Not a good day to miss earnings expectations – market falls 2.85% (TLS, BKL, TWE, SUL, WPL, WHC, ORA, CWY)

WHAT MATTERED TODAY

It was always going to be a big day with the US market off -3% plus a huge volume of companies reporting results – we’ve focussed on results this afternoon For those looking for some insight as results drop / before market open, you can listen to First Reactions HERE

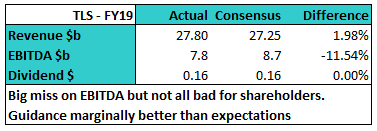

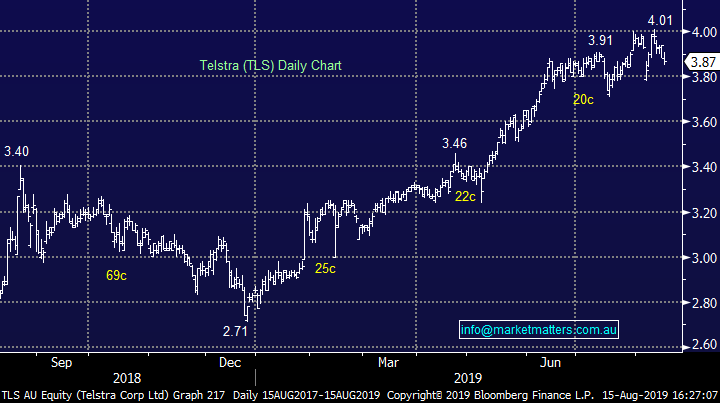

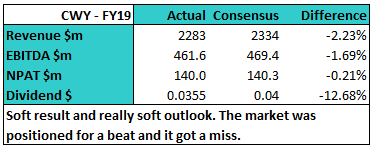

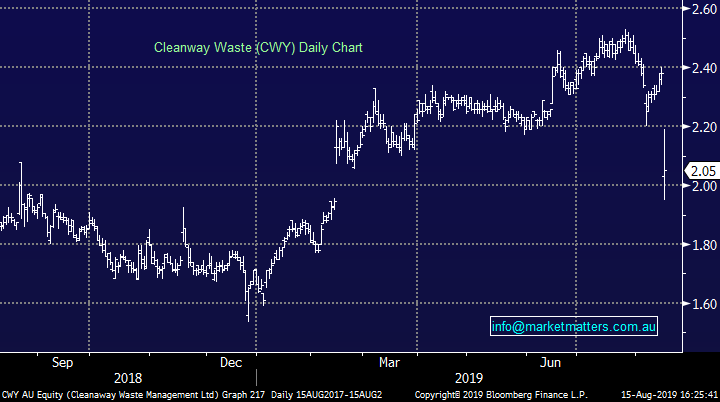

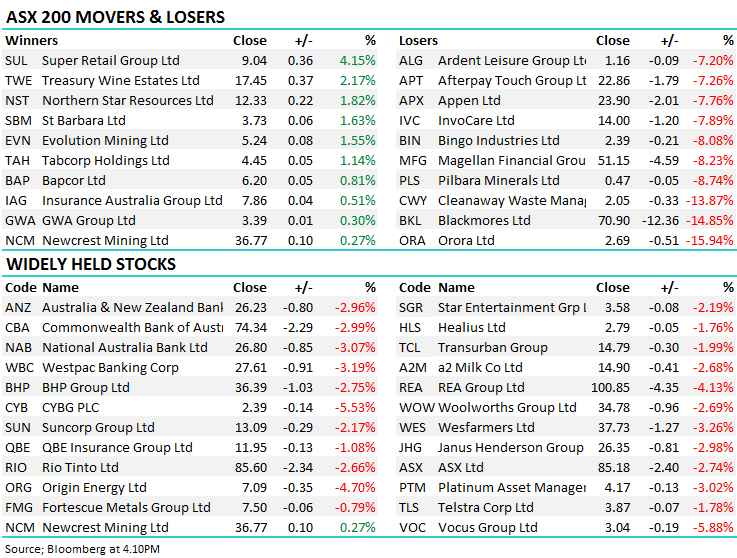

A few caught my eye more than others. Telstra (TLS) missed the mark for FY19, although FY20 guidance looked okay, the stock deserved to close lower while Woodside (WPL) was a very weak number, hurt by very slow production in the first half. The best was probably Super Retail Group (SUL) while Blackmores (BKL) dished up a very weak scorecard. Cleanaway (CWY) struggled after downgrading guidance which provided a negative read through for Bingo (BIN) which dropped 8%. More on most of the results below.

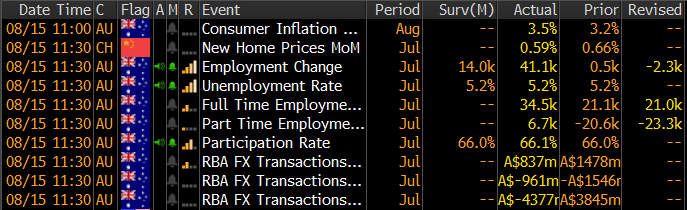

The market opened down this morning however the selling was sustained throughout the day. It ticked up a notch around 11.30pm after stronger than expected employment data was released in Australia. Better data (particularly employment) implies less chance for rate cuts domestically, and the market didn’t like it…

Economic Data Today

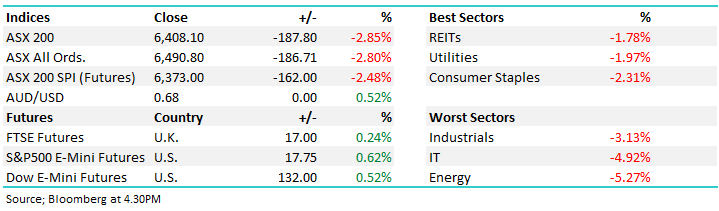

US Futures actually rallied through our time zone – more so later in the day while Asian markets traded higher. No sectors locally closed higher, with selling broad based.

Overall, the ASX 200 lost -187pts today or -2.85% to 6408. Dow Futures are now trading up +150pts /+0.60%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Stocks today: Biggest day on the reporting front and we’ve covered the majority below…Overall, not a day to miss and we saw some pretty poor updates.

Telstra (TLS) -1.78%; The big telco traded lower today but marginally outperformed the market. The big EBITDA miss was an anomaly, but the dividend was inline. The outlook was a beat for the first time in a while for Telstra. FY20 EBITDA expectations were $8.9b-$9.8b while expectations were at the lower end at $9.1b. The Telstra turnaround does seem to be on, but the share price has bolted early with the low yield environment supporting quality yield stocks.

Telstra (TLS) Chart

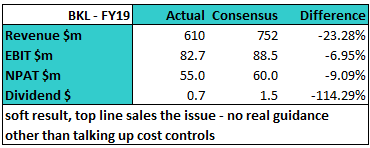

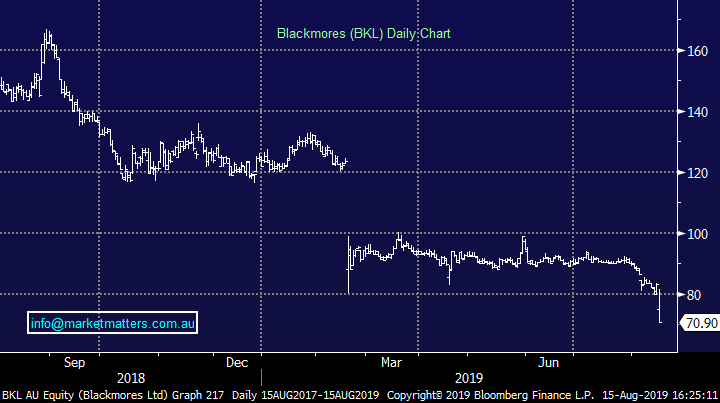

Blackmores (BKL) –14.85%: Another weak update from BKL with underlying profit at $55m for the full year v $60m expected. Top line sales the issue with revenue coming in at $610m, a long way below expectations of $752m and below the most bearish analyst expectations (range was $628m-$798m). The dividend was short of expectations and they gave no real guidance for FY20, other than to say conditions will remain challenging. Existing market expectations for FY20 were for flat top line growth but better cost management leading to a +10% increase in profits – a tough ask now.

Blackmores (BKL) Chart

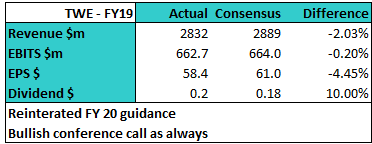

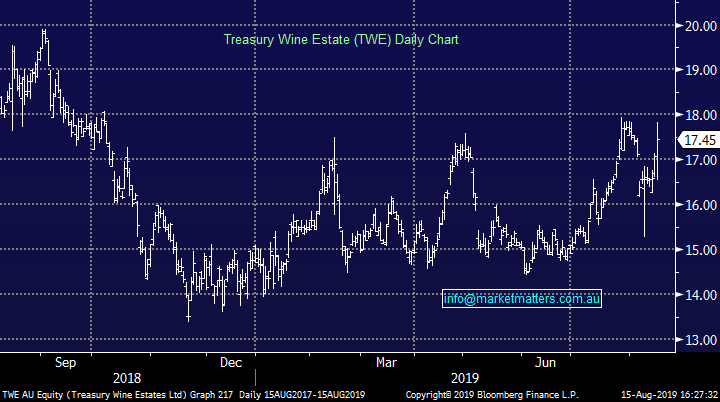

Treasury Wines (TWE) +2.17%: Result more or less in line with market expectations for FY19 with top line slightly off v consensus which flows through to a slight miss at the EPS level – although not significant. As is often the case with TWE, they talk a big game on the conference call and this time was no different – the company reiterated their expectation for EBITS growth of 15-20% in FY20.

Treasury Wines (TWE) Chart

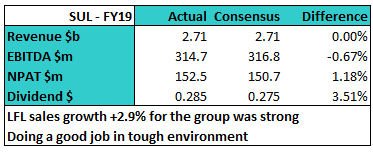

Super Retail Group (SUL) +4.15%: Result in line with low expectations in terms of top line sales and profitability. Retail is tough but SUL doing a good job to grow like-for-like sales at +2.9%. The Capex spend for FY20 was guided to $90m which is big, more investment online plus in better store footprints while they also said that trading conditions were ‘subdued’ at the start of the year.

Super Retail Group (SUL) Chart

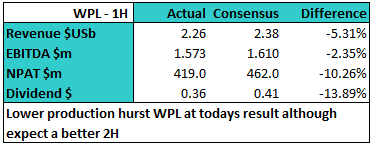

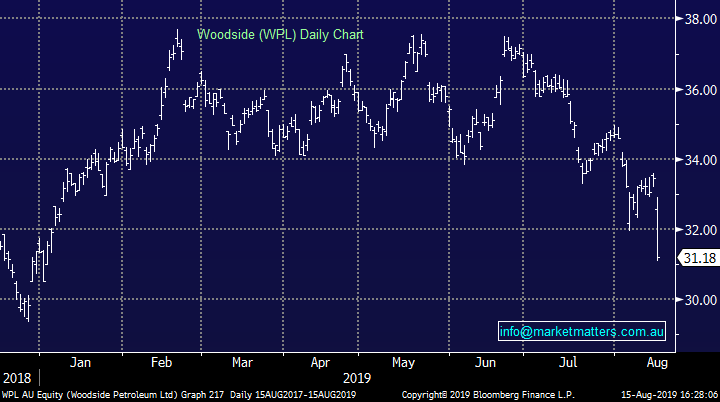

Woodside Petroleum (WPL) -6.73%: Weaker production levels hurt WPL’s first half result today with LNG maintenance an issue. 2H production should pick up but still a decent miss on most levels. The dividend was poor as were most metrics, however they have spoken more favourably about the likely 2H run-rate. WPL have a lot of work to do although balance sheet remains sound – looked like a transient production issue than anything more sinister.

Woodside (WPL) Chart

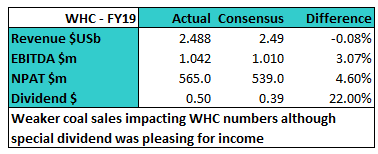

Whitehaven (WHC) -3.16%; The EBITDA line was a ~3% beat to expectations and shareholders were rewarded with a nice 30c dividend – 17c of which was a special, a good outcome for our Income Portfolio where we own the stock. Closely watched was a spike in costs which were largely expected to at least flat line, if not fall into FY20. Costs are expected to go to $70/t while 20-21Mt of saleable coal to be produced in the current financial year. All in all, not a bad result for a downbeat company, but unlikely to see the tide turn without a commodity tailwind just yet.

Whitehaven (WHC) Coal

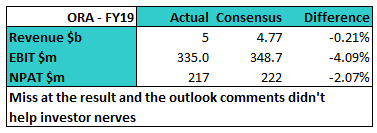

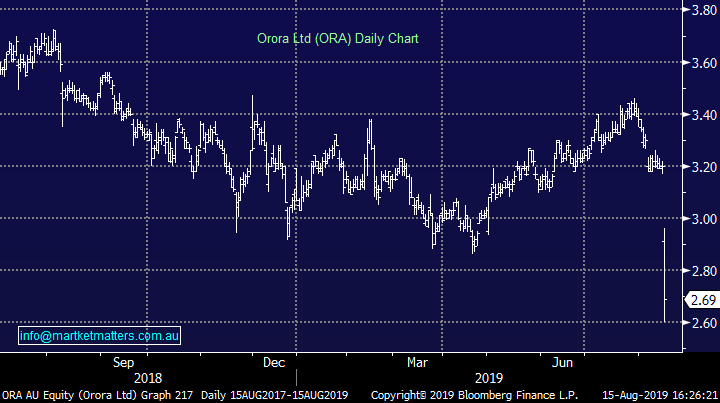

Orora (ORA) -15.94%; The packaging company followed its peer Pact Group (PGH) down the gurgler today. It was a big EBIT miss despite revenue being in line. The outlook statement was also worrying. The company talked about “challenging market and cost headwinds” which talks to a miss to the markets consensus ~5% EBIT growth in FY20. The North American market is coming under the most pressure with margins and volume.

Orora (ORA) Chart

Cleanaway (CWY) -13.87%; A dirty result for Cleanaway – a miss on EBITDA, but managed to hit the market on the NPAT line. The market was very bullish CWY heading into the result with the company talking up its ability to implement price rises. These talks seem to have stalled – as you would expect, the company likely went after the easier clients to kick things off and are now struggling with the remainder of their client base. It’s a poor read through for competitor Bingo (BIN) as well with this being one of the reasons we took a solid profit on the stock heading into reporting season. The outlook was a little soft with EBITDA growth “moderating” while the market had 20% growth priced in.

Cleanaway (CWY) Chart

Broker moves;

- Genworth Australia Raised to Outperform at Macquarie; PT A$3.25 **stock up +2.48% today to $2.89**

- CSL Downgraded to Neutral at UBS; PT A$245

- CSL Upgraded to Hold at Morningstar; PT A$210

- CSL Upgraded to Outperform at Credit Suisse; PT A$249

- Aveo Upgraded to Neutral at Macquarie; PT A$2.15

- SkyCity Entertainment Downgraded to Negative at Evans & Partners

- AP Eagers Upgraded to Outperform at Credit Suisse; PT A$12

- Regis Resources Upgraded to Neutral at JPMorgan; PT A$5.30

OUR CALLS

We sold the gold ETF (GDX) today from the growth portfolio for a profit

VanEck Gold ETF (GDX)

Major Movers Today

Have a great night

James, Harry the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 15/08/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not with standing any error or omission including negligence