Nick Scali (NCK) gives retailers hope

Nick Scali (NCK) +14.58%

Furniture retailer was out with their full year report pre market – it was a beat, no doubt about it. They pre-released earnings back in June, just a few weeks out from the end of the Financial year but even that sold the result short. Profit of $42.1m was 5% above the top end of guidance and flat on last year. The market had grave concerns around the discretionary spend, particularly with Nick Scali’s leverage to a healthy housing market – which has been anything but healthy during lockdowns. It looks as though while people couldn’t travel, they used the additional funds to spend on themselves and their home, driving decent demand for Nick Scali’s mid to upper market furniture.

The current financial year was also off to a flying start with the company noting that strong momentum in the 2nd half, which saw ~20% growth on the first, had continued into the first half with the company expecting 50-60% growth on the first half of last year despite the temporary closure of a number of Melbourne sites. Shares hit all time highs today. While we aren’t prepared to chase NCK just yet, it does give a positive read through for other retailers heading into reporting - we own Super Retail Group (SUL) in the income portfolio.

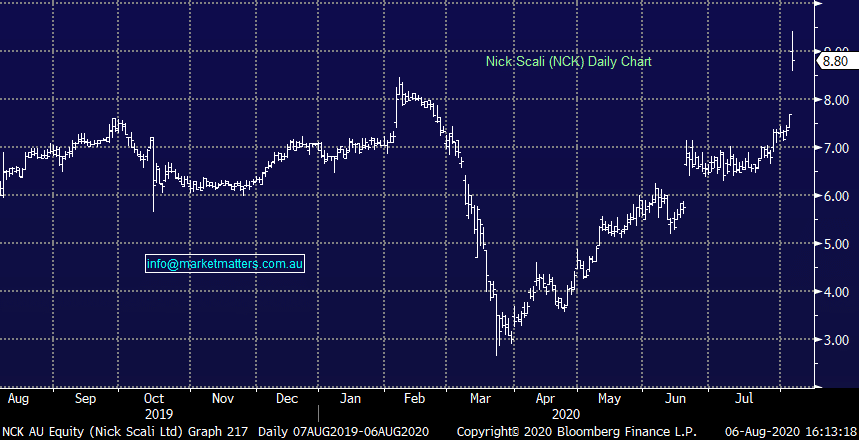

Nick Scali (NCK) Chart