Nufarm’s (NUF) tough start to FY20

Stock

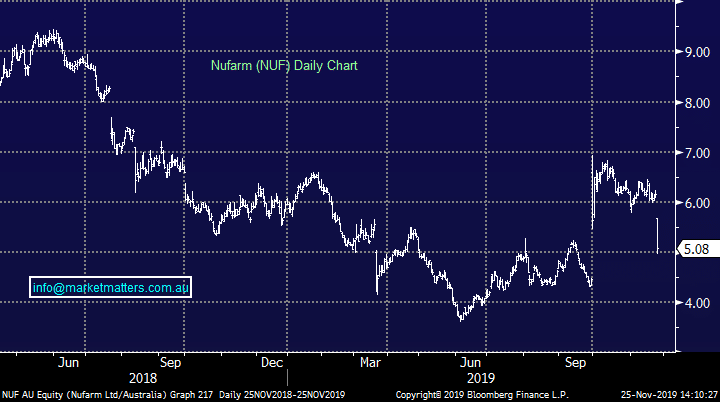

Nufarm (NUF) $5.06 as at 25/11/2019

Event

Crop protection business Nufarm has seen almost 20% wiped from shares today on news it has struggled in the first half. The company flagged a number of issues set to impact the period to the point where the company was not able to give guidance for the six months to January 2020.

The first cab off the rank was the company recognizing a number of sales rebate claims from German customers from FY19 which will drag EBITDA but around $9m, or ~2% of FY19 EBITDA. Nufarm have also needed to implement a review of procedures in handling these claims because a number slipped through the cracks which may also mean increasing costs.

Secondly, the company flagged difficult trading conditions, particularly in North America where falling demand and high inventories will halve the regions EBITDA contribution compared to the first half of 19. This alone is enough to shave ~16% off the first half figure while the announcement talks to soft demand across other regions as well.

As a result of the issues, Nufarm says “it has become increasingly difficult to forecast the half year results” but expects it “to be significantly lower than the prior year.” Throughout all of this, the company is trying to offload their South American arm with the $1.2b deal due to be completed in a matter of weeks. With performance continuing to slide, it looks like the company could use the capital.

Nufarm (NUF) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook