Oil Search (OSH) whacked on dissapointing outlook

Oil Search (OSH) –7.52%; the OSH share price took a big hit today, following energy markets lower with increasing coronavirus fears, but also helped lower by a softer fourth quarter report. Production rose around 11% for the 2019 calendar year to 27.95mmboe, coming home with a wet sail to add over 7mmboe in the final quarter and land the year within prior guidance. Growth was driven by record PNG LNG production despite the impact of remediation work that has dragged on since an earthquake in 2018. OSH is in the middle of negotiating a new PNG development with talks remaining behind schedule – timing of projects in PNG have been an issue for most resources companies that take on the terrain – while early drill results out of Alaskan exploration place Oil Search in a good position to continue to drive production higher.

The company also gave early guidance for the new year, with production expected to be flat to marginally higher at 27.5-29.5mmboe in the current year. Oil search will report their full year results in late February. The market remains concerned about their PNG plans with the government upping pressure on royalties and taxes on new energy projects. It's murky for OSH.

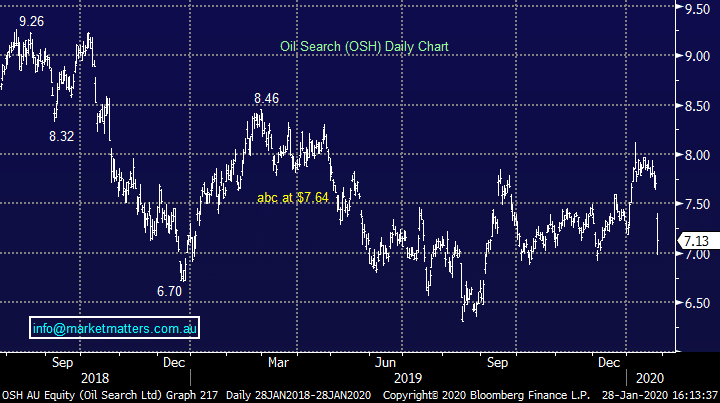

Oil Search (OSH) Chart