated with a centralised Government intent of maintaining control, however, like most things, the pendulum swings too far and we think that’s the case with Alibaba, and Chinese equities more broadly.

- There are signs that sentiment in and around China is improving, and if this theme gains further traction, some of these beaten-down Chinese consumer stocks have a lot of scope for recovery.