Metcash FY18 result impresses

Stock

Metcash (MTS) $2.88 as at 25/06/2018Event

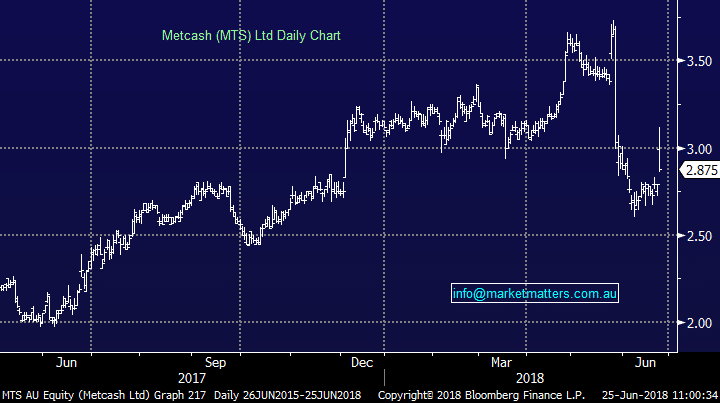

Metcash announced their full year results this morning, and surprised to the upside. Sales and underlying profit ($14.5b & $215.6m respectively) were inline, however EBIT at $332.7m was 3% above the consensus view. Growth in hardware sales was the biggest driver of the beat, with construction and DIY activity higher than expected, a sign of a growing sector rather than Metcash taking market share from Bunnings. Probably the most important part of the result was the announcement of a $125m buy back, highlighting management’s belief in the business after what has been a difficult few months as more players enter the Australian supermarket space. Metcash (MTS) Chart

Market Matters Take/Outlook

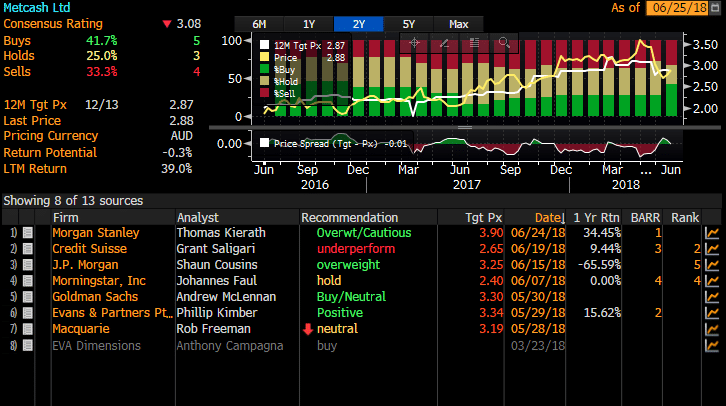

We like Metcash, and it has recovered well after informing the market of a sizable impairment just a few weeks ago. We prefer MTS over WOW & WES on valuation grounds, and the buyback will be supportive. The market is split on the stock with 5 buys, 3 holds and 4 sells with a consensus price target at current levels.