Remain open minded has been one of our catchphrases this year and we believe it definitely will apply again through 2022, not many pundits picked the ASX200’s best 10 stocks of 2021:

- Autos – ARB Group (ARB)

- Education – IDP Education (IEL)

- Financials – Pinnacle Investment (PNI)

- Tech – WiseTech Global (WTC)

- Lithium – Pilbara Minerals (PLS) and Allkem (AKE)

- Rare Earths – Lynas (LYC)

- Mining – Chalice Mining Ltd (CHN)

- Food – Graincorp (GNC)

- Telcos – Uniti Group (UWL)

With the exception of probably the 2 lithium stocks I don’t recall too many people nailing many of these with the distinct absence of tech and healthcare names catching most people out i.e. 57% of the Australian Tech Sector is down for 2021. Interestingly more of the major underperformers were on peoples radar this time last year e.g. Magellan (MFG), a2 Milk (A2M), PolyNovo (PNV) and Appen (APX) to name a few. The point we’re making is we must remember equities look at least 6-months ahead hence the themes that worked in 2021 have a good chance of not being repeated in 2022.

MM’s view towards the index is the first thing to consider:

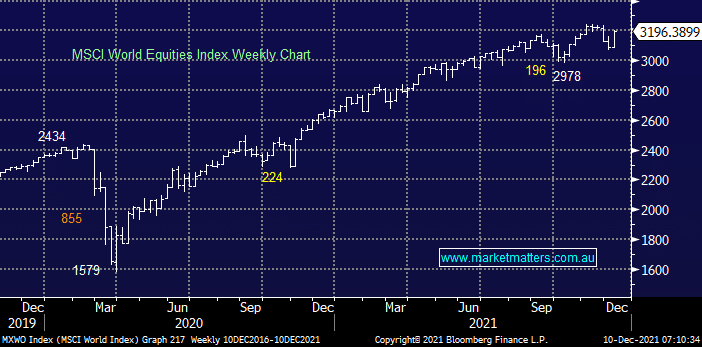

- After doubling from their March 2020 low we believe equities are in for a more volatile choppy time in 2022 especially as central banks look to normalise interest rates.

- If our view towards stocks in general proves correct the sectors which have paved the way for an excellent post COVID recovery are likely to hand the perfortmance baton to the laggards e.g. tech to defensives, especially in the US.