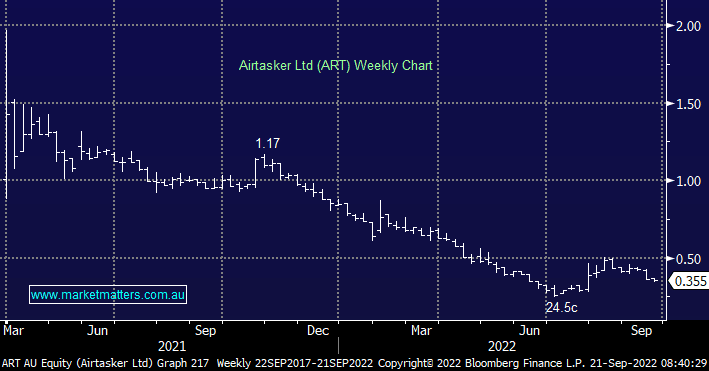

Airtasker was a hot IPO in 2021 however fortunes have turned as the market shied away from unprofitable tech companies. Management are doing the rounds after their FY22 results and we caught up with them earlier in the week. Airtasker is a founder-led marketplace for local services. It’s a product I have used and had great experiences with, however, their business took a hit in FY22 with lockdowns and floods weighing on the number of jobs posted and completed. The company recently acquired Oneflare which targets SME work with a subscription-based model with plans to integrate the two platforms. Airtasker is also pushing into the US & UK markets, though they are bigger markets they will face more competition here from the likes of Facebook Marketplace & Google. They are targeting positive EBITDA on a monthly basis for the Australian business within the next 12 months, however, the international business will need some investment.

scroll

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

MM is cautiously bullish ART, looking for more validation of the business model

Add To Hit List

Relevant suggested news and content from the site

Video

WATCH

Reporting season has taken a positive turn – James Gerrish breaks down some of this weeks action.

Recorded Friday 20th February 2026

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.