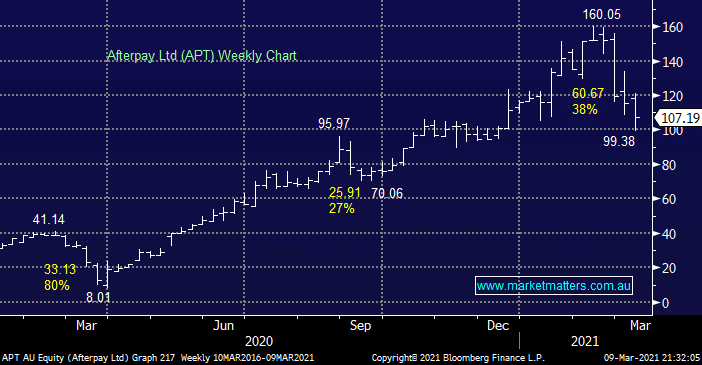

We’ve touched on APT a few times in recent reports and yesterday it bounced over 7% from its intra-day low, my “Gut Feel” is we’ve now seen a decent swing low and the next 20% for this volatile BNPL stock is up. As one of my clients said this week “there’s one last chance to take a breath before getting dragged to the bottom by the next set” in other words don’t get married to a recovery by the tech sector, a view we agree with at MM. However I do caution medium-term as competition hots up in the new financial space, PayPal is set to release its “pay in 4 instalments” offering to its 9 million customers in early June, just in time for the EOFY elevated spending.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Friday 15th August – Dow off -11pts, SPI up +8pts

Friday 15th August – Dow off -11pts, SPI up +8pts

Close

Close

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Close

Close

MM is bullish APT short-term initially looking for a ~20% bounce.

Add To Hit List

Related Q&A

Perspectives on Block Inc (SQ2)

MM’s thoughts on Block Inc (SQ2) and AGL Energy (AGL) please

Thoughts on the director selling in Block Inc. (SQ2), please

Thoughts on Neuren Pharmaceuticals Limited (NEU)

Opinion on the Afterpay and Square merger

Thoughts on ALU & APT

What does the APT deal mean for Zip Co valuation?

BNPL Podcast

Our technical view on BNPL Stocks

Afterpay Bonds – How does the pricing work?

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Friday 15th August – Dow off -11pts, SPI up +8pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Thursday 14th August – ASX +66pts, WBC, TLS, PME

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.