NAB doing a good job in a tough environment (NAB, XRO, Z1P)

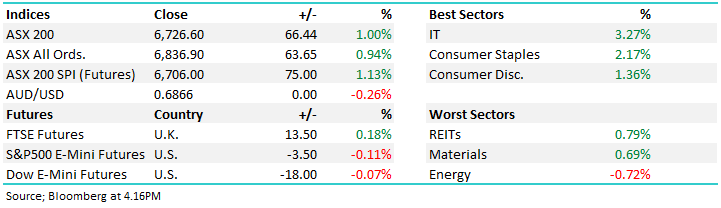

WHAT MATTERED TODAY

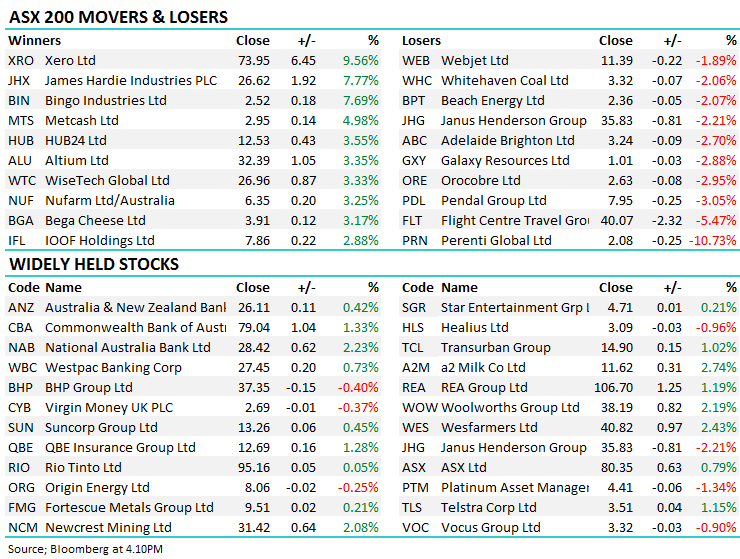

A strong day for local stocks with the out of form Australian banks keying off an inline full year result from NAB this morning – more on that below however that prompted some buying across the sector with NAB finishing up +2.23%, followed by CBA up +1.33%, WBC up + 0.73% & lastly ANZ which added +0.42%. We continue to believe ANZ will lag the other majors given the tweak to franking and the composition of their recent result.

Elsewhere, the IT stocks, which we covered this morning (click here) had a good session. A strong 1H20 result from Xero (XRO) helped plus a great session from Z1P Co after announcing a deal with Amazon. Bingo (BIN) also caught my eye today up +7.69% to $2.52 with a site tour on ahead of their AGM on the 13th November. This is the date we’ve been targeting where they should provide FY20 guidance. On the flipside, Flight Centre (FLT) -5.47% downplayed 1Q trade and hosed down full year guidance saying profit before tax would be in the range of $310-350m while the mkt was at $360m, which was a number that had already been lowered recently. Tough times in the air, and everywhere!

Overall, the ASX 200 closed up +66pts/+1% today to 6726, Dow Futures are trading marginally lower, DOW off 18pts

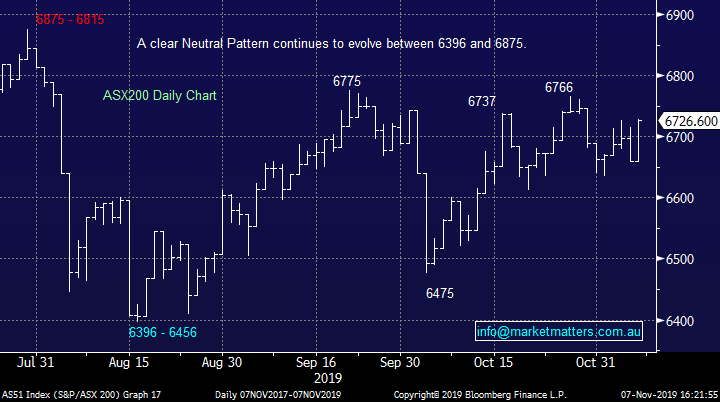

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

National Australia Bank (NAB) +2.23%; the last of the big 4 to report this period – with CBA running a June year end – and looks to be the only bank to have met expectations in what has been a tough year for the group. The bar was set pretty low for NAB following Westpac’s non-interest income issue and capital raise earlier this week, and ANZ’s drama with the international book. NAB managed underlying earnings of $6.55b and held their at 83c/share which was in line with market consensus. While growth in earnings was hard to come by at just 1.1%, they maintained more discipline around costs which rose just 0.4% on an underlying basis creating what’s known as positive ‘Jaws.’ The NIM – the difference between funding costs and loan book – fell to 178bps in the year however half on half it was flat, while bad debts started to creep up.

The result didn’t come with a capital raise like Westpac, however it did come with a slight capital concern from market. NAB’s CET1 came in at 10.4%, marginally below APRA’s unquestionably strong 10.5% hurdle however NAB expects to cover the ground with the partially underwritten DRP attached to the dividend. Based on the average DRP subscription, CET1 ratio should lift to ~10.75%. All in all, nothing outstanding about the result but also no skeletons in the closet like the bank peers. They’re doing well in a tough operating environment and our pick at the moment.

National Australia Bank (NAB) Chart

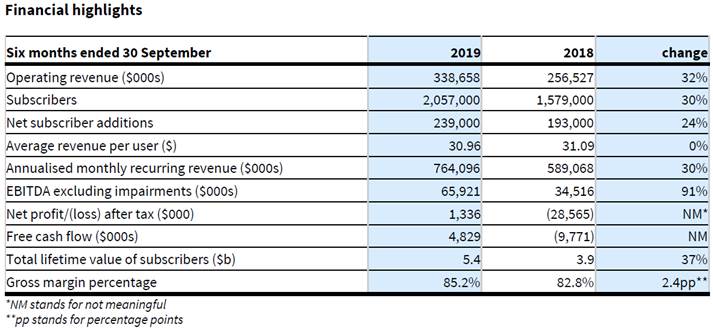

Xero (XRO) +9.56%: Another great result from the cloud based accountancy platform this morning with total subscriber numbers ticking over the 2m mark. The market was positioned for growth in subscriber numbers of +25%, they delivered +30%, revenue grew by 32% slightly above expectations and importantly they had free cash flow of $4.8m. They also booked a first half profit of $A1.24m which is pleasing. As we suggested in the AM report today the pace of subscriber growth is clearly the exciting aspect of this business – while it took more than a decade to add Xero's first million subscribers, it took just two and a half years to add the next million. Some key stats here – hard not to like this business.

Zip co (Z1P) +16.86%; bid strongly today, clawed back a week or so of softness in the share price on news it had signed on with Amazon Australia. Zip is the first instalment option on the Amazon platform giving the alternative payment option access to some 1.5m active customers on the site. The deal is a new one for Zip which has included up to 14.5m warrants to Amazon on Z1P shares. Amazon will take on 25% of the warrants with a strike price of $4.70 per share upfront, with the remainder of the warrants to be vested on particular volume milestones to be met. It looks like a good deal for both parties, but Amazon seem to have struck gold for deals moving forward taking on the ability to earn equity upside in platform partners.

Zip co (Z1P) Chart

Broker moves;

· Brickworks Raised to Buy at CCZ Statton Equities Pty Ltd.

· Centuria Rated New Hold at Shaw and Partners; PT A$3.02

· Pendal Group Cut to Neutral at Macquarie; PT A$8.25

· Pendal Group Raised to Add at Morgans Financial Limited

· Boral Cut to Neutral at Citi; PT A$5

· A2 Milk Co Raised to Buy at Morningstar

· Afterpay Touch Raised to Hold at Morningstar

OUR CALLS

We were filled in Pendal (PDL) below $8 today as planned, helped by a UBS downgrade. There was a big line of stock crossed this morning at $7.95, I would presume that was a facilitation desk. The stock consolidated yesterday’s strong move nicely.

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.