NAB’s result the best of a bad bunch for the banks

Stock

National Australia Bank (NAB) $26.00 as at 6/11/2019

Event

NAB is the last of the big 4 to report this period – with CBA running a June year end – and looks to be the only bank to have met expectations in what has been a tough year for the group. The bar was set pretty low for NAB following Westpac’s non-interest income issue and capital raise earlier this week, and ANZ’s drama with the international book.

NAB managed underlying earnings of $6.55b and held their at 83c/share which was in line with market consensus. While growth in earnings was hard to come by at just 1.1%, they maintained more discipline around costs which rose just 0.4% on an underlying basis creating what’s known as positive ‘Jaws.’

The NIM – the difference between funding costs and loan book - fell to 178bps in the year however half on half it was flat, while bad debts started to creep up.

The result didn’t come with a capital raise like Westpac, however it did come with a slight capital concern from market. NAB’s CET1 came in at 10.4%, marginally below APRA’s unquestionably strong 10.5% hurdle however NAB expects to cover the ground with the partially underwritten DRP attached to the dividend. Based on the average DRP subscription, CET1 ratio should lift to ~10.75%.

All in all, nothing outstanding about the result but also no skeletons in the closet like the bank peers. They’re doing well in a tough operating environment. T

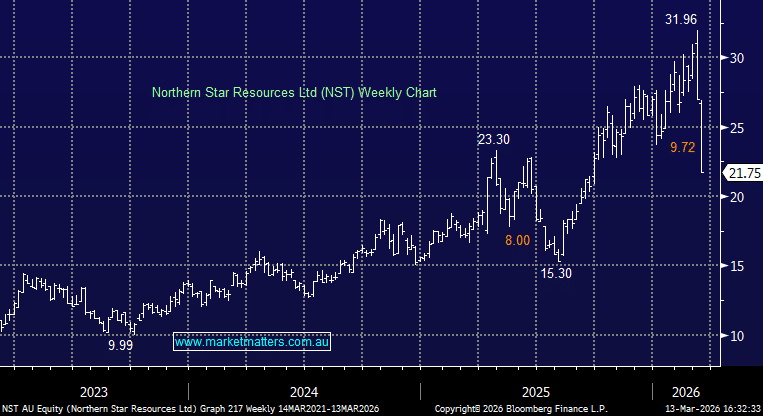

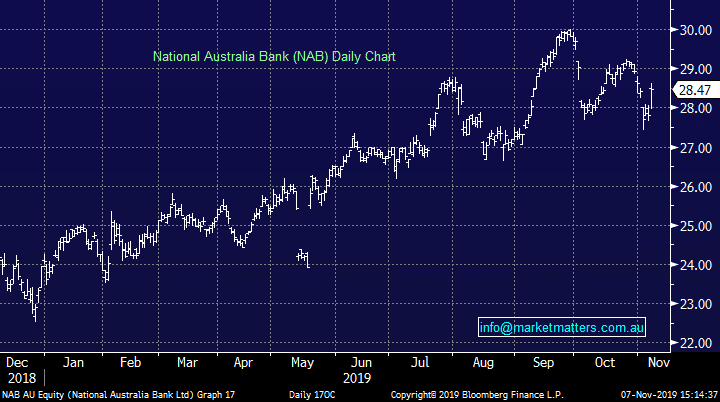

National Australia Bank (NAB) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook