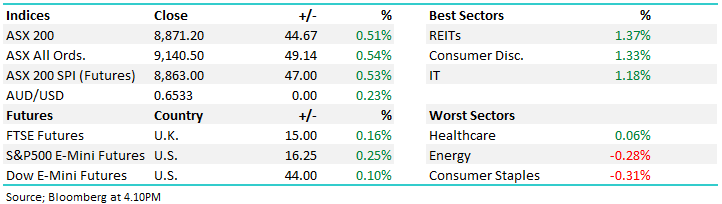

The ASX200 was whacked 160-points on Wednesday after hotter-than-expected GDP figures tempered rate cut expectations, but by Friday’s close, the market had recovered over 80% of the fall. Nerves increased throughout the week into Friday night’s pivotal US Job Report, but after the release, markets remained uncertain as Fed rate cuts looked a given following the weak numbers, but concerns started to percolate around the health of the US economy.

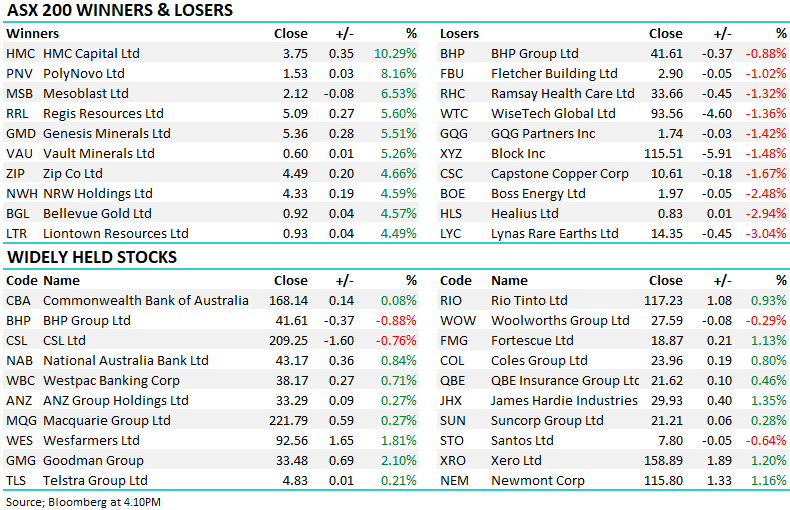

By Friday’s close, the winners and losers enclosure was more sector-influenced with the reporting season in the rear view mirror. The gold names dominated the gains as the precious metals punched to new all-time highs, while fund managers/platform providers struggled as the market wobbled, as did the tech names following moves on Wall Street and gyrations in bond markets.

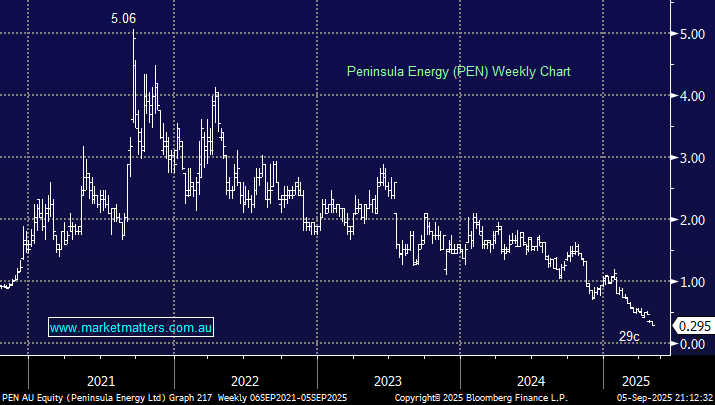

Winners: Genesis Minerals (GMD) +18.9%, PolyNovo (PNV) +16%, NRW Holdings (NWH) +12.8%, Perseus Mining (PRU) +12.4%, Regis Resources (RRL) +12.2%, GrainCorp (GNC) +8.1%, Harvey Norman (HVN) +7.7%, Deep Yellow (DYL) +5.2%, and Tabcorp (TAH) +4.6%.

Losers: Megaport (MP1) -14.3%, Bapcor (BAP) -11.3%, Pinnacle (PNI) -10.5%, Generation Dev. (GDG) -10.4%, Netwealth (NWL) -8.7%, Wisetech (WTC) -8.1%, IGO Ltd (IGO) -7.1%, Guzman YH Gomez (GYG) -6.4%, Breville Group (BRG) -6.3%, Bendigo Bank (BEN) -5.9%, and Flight Centre (FLT) -5%.

On the economic and geopolitical front, two major releases dictated market sentiment:

- Also, a big week of dividends weighed on the ASX with a number of major stocks looking weaker at first glance than they actually were, e.g. BHP, Wesfarmers (WES), and Woolworths (WOW).

- On Wednesday, stronger-than-expected GDP numbers reduced local rate cut expectations, weighing on rate-sensitive names – the RBA is now expected to cut once more in 2025 and once in 2026.

- The ASX plunged the most in months following the GDP, but investors again bought the dip through Thursday and Friday.

Overseas markets ended the week on the back foot after a weaker-than-expected U.S. Jobs Report increased hopes for rate cuts but fanned worries about a slowing U.S. economy. The S&P 500 closed down -0.3%, while the rate-sensitive Russell 2000 small-cap index ended the day up +0.5%. In Europe, the German DAX fell 0.7%, while the UK FTSE fared better, only slipping 0.1%.

- The SPI Futures are calling the ASX200 to open down 0.2% on Monday after the lacklustre market reaction to the US Job Report.