Money finds its way in ahead of the long weekend (GNC)

WHAT MATTERED TODAY

***Please note, given the long weekend, there will be no Weekend Report sent on Sunday. Instead, we will send a version of the weekend note through on Tuesday Morning. We hope you have a great long weekend –James***

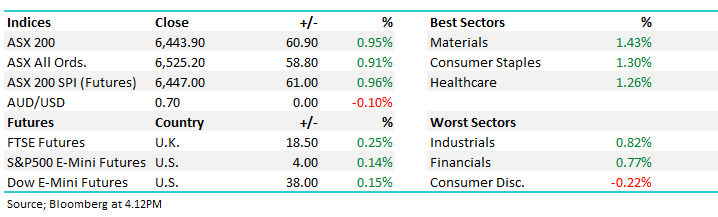

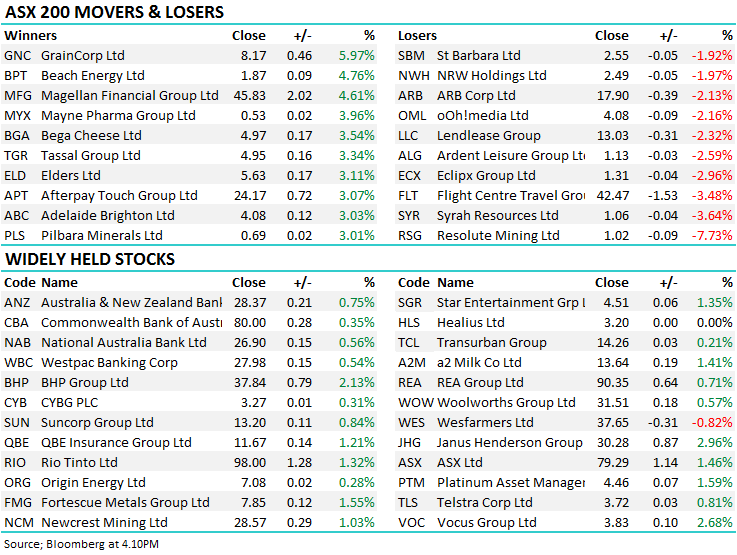

It seemed there was a some buying appetite heading into the long weekend, with the local market starting strong and then rallying late in the day to close on the high with an extra 13pts added in the match this afternoon. Money was headed into resources names which saw a steady stream of buying as the day went on. GrainCorp helped the consumer staples names do well today while the consumer discretionary sector was the only one to fall.

It is set to be a big long weekend with US employment data out tonight, as well as UK GDP data hitting on Monday.

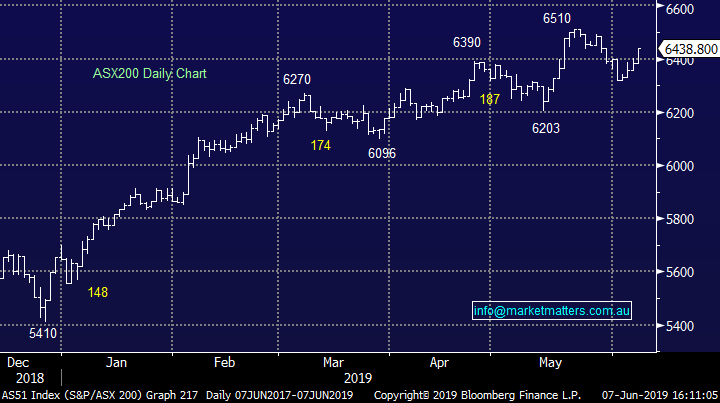

Overall today, the ASX 200 closed up +60pts at 6443. Dow Futures are trading up +38 points or 0.15%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE:

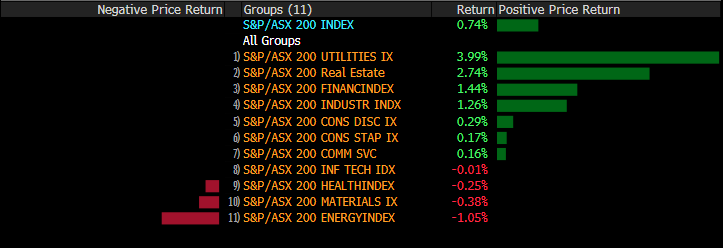

Sectors this week; The bond proxy utilities and REITs were best on this week. Energy and materials followed weakness in oil & resources lower.

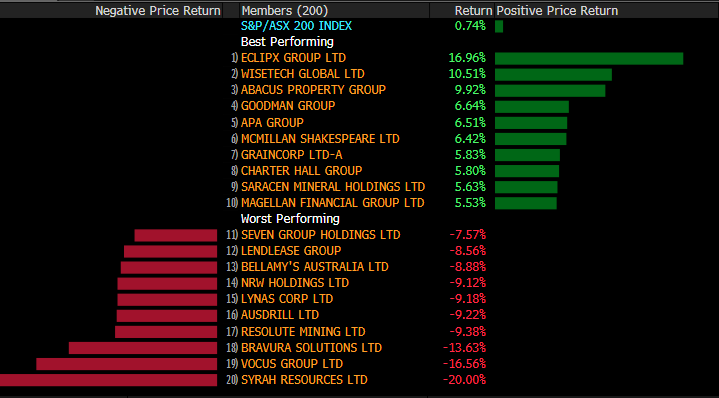

Stocks this week; Eclipx (ECX) bounced back this week, while one of the most shorted companies in Syrah (SYR) looks to have taken more shorts on

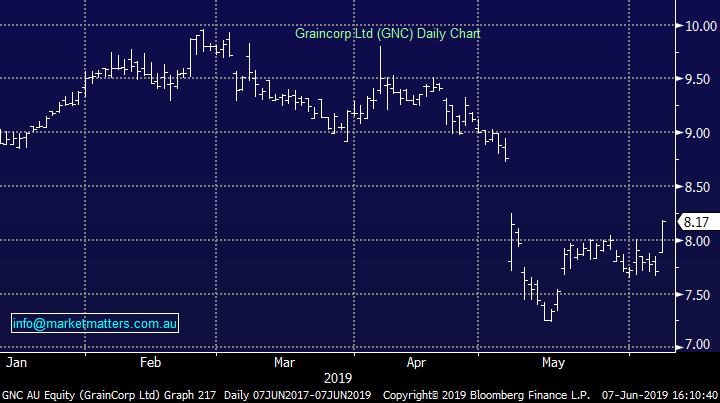

GrainCorp (GNC) +5.97%; the local grain dealer saw its share price higher today on news it had inked a 10-year long insurance deal against poor harvests with Aon that will see GNC compensated if crop harvests fall below 15.3mt, while the company will have to pay the insurer if production rises above 19.3mt. The insurance deal aims to smooth out earnings for the business, allowing better business planning through the cycle. In the 2018 financial year the drought stricken east coast of Australia managed 16.6mt, a fair distance from the record breaking 28.2mt in FY17.

The volatility of earnings for GNC in life after the malt business departs was playing on investors’ minds ahead of the demerger after it saw EBITDA fall from a $30m gain in the first half of FY18 to a $52m loss in 1H19. On the day, the stock fell almost 7% while GNC is currently trading around 20% below this year’s high set in February. The market likes some stability to earnings and GNC will be rewarded.

GrainCorp (GNC) Chart

Broker Moves;

- JB Hi-Fi Downgraded to Neutral at JPMorgan; PT A$29

- Rio Tinto Downgraded to Underweight at Barclays

- Super Retail Downgraded to Neutral at JPMorgan; PT A$9.50

OUR CALLS

No changes today

Watch out for the weekend report. Have a great night,

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 7/06/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.