Nickel roars higher on Indonesian supply concerns (WSA, IGO, IPL, PLS)

WHAT MATTERED TODAY

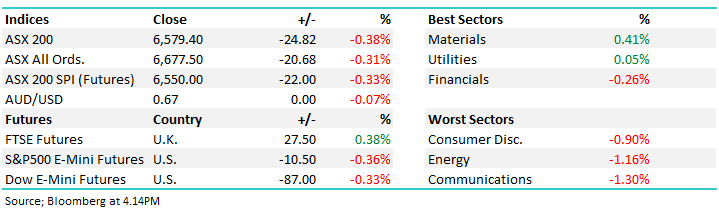

Stocks were down early this morning tracking weakness in US Futures following yesterday’s move by the Trump administration to implement its planned 15% tariffs on $US110bn of Chinese goods including footwear and even the Apple Watch, and as promised China retaliated. More tariffs are planned by both sides for October and December.

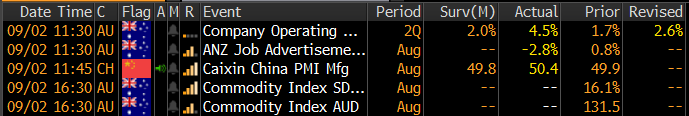

Manufacturing data was stronger than expected from China today with the Caixin PMI printing +50.4 versus 49.8 expected. This supported the Iron Ore price in Asia today with Iron Ore Futures up +5.8% - RIO & FMG strong on the back of this (FMG went Ex-dividend by 26cps closing down 15c). The material sector the best on ground today while weakness in Telstra (TLS) weighed on the communications sector.

Economic Data Today

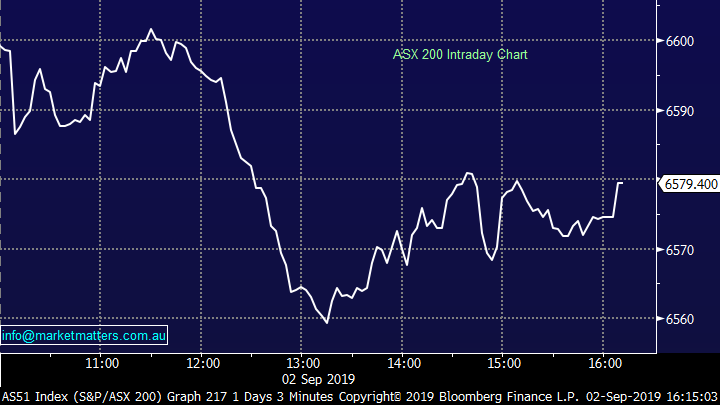

Overall, the ASX 200 lost -24pts today or -0.38% to 6579, Dow Futures are now trading down -98pts /-0.37%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Nickel Stocks: Ripped higher today, Western Areas (WSA) +14.11% and Independence Group (IGL) +10.29% on reports that the Indonesian Government plans to reinstate the Nickel ore ban in December 2019. On Macquarie’s numbers - in 2019 nickel ore exports have been running at 20ktpa recoverable nickel, equivalent to 10% of world nickel supply. While some supply response from the Philippines is possible should the ban be re-instated, the net effect could be to more than double the current supply deficit. That’s caused a big re-rating in the Nickel price, up 7% on the news today and more than 40% in the last two months. The Nickel stocks have been doing well of late, particularly WSA which has bounced strongly from the $2 region. More information needed however ultimately, commodity stocks track their underlying commodity and the current price of Nickel will see big upgrades to earnings for FY20 in both names.

Nickel Chart

Western Areas (WSA) Chart

Incitec Pivot (IPL) -4.36%: The explosives, fertilizers and chemicals distributor Incitec Pivot was hit early in the session today on a downgrade with shares trading as low as $2.74, 14.6% below Friday’s close however the stock recovered as the session rolled on. The company downgraded its EBIT guidance for FY19 by around 26% to the midpoint of the $285m to $295m range for the September year end. About a third of the downgrade stemmed from commodity pricing and exchange rate impacts, while the remainder was focused to the fertilizer business which the company is now reviewing. The US ammonia plan at Waggamana has been under performing in the second half of the year while fertilizer revenue has been hit by drought and rising gas prices in the Queensland production facility. UBS has been called in to look at Incitec in an effort to assess how best to extract value from the three components of the company.

Incitec Pivot (IPL) Chart

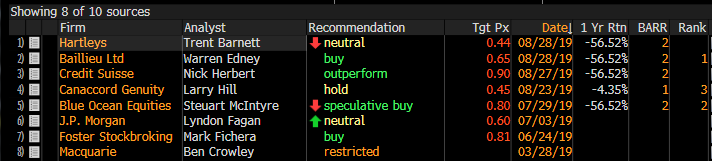

Pilbara Minerals (PLS) Voluntarily suspended: Lithium stocks are having a tough time with slow demand hurting prices at a time when many of them are undergoing big capital intensive expansion projects. Pilbara were in talks to sell a project stake however that fell over on valuation grounds. They are now tapping the market for fresh equity although the trading halt requested on Thursday was scheduled to be lifted this morning – they clearly need more time to convince potential backers – never a good sign. Now the halt will remain until Friday assuming the raise is successful.

Here’s current broker calls on PLS…All look incredibly optimistic now

PLS Broker Calls

Pilbara Minerals (PLS) Chart

Broker moves; Report out today from Credit Suisse naming Boral (BLD) and Whitehaven (WHC) amongst their best Australian buy calls…Elsewhere

· Metals X Downgraded to Neutral at Macquarie; PT A$0.16

· Resolute Mining Upgraded to Sector Perform at RBC; PT A$1.50

· PWR Holdings Downgraded to Hold at Bell Potter; PT A$5

OUR CALLS

No changes today

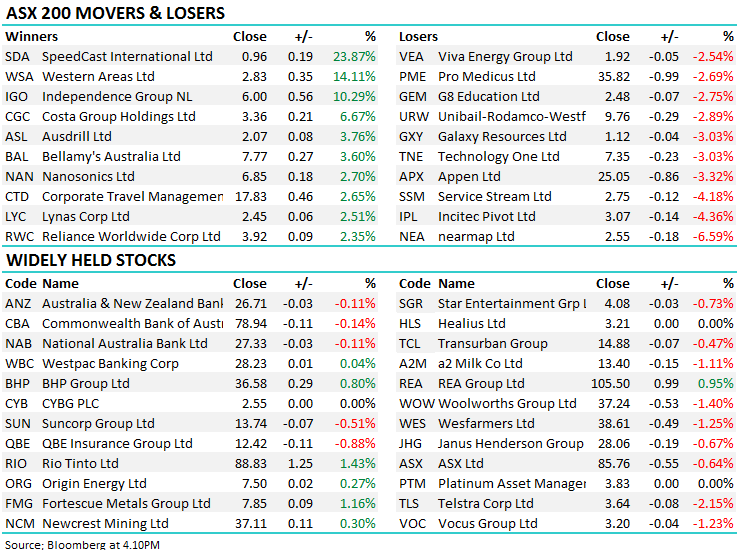

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.