Morning rally fizzles (again) as markets remain in a holding pattern – Reece hits highs (REH, Z1P, APT, WOW, APX)

WHAT MATTERED TODAY

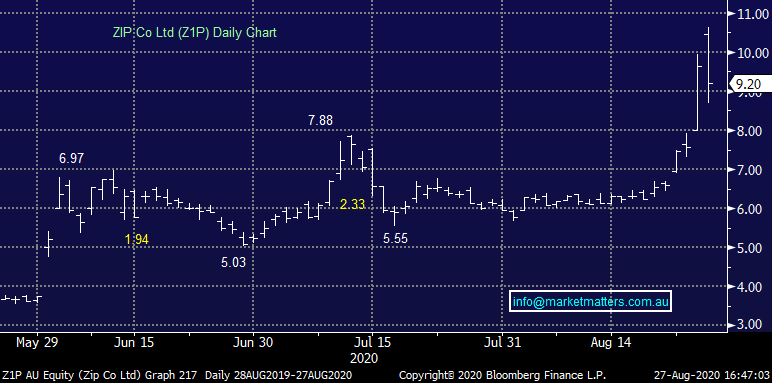

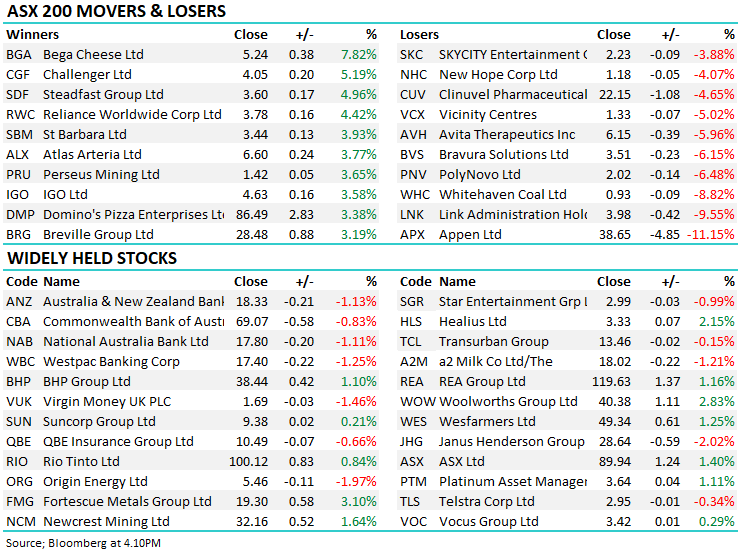

Another session where early gains fizzled out and the market trended lower into the close. Tomorrow marks the final official day or reporting, although a few stragglers come in late – it’s been a very busy few week, pretty exhausted TBH. We’ve had one landmine to date in Bravura Solutions (BVS) which was hit again today, the feedback I’m getting is fairly mixed, they’ve certainly guided conservatively however there are a number of variables in the coming 12 months, still pondering our best approach around this for now.

Overall today, reporting was more negative than positive today, artificial intelligence business Appen (APX) fell 11% on weaker than expected guidance, Harry covers off below, while share registry Link (LNK) was also hit, down 9% - I have a real dislike for share registries, as many do no doubt! At a sector level, Materials were strong, recovering from recent weakness while the more defensive style utilities lagged.

Asian markets were all higher today, while US Futures pulled back, but not materially so.

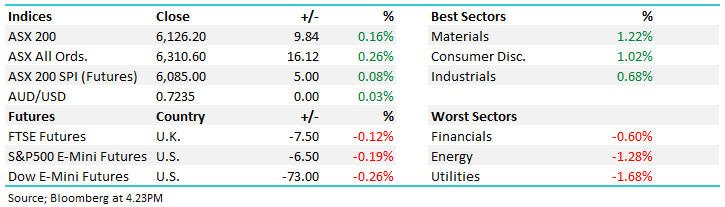

By the close, the ASX 200 was up just +9pts / +0.16% to 6126. Dow Futures are trading down -73pts / -0.26%

LOCAL REPORTING CALENDAR: CLICK HERE **Please note, data sourced from Bloomberg, not all ASX companies are on this list and dates can vary**

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

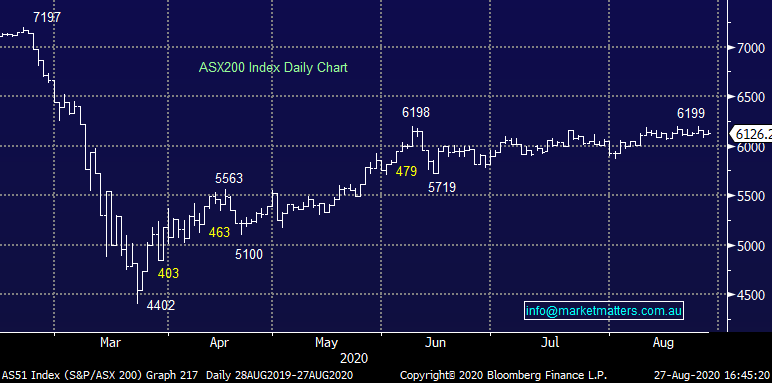

Reece (REH) +11.34%: FY20 results beat on all metrics from the top line to the bottom line and everything in between. Growth is coming through from their US business and they’re very much exposed to strong home building we spoke of in the AM note today. The stock actually hit an all-time high today above $13, only to cool off into the close. Upgrades to flow through tomorrow and we’ll see how it fares from there. We like the sector, the growth profile and clearly they’ve delivered strong numbers today, just valuation a bit rich now. We hold in the growth portfolio

Reece (REH) Chart

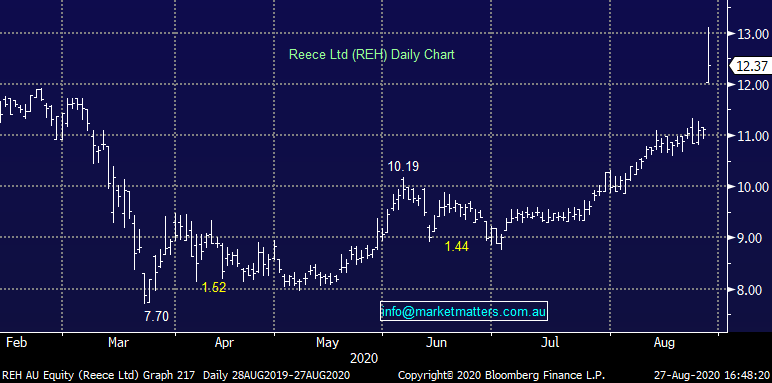

Zip Co (Z1P) -4.66%: Released their FY20 results this morning, the stock opened higher and was sold off thereafter. They’ve been active in releasing news flow of late, so all the key historical growth drivers, transaction value and revenues were already known. Clearly this is a hot stock and yesterday’s +27% move gave way to some selling today. What we want to see now is some consolidation above $8.00 after a solid bounce – consolidation of the rally. This is now very much in the sights of day traders, $405m worth of stock traded today, which is massive. We remain positive given the decent momentum. We hold in the growth portfolio

Zip Co (Z1P) Chart

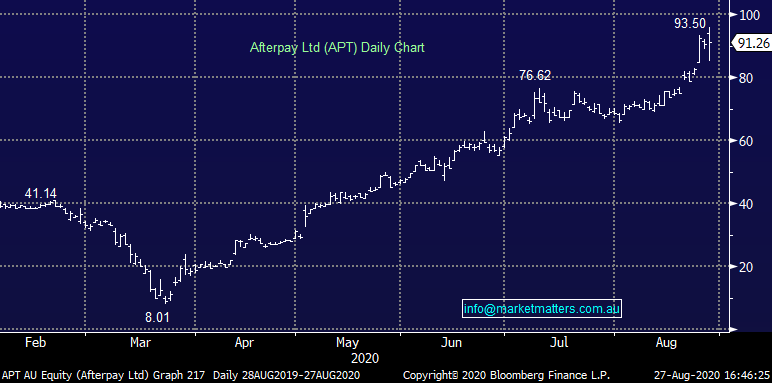

Afterpay +0.60%: Also, out with FY20 results today, but again there wasn’t a lot of new news. In terms of growth drivers for APT, and this is what the mkt is after, they have a number of new launches happening, Canada has just launched, in store launched at a smaller scale in the USA in July, Europe is launching in FY21 – they announced an acquisition earlier this week, while they’re potentially talking about first regional Asia expansion with an Indonesian team to be established and Tencent relationship being explored into Asia. Market likes growth and APT is delivering in spades.

Afterpay (APT) Chart

Wisr (WZR) -7.69%: small alternative lender Wisr beat revenue expectations of $6.7m by 7.5%, printing $7.2m but the company’s presentation was lacklustre, and the stock was pretty heavily sold through the session. Business has been booming through the COVID period with loan originations running hot – a record $42m new loans were written in the final quarter. The issue today was that while the company has been eagerly updating the market throughout the last few months, it provided little in the way of an update for progress in the new financial year. For a growth stock, that concerned a lot of holders and the shares felt selling for most of the day. There is little to say that business has all of a sudden collapsed, so we think today’s reaction is over zealous. We like as a speccy play – what this one over the next few days as they do the rounds and provide more ‘meat on the bones’ of the result today.

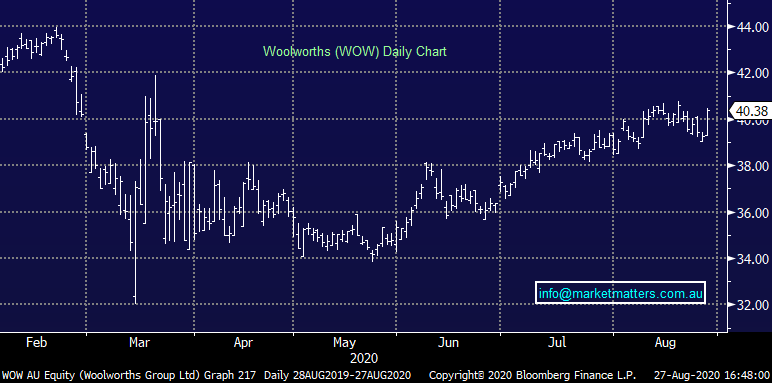

Woolworths (WOW) +2.83%: higher today on a full year beat – EBIT of $3.2b was slightly ahead of expectations. LFL sales were +7.3% for the full year with the pantry-demic obviously driving a lot of the growth. Big W was a standout as well managing to see performance improve, swinging into a profit for the year. Outlook was also solid – similar to the Coles result. Supermarket LFL are running 11.9% higher for the first 8 weeks, Big W +21.1% and Endeavour Drinks +23.7%. It is expensive but has done well.

Woolworths (WOW) Chart

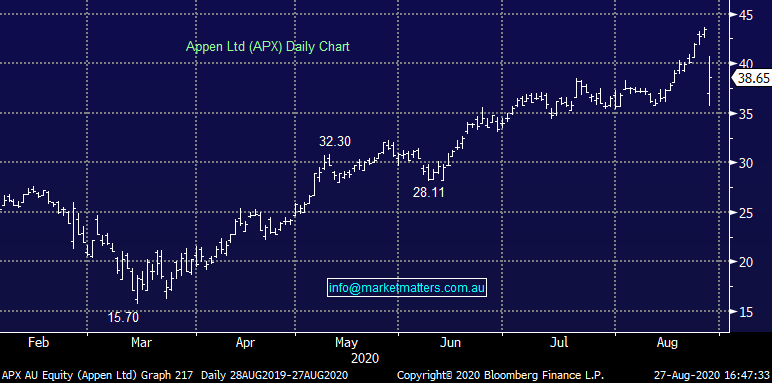

Appen (APX) -11.15%: tough day for Appen on soft guidance at the half year result. Revenue and EBITDA for the first half beat by 4.5% & 6.5% respectively. The AI has seen demand growing throughout the pandemic benefitting from the increased ecommerce usage, among other trends. Guidance was soft though, with the range of $125-130m below market expectations of $132m while it also relies on an AUD/USD price of $0.70, below spot. Shares did find some support late in the session, a good sign a few buyers lie in wait.

Appen (APX) Chart

BROKER MOVES

· Growthpoint Raised to Buy at Moelis & Company; PT A$3.81

· PolyNovo Raised to Buy at EL & C Baillieu; PT A$2.45

· APA Group Raised to Outperform at Macquarie; PT A$11.72

· Bravura Cut to Underweight at Wilsons; PT A$3.22

· Home Consortium Ltd Cut to Neutral at Credit Suisse; PT A$3.21

· Eagers Automotive Raised to Buy at Moelis & Company; PT A$10.29

· Western Areas Cut to Hold at Bell Potter; PT A$2.13

· Eagers Automotive Cut to Hold at Bell Potter; PT A$9.50

OUR CALLS

Growth Portfolio: We bought Vocus (VOC), increased conviction in two existing holdings (BPT & NAB) and funded it through the sale of WBC & WPL.

Income Portfolio: We switched from Westpac (WBC) to National Bank (NAB) on a like for like basis in the Income Portfolio

Major Movers Today

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.