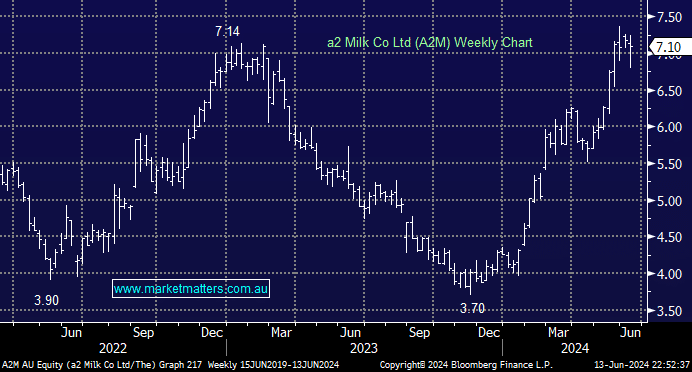

a2 Milk Co Ltd (A2M) has driven impressively higher since mid-January, helped by a solid 1st half with profits up +16%, ahead of expectations. The company’s performance in the US and China has improved, allowing it to upgrade FY24 guidance. A slow but steady unwind of a ~6% short position has also helped support the stock through 1H. In February, we said, “We can see A2M testing ~$7 this FY, making it an attractive risk/reward buy into dips towards $5.50.” this has proved on point, and we wouldn’t be chasing the NZ-based stock at the current levels.

- We like A2M’s turnaround, but the risk/reward makes us observers after its almost 100% rally in the last 6 months.