Nick Scali breaks the back of the retailers today (NCK, EVN)

WHAT MATTERED TODAY

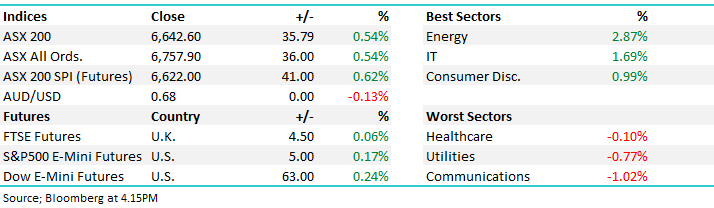

A fairly lacklustre session locally today coming off the back of something similar overnight as the market digests the ebbs and flows of recent China / US trade negotiations, this will likely be a theme over the coming month until pen is put to paper on phase 1 of the deal. US quarterly earnings kick off tonight with a very big session for US investment banks, JP Morgan’s Jamie Dimon the first cab off the rank before market opens tonight, while we also see numbers from Goldman Sachs, Citi, Wells Fargo + Blackrock. Watch for coverage in the International note tomorrow morning.

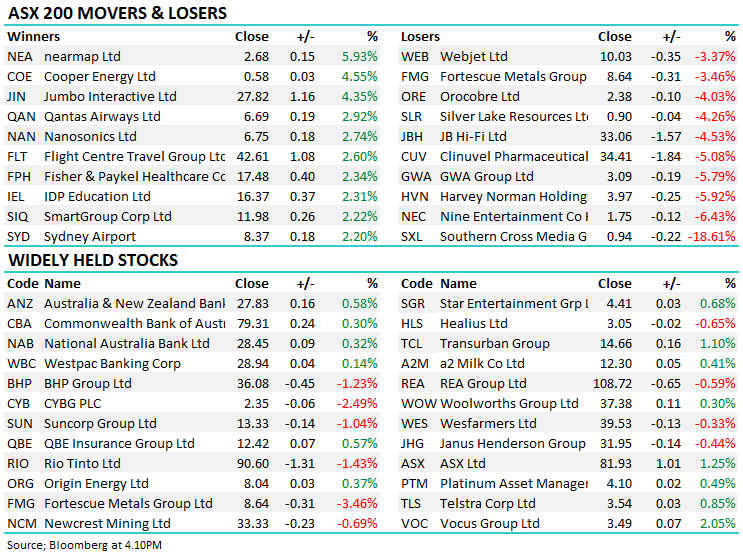

Locally, it was reverse of yesterday with the defensive areas of the market performing best, Healthcare offered most support today thanks to a strong performance by CSL which traded to a new all-time high at $248.39, while on the flipside, a large downgrade by Nick Scali (NCK) put pressure on the retailer, NCK off by 13.75%, Harvey Norman (HVN) -5.92% & JB Hi Fi (JBH) down -4.53%. While we have no exposure in this part of the market we flagged the sectors weak technical picture last week and todays follow through now has us bearish the consumer discretionary sector. We have no interest buying the dip in NCK after the stocks has defied gravity / weak trends in housing for too long – for aggressive traders, the sector looks a short.

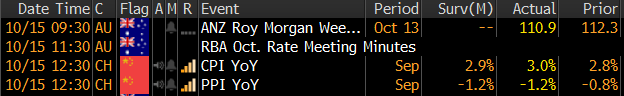

On the economic front today, the RBA minutes were released from the last meeting (when rates were cut to 0.75%) explaining the boards thinking – essentially saying the case for taking interest rates below 1% for the first time outweighed the risks posed by its dwindling policy ammunition. They sighted threats to global growth, ongoing easing among major peers and a stubborn unemployment rate in Oz as the main reasons underpinning the move…the Aussie Dollar was pretty much unchanged at 67.73c.

Elsewhere, Chinese inflation was stronger than expected at 3.0% v 2.9% YoY expected.

Source: Bloomberg

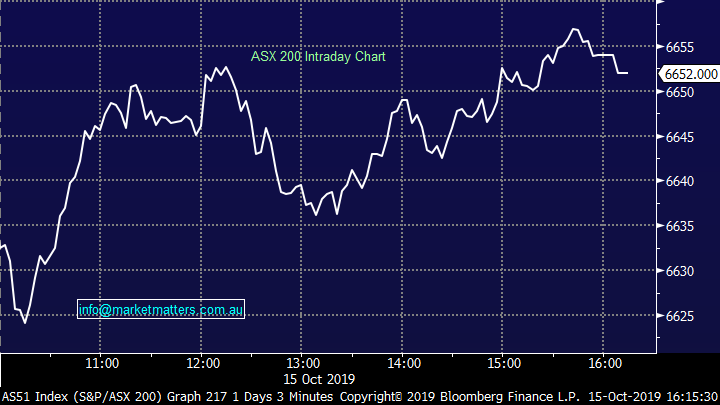

Overall, the ASX 200 closed marginally higher today, up +9pts or +0.14% to 6652, Dow Futures are trading up +55pts/+0.21%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

Nick Scali (NCK) –13.75%; Shares were down as much as 22% at one stage today after the warned of weak sales around midday. The trading update noted falling store traffic which had led to falling LFL sales, “which are currently down 8% YTD compared with the previous year.”The company had already noted slowing sales at the full year result in August, however conditions appear to have deteriorated enough to lower guidance with the company now expecting $17m-$19m NPAT for the first half, well below the $25m seen in 1H18.

Nick Scali blamed the fall in customers on a deteriorating housing market which has seen some price recovery, but very low volumes. The company had been doing a decent job of fighting the housing market decline over recent years but now it looks like it’s starting to bite. The market was looking for flat year on year earnings at around $42m in FY20. NCK tends to have a strong first half skew thanks to the spring and summer trade flow so it is unlikely to get near consensus. We have no interest in buying the dip here

Nick Scali (NCK) Chart

Evolution Mining (EVN) -0.45%; the gold producer was out with their first quarter figures which were mixed causing some volatility in the stock. Production was marginally behind the June quarter however guidance for the full year was unchanged at 725-775koz. The issues come on the cost side which came in at $1,018/oz, well above previous AISC guidance forcing the company to increase guidance here by $50/oz to $940-$990/oz. part of the increase came from higher royalties being paid – a good thing for the company as it means they are receiving a higher price for their produce. The bulk of the rise though came from stability issues at their Mt Rawdon mine which forced remediation works and a revised mine plan. Despite all this, the report was taken reasonably well from the market with Evolution given the benefit of the doubt on 1st quarter numbers. We own EVN in the Growth Portfolio and like gold stocks into current weakness.

Evolution Mining (EVN) Chart

BROKER MOVES; Busy day for analysts, WSA caught the eye after being upgraded by Goldmans – the stock holding above $3 support.

· Western Areas Raised to Neutral at Goldman; PT A$3.20

· Independence Group Cut to Sell at Goldman; PT A$5.50

· SeaLink Raised to Outperform at RBC; PT A$5.25

· SeaLink Raised to Outperform at Taylor Collison; PT A$4.50

· Orora Raised to Hold at Morningstar

· Perpetual Raised to Buy at Morningstar

· Rhipe Rated New Overweight at JPMorgan; PT A$3

· ALS Cut to Neutral at Credit Suisse; PT A$8.40

· Suncorp Cut to Underperform at Credit Suisse; PT A$12.75

· Santos Cut to Equal- Weight at Morgan Stanley; PT A$8

· Santos Cut to Neutral at JPMorgan; PT A$7.75

· Contact Energy Cut to Hold at Deutsche Bank; PT NZD8.77

· Mercury NZ Cut to Sell at Deutsche Bank; PT NZD4.80

· Afterpay Touch Rated New Overweight at Morgan Stanley; PT A$44

· National Storage REIT Rated New Sell at Goldman; PT A$1.51

· Bank of Queensland Cut to Reduce at Morgans Financial Limited

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.