US lithium goliath ALB has halved production and stopped expansion at its $2 billion lithium hydroxide plant in southwest Western Australia as Li prices tumbled. However, In November, the company maintained 2024 guidance for EBITDA of $US1.05bn as it continues to strip costs out of operations, and its fourth-quarter earnings result next month will be watched carefully.

ALB is the largest integrated global lithium player and will be well positioned when Li can push back above $US800 – Remember, in the last week of November, UBS called the low for Li Spodumene prices.

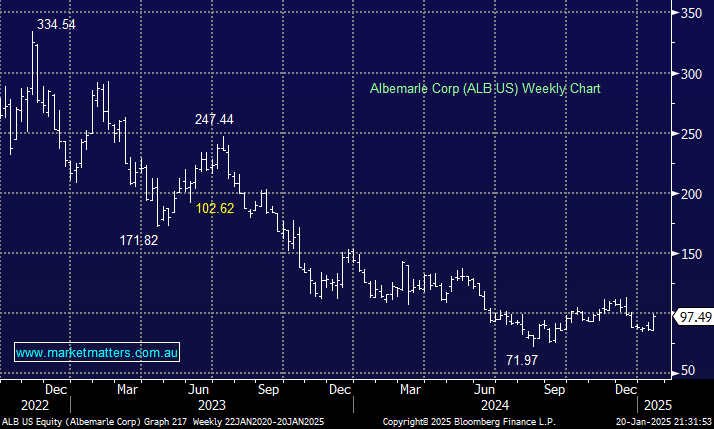

- We are bullish on ALB, initially targeting a test of the $US130-40 area – MM holds ALB in its International Equities Portfolio.