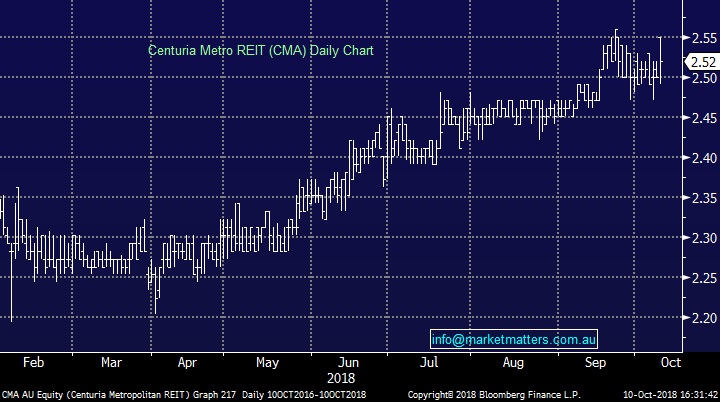

Navitas may finally go private while the market selling takes a breather (CMA, CNI, NVT)

WHAT MATTERED TODAY

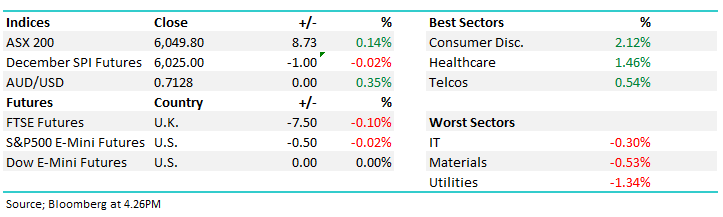

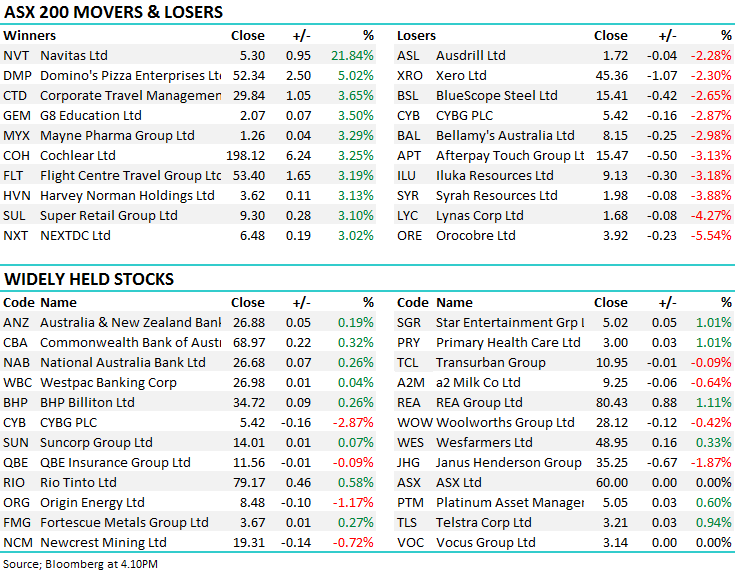

A choppy day today, the index weaved in and out of positive territory for most of the morning before the banks caught a bid and forced the index a touch higher. Buying wasn’t really sustained, broad-based or on high volume which suggests this could just be a breather for the market following such aggressive selling over the past few days. The consumer discretionary sector fared the best, while utilities continue to drag as the retail energy market continues to fear further government intervention.

The growth end of town saw some relief, a particularly solid bounce in CSL & Cochlear which we purchased yesterday, up 3.25% & 1.91% respectively, as well as another recent purchase of our in Aristocrat which jumped 2.61%. In fact a number of the dogs had reasonable days with the out of favour retail space doing well, in particular Super Retail Group (SUL) which we discussed in today’s income report here. A class action was launched against CBA claiming super accounts received less than competitive rates – appears to be an opportunistic attack, looking for $100m which is small compared to CBA’s earnings.

Head stock Centuria (CNI) launched a rights issue to pay for rights in an issue from their Centuria Metropolitan REIT (CMA) as they raise money to buy a number of properties. We discuss this capital raise and also the private equity bid for Navitas (NVT) below.

Overall, the index closed up 8 points or +0.14% today to 6049. Dow Futures are currently trading flat while Hang Seng (Hong Kong Futures) are up +0.88/229pts.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Goldman’s were busy in the resource space - a boring neutral initiation on Fortescue, going soft on South 32 and upgrading Rio to a buy clearly preferring the quality end of the sector at the moment.

The aged care stocks also caught a bid on a note by Ord Minnett who recognized the positive outcomes a Royal Commission could have on the sector long term. They worked on the theory that the established players have long term appeal as the commission may raise barriers to entry, reducing competition and increasing margins. With the commission details yet to be announced, I’d say this report may have jumped the gun

RATINGS CHANGES:

· Qube Rated New Sell at Citi; PT A$2.40

· Japara Upgraded to Neutral at JPMorgan; PT A$1.25

· Fortescue Rated New Neutral at Goldman

· South32 Downgraded to Neutral at Goldman

· Rio Tinto Upgraded to Buy at Goldman

· News Corp GDRs Upgraded to Buy at Goldman; PT A$24.40

· Tawana Resources NL Rated New Accumulate at Hartleys Ltd

Navitas (NVT) $5.30 / +21.84%; The long-time takeover target Navitas has finally received a serious offer that could put the company in private hands. The global education provider has today announced a bid was received from a consortium led by private equity firm BGH capital, offering all cash at $5.50 or shareholders the opportunity to own stock in a private version of the company. The offer represents a 26% premium to yesterday’s close, however NVT was trading above the offer price for much of January this year which may play on investors’ minds. BGH did announce that the consortium includes some of the biggest shareholders including he co-founder Rod Jones and Australian Super, as well as taking a sizable stake in the business themselves to boost voting power.

Navitas (NVT) Chart

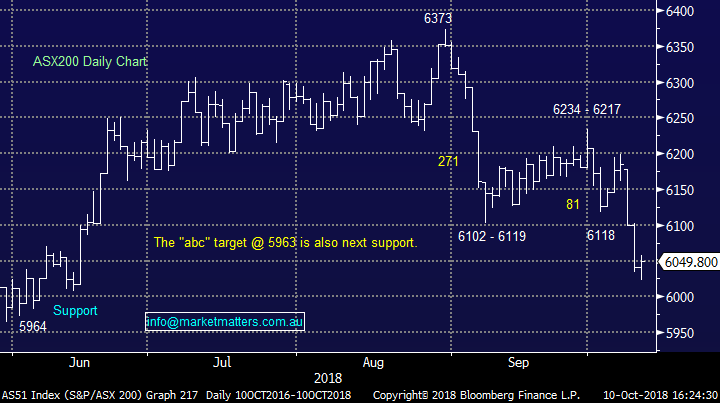

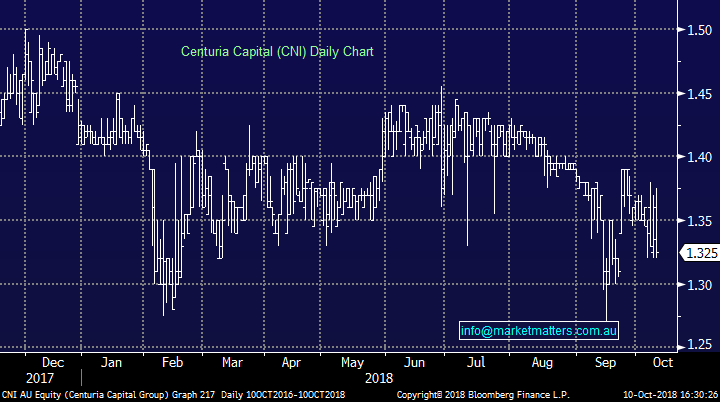

Centuria (CNI) $1.325 / unch & Centuria Metro REIT (CMA) $2.55 / unch; the headstock and their metropolitan fund are both raising some money to purchase 4 properties totalling about $500mil. The properties are being sold by US Family office Hines and has provided CMA the chance to significantly increase the size of the REIT. The rights issue will allow 1 new share for every 3 in CMA, while CNI holders have the option to buy 1 for 5 at small discounts to their last traded. CNI is looking to raise funds to pay for their CMA rights, with the headstock showing confidence in the metro REIT while ensurign their 23.4% stake is not watered down.

CNI is also offering a bond within the deal, using excess funds to fund further partnerships with key stake holder the Lederer group which will add to their management rights portfolio. All in all, a big deal which significantly changes the metrics for both stocks.

Centuria Capital (CNI) Chart

Centuria Metro REIT (CMA) Chart

OUR CALLS

We sold the BEAR & USD ETFs in the Growth Portfolio today.

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 10/10/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.