Metcash (MTS) trades higher on strategy update

Stock

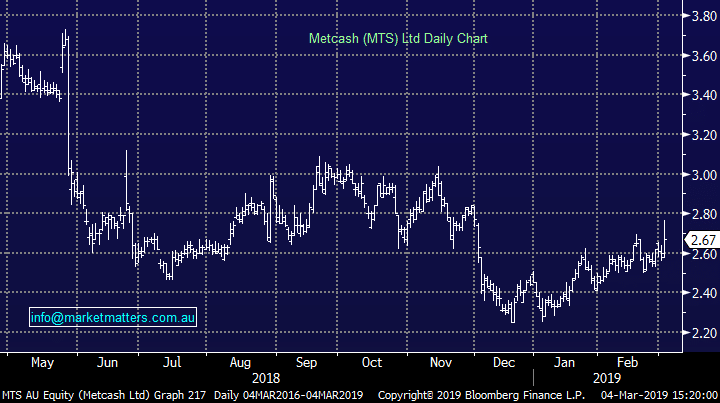

Metcash (MTS) $2.67 as at 4/03/2019

Event

Metcash held their strategy day and outlined a plan to drive growth across the business. MTS is the wholesale supplier to many IGA supermarkets, Mitre 10 outlets and various other brands and continues to battle the retail wide headwinds, however on the back of today's plans, the stock trading over 2% higher.

The retail space has seen slow growth amid increased competition however today they detailed a $165m plan over the next 5 years to ensure growth outpaces the sector.

Metcash identified convenience, store upgrades and private label products as key to delivering profits. Around 500 stores have been identified for a bit of a nip-n-tuck, while currently less than 5% of sales are of private label products - MTS are looking to increase their offering.

Both liquor and hardware are witnessing a slow growth phase and change in tack from consumers. Through their Porters liquor brand, MTS is looking to respond to the ‘Premiumisation’ of sales, positioning themselves as a higher end supplier. Home Timber and Hardware are struggling with the housing down turn and lower construction starts, similar to the issues facing Bunnings. Here Metcash are looking at digitalization as they target growth in market share of house builds from ~30% to 70%.

The strategy update also came with a trading update as Metcash enter the last month of their April year end, with food sales to be marginally higher than last year, liquor performing well with increased wholesale numbers while hardware sales are softening.

Metcash (MTS) Chart

Market Matters Take/Outlook

Market Matters Take/Outlook