NWH reinstates dividends (NWH, ALL, BIN, SSM)

WHAT MATTERED TODAY

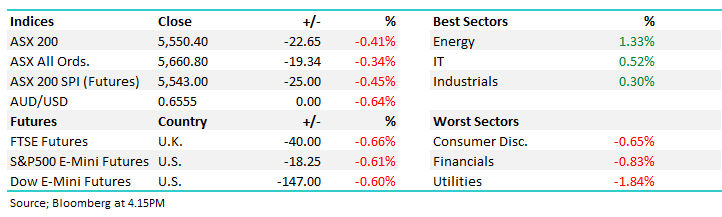

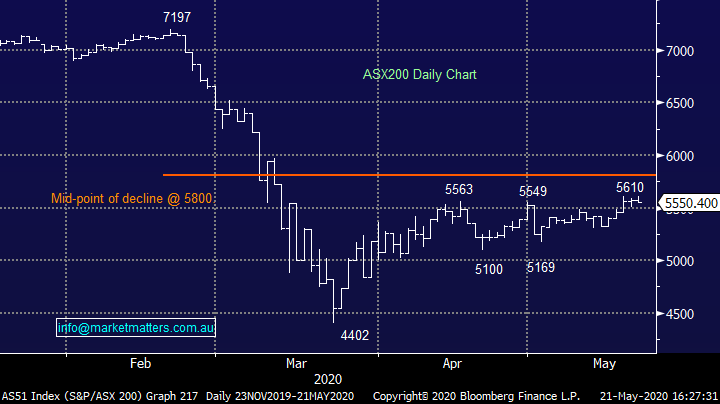

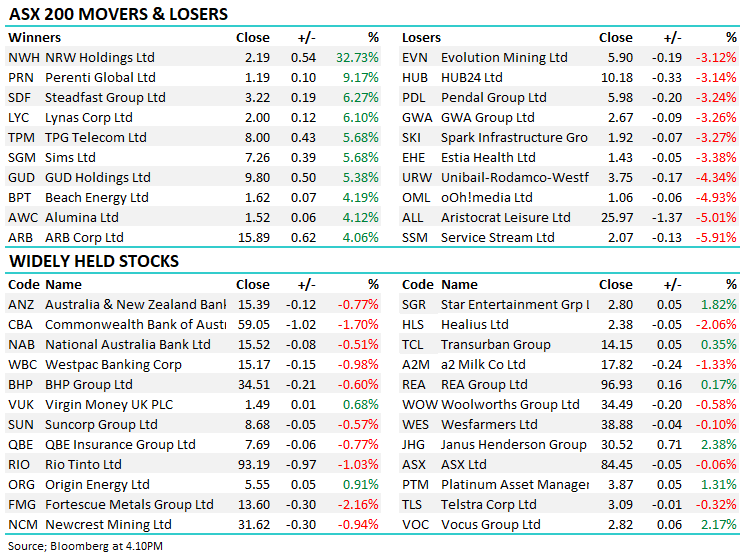

The ASX broke its 4 day wining streak today to end the session marginally lower weighed by the more defensive utilities sector while Energy and IT continued to outperform. A fair amount of stock specific news to get across today, a number of stocks we hold out with updates that proved to be a mixed bag overall, although NRW’s update and 30+% pop in the stock a clear highlight.

At the index level today, the market peaked early with options expiry for May before losing 60pts into the close. As we’ve suggested the last few days, the short term picture is now more muted as the mkt traded up to 5600. We’ve used that to increase cash across the portfolio today and now sit tight for other stock specific opportunities to drift along.

Asian markets edged lower today, although all less than 1% while US Futures were down during our time zone.

Overall, the ASX 200 closed down -22pts or -0.41% to 5550. Dow Futures are trading down -147pts/-0.60%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

NRW Holdings (NWH) +32.73%: The mining and construction services business provided a business update today, and wait for it, reinstated their dividend which had been suspended. They talked of a record 10 months and are on track to meet full year guidance. To put this into context, NRW trades of 10x earnings with a very strong order book of mostly contracted projects. In terms of guidance, the company said didding activity is high and following the BGC acquisition the pipeline continues to improve given the likely acceleration of public infrastructure projects. NRW is very well placed to address a growing list of opportunities through both its Golding business on the east coast and the significantly enhanced construction business in the west. With respect to the outlook for FY20 we remain on track to meet our revenue guidance of $2 billion. We own in the Platinum Portfolio and remain happy holders for now.

NRW Holdings (NWH) Chart

Aristocrat Leisure (ALL) -5.01%: Delivered half year results this morning that were impacted by COVID-19 as expected however the business remains strong, the balance sheet is in good nick and the digital division continues to grow. We held this stock in the Platinum Portfolio however today we took profits on the position, the decision was based on two main factors. From a business perspective, the market was focussed on top line growth in digital and while it grew by 19% in AUD terms, the market was looking for mid 20’s. This is likely to lead to downgrades tomorrow which could curb the recent momentum in the stock. At a portfolio level, we wanted to increase cash into current strength, and by selling ALL and trimming Bingo (BIN) today, we’ve now brought cash up to over 13%.

Aristocrat Leisure (ALL) Chart

Bingo (BIN) -2.19%: Staying on BIN, we’ve seen a number of analysts downgrade earnings assumptions here, UBS the latest to move overnight, the broker saying softness in residential, commercial and diversified construction to hit volumes, however that will be offset by a growing infrastructure pipeline. They retain the buy call however move price target from $3.45 to $2.55 and lower earrings numbers. While we don’t generally like going with the crowd, we had a big overweight position on the stock in the Platinum Portfolio and this being the 3rd broker downgrade (Shaw, Credit Suisse now UBS) implies the stock could tread water in the short term. We cut our position in half to raise some cash. Now holding a 3% weighting.

Bingo (BIN) Chart

Service Stream (SSM) -5.91%: two parts to the session today – SSM initially held up well before halting trade mid-afternoon to provide an update on the business in the COVID world. The network services company said while demand had remained strong it had incurred some costs as it brought in safety measures to reduce the risk on employees while some customers had paused or delayed work. As a result of the impacts, the company guided EBITDA for the full year to $108m, a small fall based on comments at the half year result and $6m/5% below market expectations. The managing director also noted that the impacts would likely be felt into early FY21 despite the strong pipeline of work ahead of it. Disappointing for holders, of which MM is, but the small fall in EBITDA seemed already priced in. SSM did close off its lows which is promising. $2.00 strong support.

Service Stream (SSM) Chart

BROKER MOVES;

· Western Areas Cut to Neutral at Citi; PT A$2.50

· Fortescue Cut to Sell at Citi; PT A$11.10

· Seek Cut to Hold at Morningstar

· Charter Hall Group Cut to Hold at Morningstar

· TPG Telecom Raised to Overweight at JPMorgan; PT A$8.65

· Fortescue Raised to Hold at Morgans Financial Limited

· Genworth Australia Cut to Negative at Evans & Partners Pty Ltd

· Sims Raised to Neutral at JPMorgan; PT A$6.90

· Sydney Airport Cut to Hold at Jefferies; PT A$6.26

OUR CALLS

Platinum Portfolio: We sold Aristocrat (ALL) and reduced Bingo (BIN)

Major Movers Today

Have a great Weekend all

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.