We often hear people say the trends your friend and one trend that’s certainly been like a tidal wave over recent years has been the adoption of ETF’s by investors – there’s almost $US9.5 trillion invested in ETF’s across over 9,000 products in 62 different countries. There’s certainly nothing new about the ETF market but to active investors like MM we often prefer to select individual stocks for our market exposure but to the passive investor with little interest / knowledge of markets ETF’s make huge sense.

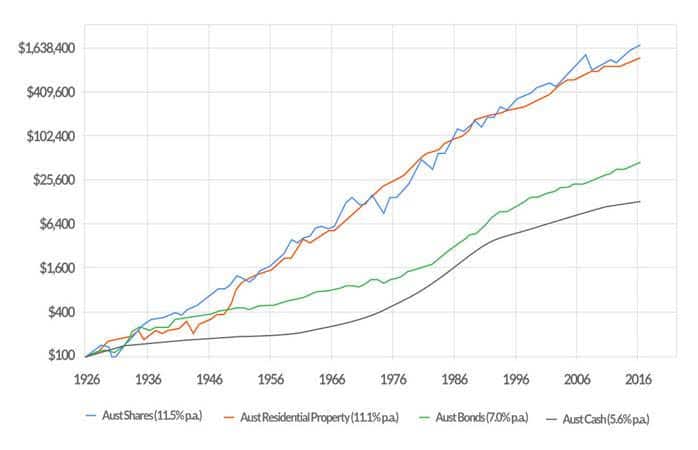

Equities have been the outstanding asset class over the last 100-years with cash most definitely not king! Hence for people looking to build wealth regular investing in an index ETF makes total sense especially regular deposits for young people e.g. the A200 from BetaShares for Australian equities, iShares IVV ETF for US S&P500 exposure and the iShares IEU ETF for a European investment.

However for MM we like the idea of using ETF’s for “tricky” new industries where we believe the risks for individual stocks are extremely elevated compared to say simply looking for exposure to Australian banks, plus simply views that are hard to manage through individual stocks alone. Wherever possible I have used an ASX listed ETF as I know this is the preference for the majority of MM subscribers but obviously in many cases excellent alternatives exist on global exchanges.