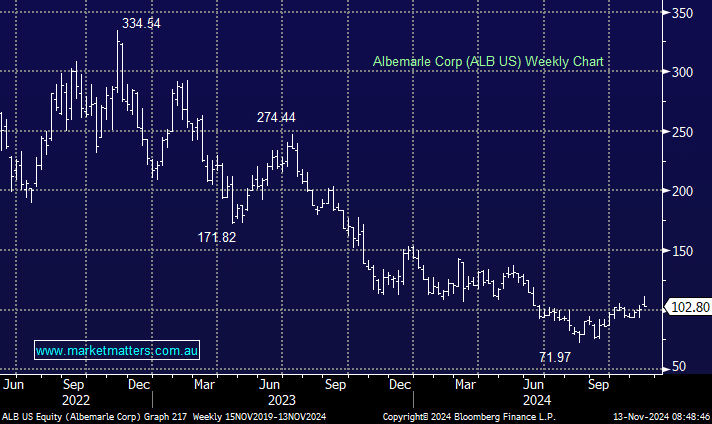

We bought ALB in February this year just above current levels, with the position down ~10%. Not a great outcome, though a significantly better result than some sector peers. Q3 production was released last Thursday, and the stock has traded mildly higher on what we’d call, less bad than feared numbers, amid signs the market is bottoming.

Adjusted Ebitda (which Charlie Munger would have called B/S earnings) of $US211m were around 11% ahead of expectations. They maintained 2024 guidance for Ebitda of $US1.05bn as they continue to strip costs out of the operations. With Lithium prices in the doldrums and an over-supplied market expected until 2026, costs become an important element to support earnings.

- A common theme across the sector is spending less by developing less. ALB for example guided to a reduction of capex in 2025 of a significant ~50%, to $US800-$900 million.

Less spend on development = less future production which will ultimately bring the market back into balance, and then deficit, by which time we’ll see a recovery in prices. The key to it is picking the inflexion point. With prices down ~85% from their lofty highs, and we’re confident the long-term demand trends remain intact, we’ve got to be getting close – right?

- We believe the Lithium sector is looking for a low, and ALB is the largest integrated player globally.