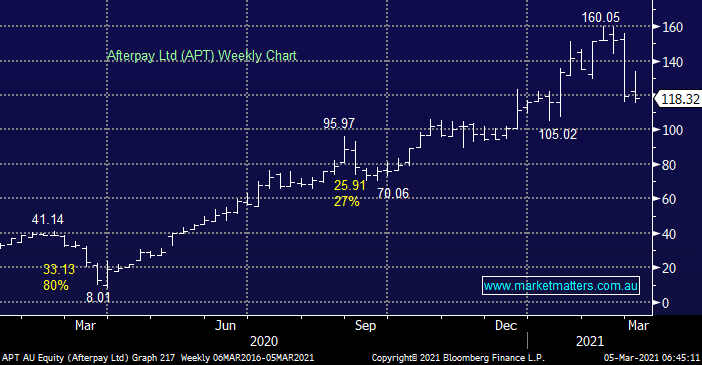

Afterpay continues to dominate the market news as the volatility in the BNPL space magnifies even the most dramatic sector moves. Over the last 4-weeks APT has corrected 26% into our identified major technical support area, from a risk / reward perspective we are now bullish APT which coincides with our short-term positive outlook for the IT Sector – that’s a contrarian Friday call for you as many in the office talk about going to cash!

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 15th August – Dow off -11pts, SPI up +8pts

Friday 15th August – Dow off -11pts, SPI up +8pts

Close

Close

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Close

Close

From a risk/reward perspective, we are now bullish APT around $118

Add To Hit List

Related Q&A

Perspectives on Block Inc (SQ2)

MM’s thoughts on Block Inc (SQ2) and AGL Energy (AGL) please

Thoughts on the director selling in Block Inc. (SQ2), please

Thoughts on Neuren Pharmaceuticals Limited (NEU)

Opinion on the Afterpay and Square merger

Thoughts on ALU & APT

What does the APT deal mean for Zip Co valuation?

BNPL Podcast

Our technical view on BNPL Stocks

Afterpay Bonds – How does the pricing work?

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 15th August – Dow off -11pts, SPI up +8pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.