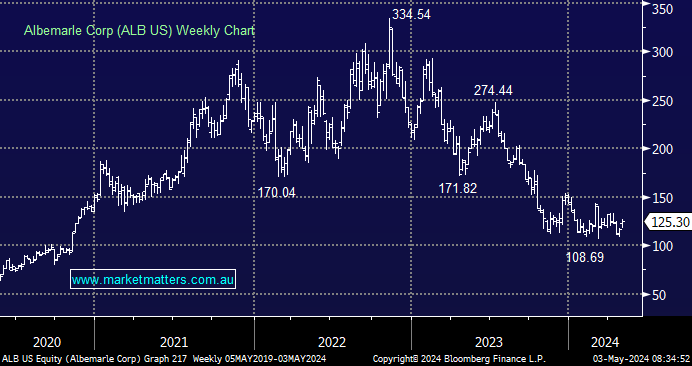

ALB is the world’s largest producer of Lithium, making it a very important cog in the battery metal chain. On Wednesday they reported 1Q24 results and held an earnings call overnight, providing a lot of detail about the state of the Lithium market. From an earnings perspective, they saw a huge drop year on year, but ultimately, they beat expectations marginally for the quarter, reporting adjusted earnings per share of 26c from sales of $US1.4bn. A year ago, Albemarle reported a profit of $10.32 a share from sales of $US2.6bn!

Earnings and sales have fallen with the price of lithium. Benchmark lithium prices started 2024 at roughly $14,000/mt having started 2023 at about $73,000/mt; however, they have risen about $2,000/mt from recent lows. ALB left 2024 guidance unchanged, with lithium price expectations ranging from $15,000 to $25,000, with more price discovery likely as more sales are made via auction, which could also create greater volatility in the associated stocks.

- We think Lithium is at the bottom of the range, and better times are ahead for the sector, ALB shares rose 5% overnight.