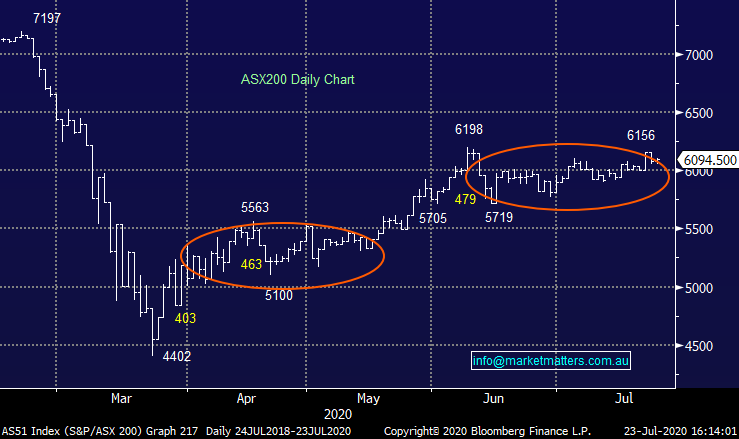

Newcrest shines with strong production update (NCM)

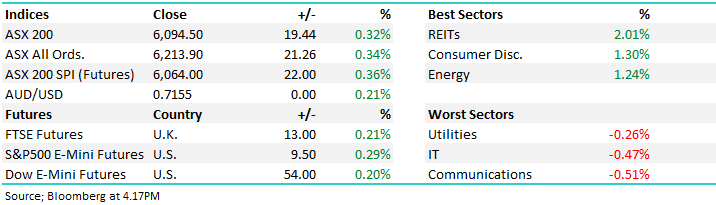

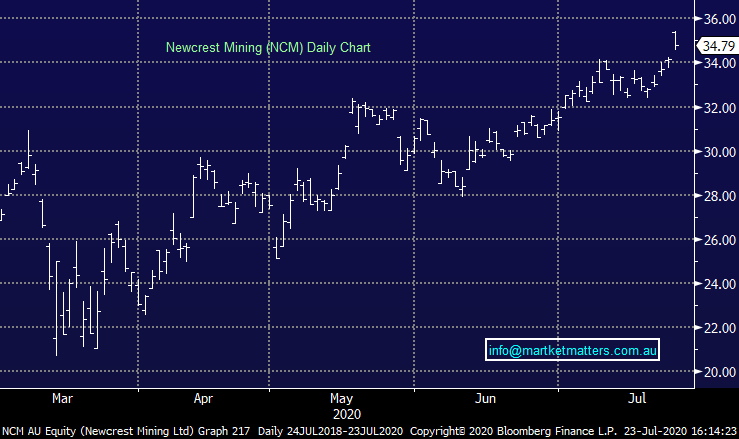

WHAT MATTERED TODAY

A mixed day for stocks with much of the focus being targeted towards the mini-budget – in the media at least. In reality, the situation is still so fluid and will be very dependent on what happens in Victoria, however the key takeaway for us was that the economy has performed better than expected, and throwing money at the problem has worked so far – more thoughts on this below.

Around the region today, Asian stocks were mixed, Japan and China down, Hong Kong up while US Futures during our time zone were very muted for most of the day, although have now ticked higher.

Overall, the ASX 200 added +19pts / 0.32% to close at 6094. Dow Futures are trading up +54pts / +0.20%

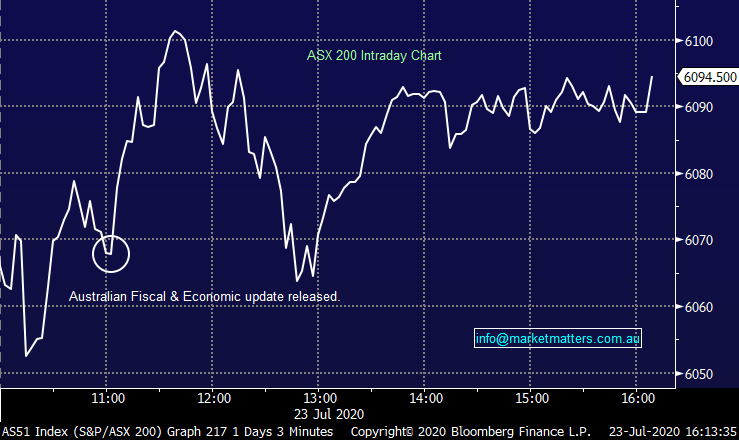

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

Budget Update: I watched the Treasurer and Finance Minister outline the state of the economy today and a few obvious aspects stood out:

- The budget numbers are a best guess in a very fluid situation. What happens next will depend on what happens in Victoria and whether or not the virus leaches further into NSW.

- The numbers today were predicated on 4 more weeks of Victorian lockdowns doing the trick, but that remains to be seen, an importantly, no lockdowns in NSW.

- While the economy has slowed, the outcomes have been a lot better than first thought, largely on the back of the consumer continuing to consume.

- GDP will contract 3.75% this calendar year, however when I look back at the RBA’s assessment as recently as May, they were forecasting a 6% contraction = big beat

- While consumers have held up okay, business investment hasn’t. Business investment / capex is when businesses spend money today on the expectation of earning more from the investment in the future. Right now, that’s not happening and it’s a major issue. I can tell you from my own experience running a business that carrying higher cash balances has certainly been a focus. The key for the economy now is getting businesses to spend – to take a risk – to be confident enough to have a crack.

- While the headlines are about debts, deficits, serviceability and the like, and the numbers are staggering, the key to all of this is about stimulating growth, an economy growing can pay the debt off, an economy contracting, can’t.

- As we’ve suggested for a while now, the better health outcomes have dropped down to better economic outcomes while the stimulus has been significant. More to do however todays update does show that Australia is fairing pretty well, despite the headlines implying otherwise.

Newcrest Mining (NCM) +1.93%: Out with their FY20 and June Quarter production and sales scorecard today and the numbers were good. While they didn’t announce FY21 guidance (they will do at FY results next month), todays result showed that NCM, like OZL yesterday has turned the corner in terms of operational issues and can now focus on ramping up for growth. They’ve previously said they want 5 tier 1 assets and they have a few credible options already on the books to complement Cadia & Lihir. Expect more growth through drilling from NCM as they work through their “organic growth journey” over and above any M & A. We like Gold, and NCM, I’m starting to get frustrated with not owning it (yet), however the selloff into morning highs on the back of a very good production update shows it’s a well owned stock ATM.

Newcrest Mining (NCM) Chart

BROKER MOVES:

· Damstra Holdings Pty Ltd Cut to Hold at Moelis & Company

· AP Eagers Rated New Buy at UBS; PT A$7.90

· Stockland Raised to Neutral at Citi; PT A$3.16

· QBE Insurance Cut to Underperform at Macquarie; PT A$8.20

· Magellan Financial Cut to Underperform at Macquarie; PT A$57.50

· Aurizon Raised to Hold at Morningstar

· Resolute Mining Raised to Outperform at Macquarie; PT A$1.05

· Newcrest PT Raised to A$34 from A$30 at CIBC

· OZ Minerals Cut to Hold at Morgans Financial Limited

· QBE Insurance Cut to Hold at Bell Potter; PT A$10.60

· Resolute Mining Cut to Hold at EL & C Baillieu; PT A$1.34

OUR CALLS

No changes today

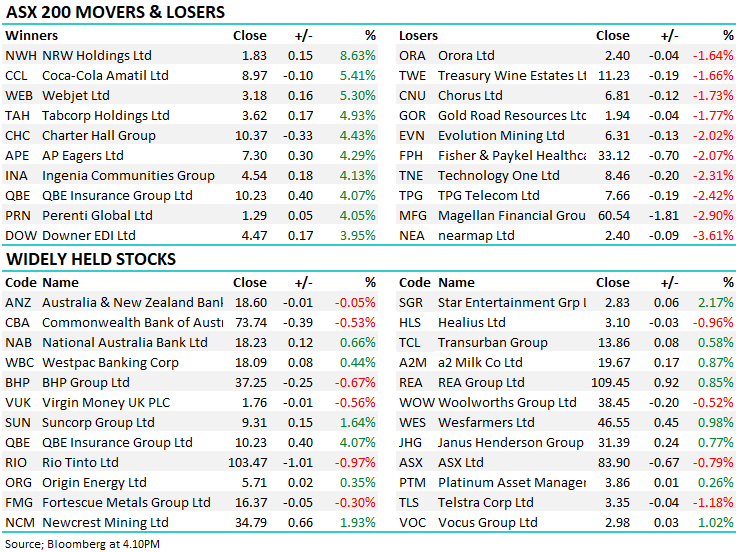

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.