Mineral Resources fires at Atlas Iron (MIN, AGO, AWC)

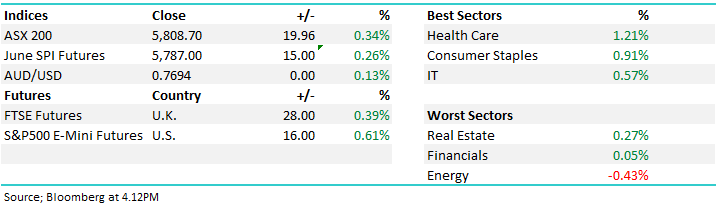

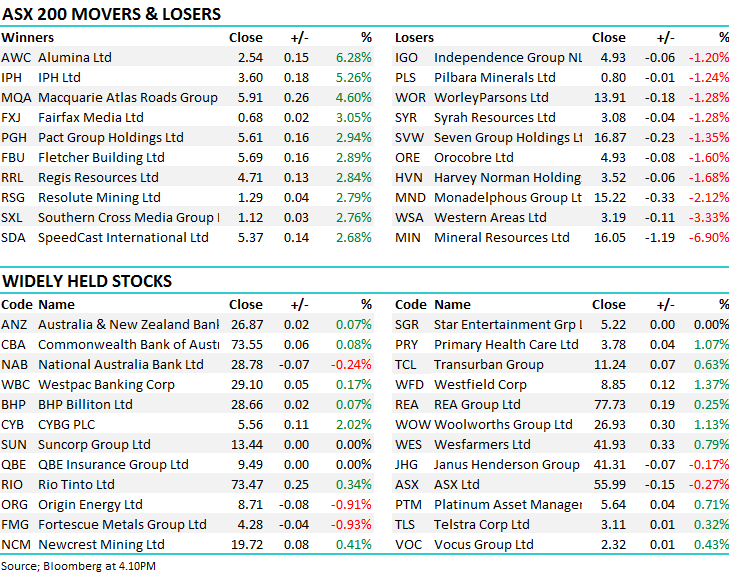

WHAT MATTERED TODAY

The local market shrugged off the weakness seen overseas on Friday, with a push back above 5800 in what was predicted to be a weak session. Buyers dismissed the trade tensions and weak US jobs data to see the banks underpin the rebound, just as they did last Thursday, with NAB the only of the four to finish lower – likely on the news that the planned 6000 job cutting push had begun with more than 20 bankers sacked from its credit risk department.

Mineral Resources was the worst performer after launching a bid at Atlas Iron and re-emerging from the trading halt this morning, while Alumina was the best in the bourse, up over 6% - more on these two later. Healthcare had a breather from recent weakness to top the charts, while energy was the only sector to drag on the index.

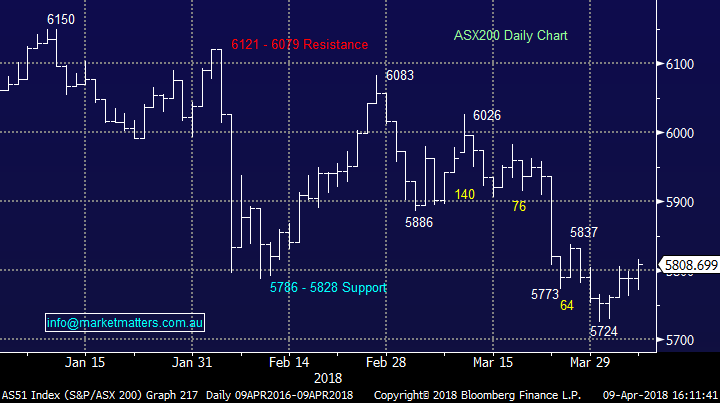

Overall, the market rallied 0.34%, adding 19 points to 5808 – futures were up 0.94% from the close overnight.

ASX Chart

ASX Chart

CATCHING OUR EYE

Broker Moves – some diversion between Rio and BHP by the analysts today with a downgrade and an upgrade respectively, a trend that we have been noticing over the last few weeks – although Rio managed to outperform BHP today.

- Perpetual (PPT AU): Upgraded to Buy at Morningstar – fell 0.73% despite the good news

- BHP (BHP AU): Upgraded to Buy at SocGen – rising a small 0.07%

- Rio Tinto (RIO LN): Downgraded to Neutral at Exane; Price Target 40 Pounds [~$73 AUD] – brushing the downgrade and rising 0.34%

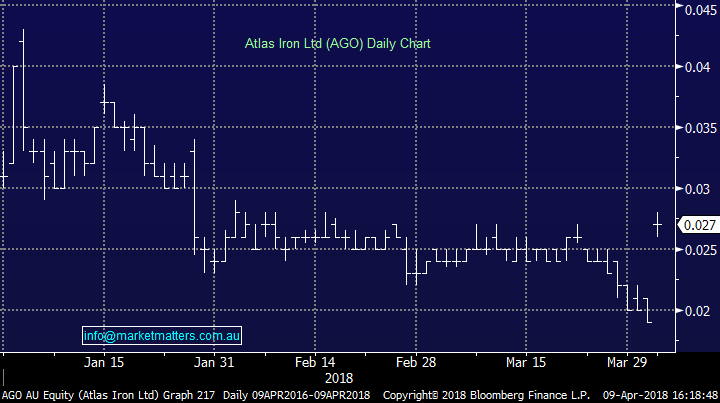

Mineral Resources (MIN) -6.9% / $16.05 – MIN and AGO came back online today after being placed in trading halts on Thursday pending the announcement of a deal. This morning it was revealed MIN had offered an all scrip offer valuing AGO at a 59% premium to the last close of both companies which is likely to receive the board’s approval and see the end of a bumpy ride for AGO over the years which has grappled with debt and a volatile iron ore price.

Mineral Resources has been on the lookout for targets after missing out on the oil & gas play AWE just a few weeks ago. The move for AGO is seemingly positive, as both operate in the Pilbara Iron Ore deposits in WA – however clearly MIN has paid a large premium for the leveraged miner, and also skews the company towards Iron ore which has had a tough time of late and the market seems reasonably downbeat about. We have been keeping an eye on MIN for some time, and further weakness may present an opportunity however we already own ORE in the space.

Mineral Resources (MIN) Chart

Atlas Iron Ltd (AGO) Chart

Alumina (AWC) 6.28% / $2.54 – From the worst performer to the best performer today, Alumina continues its strong move higher on the back of higher Aluminium prices. The trade war has inflated the metal’s price, pre-empting the move by the US to slap a 10% tariff. Many US Aluminium smelters have stated that tariffs will likely do little to see US production increase as power costs remain high. Alcoa, in which Alumina is in a joint venture with, has about 350,000 tonnes of idle capacity at its US operations and has stated it is unlikely to ramp up activity while energy cost remain high – with or without tariffs. Great news for international suppliers despite that tax. We own AWC in the Growth Portfolio, and are targeting fresh new 5 year highs – now just ~3% away.

Alumina (AWC)

OUR CALLS

No Changes to the either portfolio today.

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 09/04/2018. 5.04PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here