Myer disappoints + a look at short interest (MYR, BSL)

WHAT MATTERED TODAY

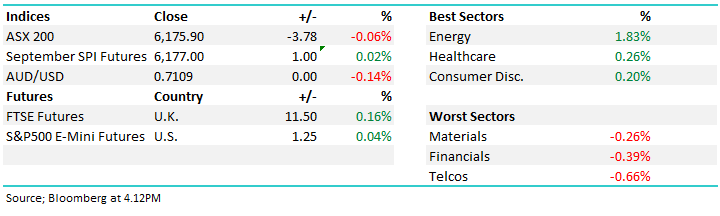

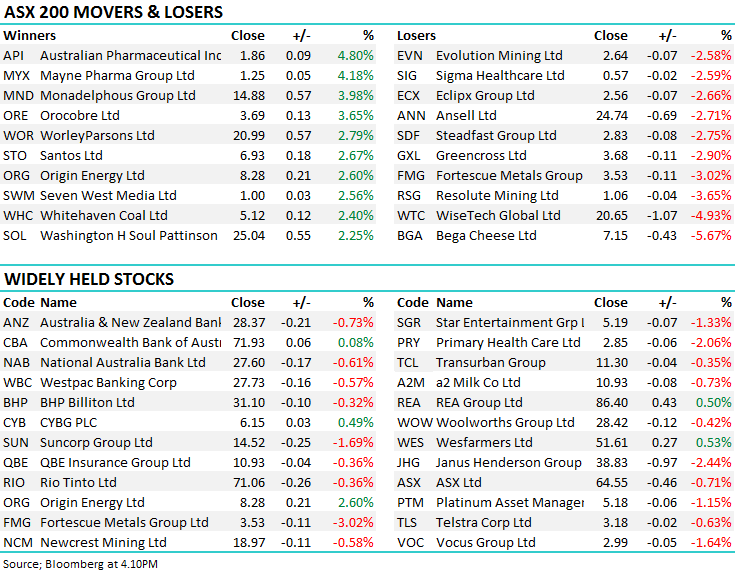

The market recovered reasonably well from a ~25 pt drop in early trading however it never managed to edge back into the green for the day, spending most of the day 5-10points down. Energy lead the charge today as oil saw a rebound back towards the $US 70 mark it broke last week. Healthcare was the only other sector to see broad-based buying, while there was huge disparities in the stock moves across the rest of the index. Financials for example saw CBA +0.08% & Macquarie +1.31% yet the 3 other big banks fell (ANZ the worst -0.73%) along with Suncorp –1.69%. Telcos were the worst sector today, but they also saw some big performance disparity on a stock level – Speedcast up 0.48% while Telstra & TPG were both lower.

Overall, the index closed down -3 points or -0.06% today to 6175. Dow Futures are currently trading are up just +0.08%.

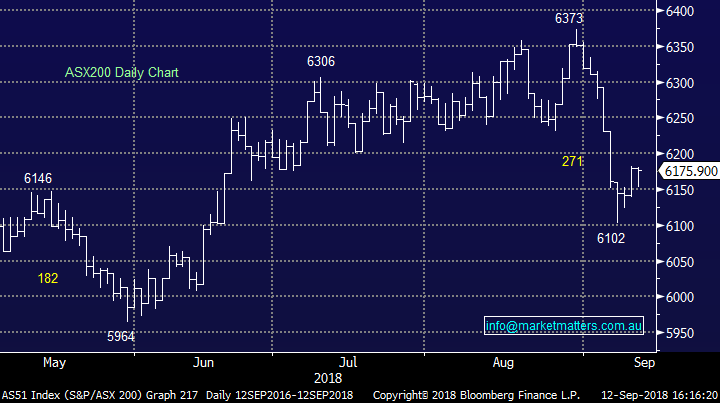

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; Citi turned aggressively negative on Bluescope steel after drastically reducing the steel demand outlook for both China and the US. The double downgrade from a buy straight to a sell was accompanied by a 27% cut to the target price as Citi called the top of US steel markets when prices peaked in July. Chinese environmental restraints have also eased as summer sets in and steel makers have the capacity to increase output – if local demand cannot keep up, Chinese steel will flood the global market and put pressure on BSL. Steel margins have been at long term highs for some time, however this has already begun to turn and since prices peaked in July, Bluescope has fallen -12.5%. BSL closed around flat (+0.24%) today but was extremely volatile.

Bluescope Steel (BSL) Chart

RATINGS CHANGES:

· Bluescope Downgraded to Sell at Citi; PT A$15

· Sky Network TV Upgraded to Outperform at Macquarie; PT NZ$2.60

· Whitehaven Upgraded to Buy at Clarksons Platou; PT A$6.50

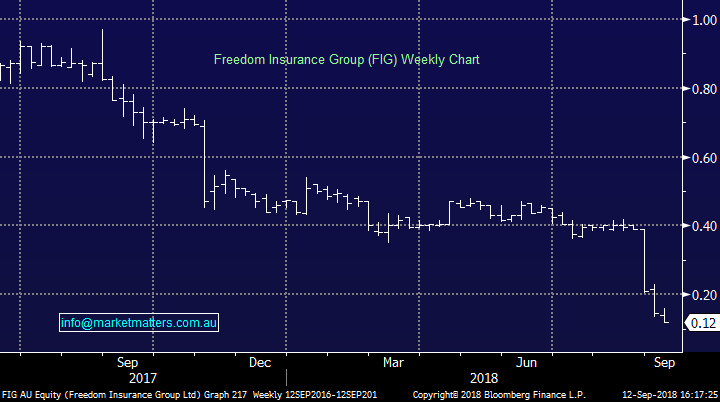

Royal Commission; Another big session at the Royal Commission today with a focus on the sale and structure of Insurance products. For that reason we saw the majority of insurance stocks trade lower, with most pain once again focussed at the smaller end of the spectrum with Clearview Wealth (CVW) and Freedom Insurance (FIG) down ~5% and ~20% respectively. The revelations this week have been damning and have really been focussed on the hard core sales tactics used by product sellers.

There will be significant regulatory scrutiny from here on in and rightly so. Just another example of why the general public find it hard to trust many financial services operators and why there’s such a wonderful opportunity for a new, unique, transparent approach in the financial services sector – something that is not lost on MM!

Freedom Insurance (FIG) Chart

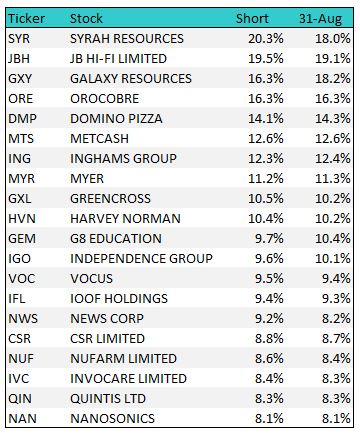

Short Interest; a quick look at the short interest post reporting season, the consumer names have clearly jumped higher as the market becomes increasingly negative household debt/interest rates/house prices, while battery input companies also dominate the list. Graphite prdocuer Syrah returned to the top of the list – it has been heavily shorted for some time, hovering around 20% mark with the company short on capital while looking to develop a battery anode plant in the US. Lithium names Galaxy & Orocobre come in 3rd & 4th, although GXY has recently seen some short covering. The rest of the top 10 is all consumer facing stocks with most seeing short interest increase over the first week of September.

Data for short interest is 4-days delayed. Data compiled through Shortman.com.au

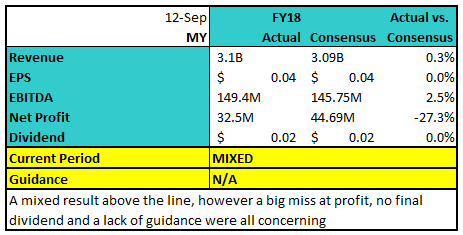

Myer (MYR) $0.415 / -4.6%; Myer continues to disappoint investors with another soft result released pre-market. Above the line, the result wasn’t too bad with sales falling 3.2% over the year – better than previous efforts. It was the profit line that saw a big miss to consensus estimates, and no dividend to be paid in the full year was another red flag for investors. The result looks even worse once one-off/implementation costs are added in. A $32m profit drops to a $486m loss as capital is deployed to try and turn this sinking ship around.

Even the new CEO John King said the result was disappointing as he laid out his plan to revive Myer – stripping out costs, focus on price and stock offering while restoring the customer experience in Myer stores that has been disappointing for some time. The launch of the new Myer website is also key to John’s “Customer First Plan.” It all sounds well and good, however management has failed to set profit or sales targets into FY19 which will rattle investors.

Myer Holdings (MYR) Chart

OUR CALLS

No trades across the MM Portfolio’s today.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.