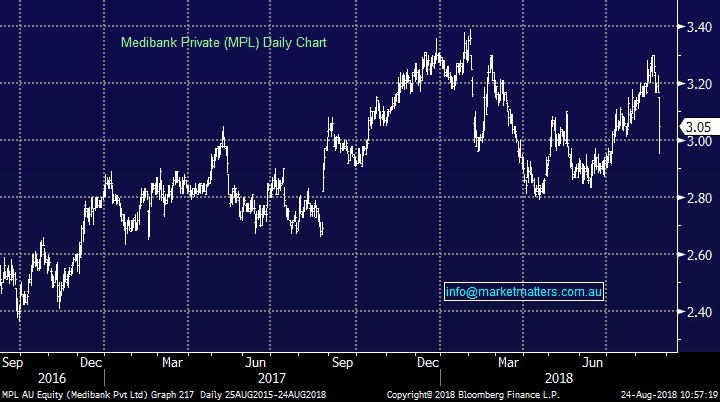

Medibank takes their medicine

Stock

Medibank private (ASX:MPL) $3.05 as at 24/08/2018Event

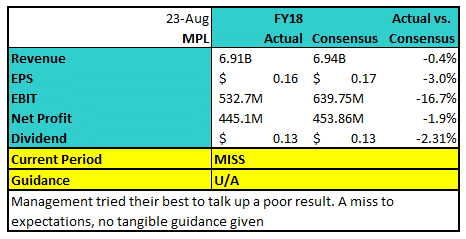

The private health insurer missed expectations in their FY18 report announced this morning, doing the best they could to talk up a poor quality result. A ~2% miss at the profit line was driven by poor investment income as NPAT fell 1% over the year. It has been a tough operating environment for private health insurers with margins coming under pressure and lower take up of cover across Australia. Medibank is trying to balance profit margins with lower premiums to drive some growth. They did receive a benefit this year with lower claims allowing the company to release provisions, however the result still fell short. They are making an effort to deliver growth through scale announcing a small potential acquisition of ~$70mil while costs cutting and productivity measures will remain front and centre in FY19.

Medibank Private (MPL) Chart

They are making an effort to deliver growth through scale announcing a small potential acquisition of ~$70mil while costs cutting and productivity measures will remain front and centre in FY19.

Medibank Private (MPL) Chart