One eye on the budget (SAR, NST)

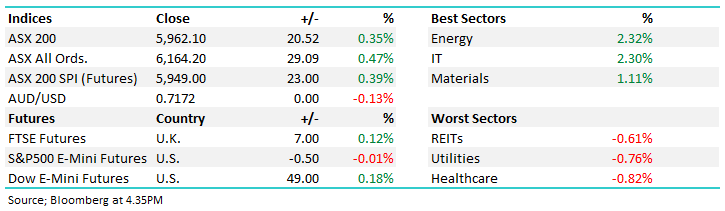

WHAT MATTERED TODAY

The ASX was hesitant to make any meaningful move in either directrion today, chopping around par throughout the session as investors have one eye on tonights Fedral Budget. The papers have been drip feeding pieces of information for the past few days though nothing is really set in stone until the much anticipated document lands. If the rumours are to be believed we are set to see increased income support, tax cuts and employment subsidies to help replace Jobseeker and Jobkeeper payments that have begun to roll off. The RBA was unmoved today, keeping rates on hold at 0.25% as expected though finished off their statement with perhaps a more accomodative line than expected, looking at “how additional monetary easing could support jobs” while the economy goes through a choppy recovery. The Aussie dollar saw a brief rally against the greenback on the announcement but traded back to pre-announcement levels soon after as the market digested the news – or lack thereof. The key message from the RBA was jobs today with inflation seemingly taking a step back until employment gets under control. I expect a similar message from the PM and Treasurer tonight – that the budget will spend some time in the red with big spending planned until we near ‘full employment.’

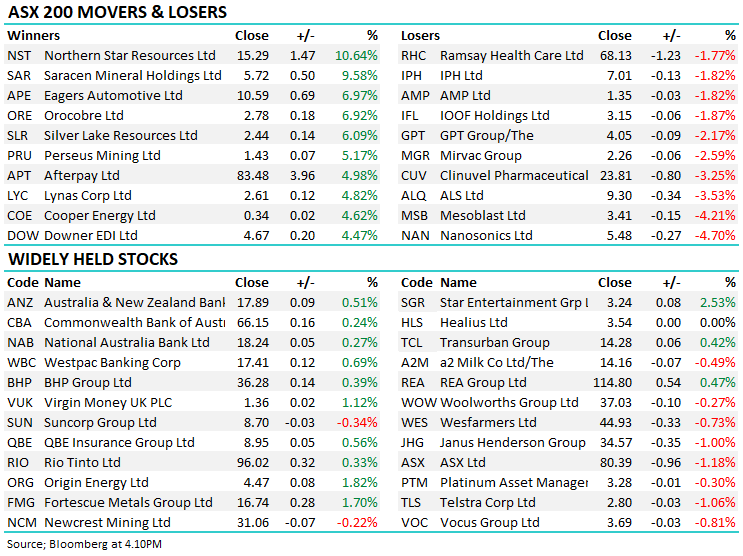

Tech followed the Nasdaq higher, while energy continued its recent rebound as oil prices jump off multi-month lows. Health and utilities were less sought after. The big winners were two fo the gold names in Northern Star (NST) & Saracens (SAR). Asian indicies were broadly stronger today and US futures spent most of the night trade in the black.

By the close, the ASX 200 was up by 20pts / +0.35%. Dow Futures are trading up 234pts/+0.85%

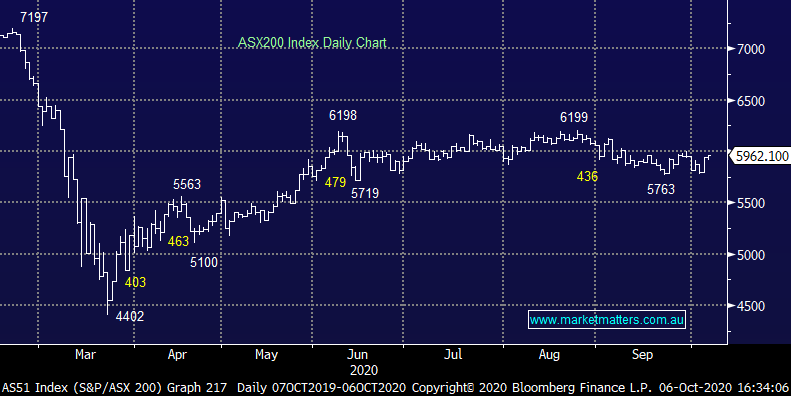

ASX 200 Chart

ASX 200 Chart

CATHCING MY EYE

Northern Star (NST ) +10.64%, Saracen (SAR) +9.58%: when there’s smoke rang true again today with rumours coming true - JV partners in the Super Pit mine are now looking to merge as Saracen folds into Northern Star. The deal would see Saracen shareholders receive 0.3763 NST share for each SAR share, along with a 3.8c special dividend to create a $16b market cap, top 10 global gold name on completion in February. While still pending final shareholder and court approval, the board has recommended the deal and the market seems to like on first run. It would create a gold miner with 19 million oz reserve, and a 49 million oz resource. The new company could realise up to $2b in synergies with a number of mines operating in close proximity as well as reduced management costs. It’s a pretty good deal if they can realize the plans presented today. The gold space is poised for an M&A super cycle with a number of cashed up miners as well as a strong gold price encouraging deals. We own Newcrest (NCM) in the Platinum portfolio but are looking to add to gold exposure.

Saracen (SAR) Chart

BROKER MOVES

· Westpac Raised to Outperform at Macquarie; PT A$18

· ANZ Bank Raised to Outperform at Macquarie; PT A$18.50

· Nanosonics Rated New Underweight at JPMorgan; PT A$5.05

· Coles Group Raised to Outperform at Credit Suisse; PT A$20.16

OUR CALLS

No changes today

Major Movers Today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.