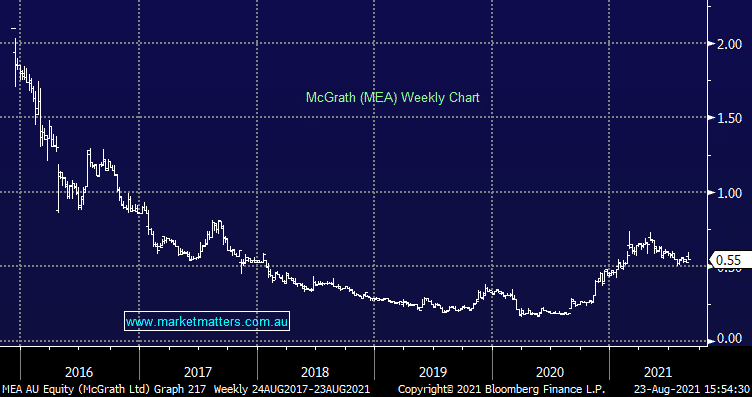

McGrath (MEA) bullish real estate

FY21 Results: The real-estate agent announced a 34% increase in revenue today taking it to $122.4m, NPAT of $19m and its first dividend since 2017 as strength in the property market filtered through to a good turnaround in earnings. After a tough few years, MEA now has a market capitalization of $92m which against its NPAT for FY21 looks cheap (less than 5x earnings). As always, guidance key with the Chief Executive Eddie Law talking it up (although that’s standard for Sydney real-estate agents!!). “Our expectation was that the lockdown wasn’t going to be as extensive as it’s been, but amazingly, and I do say amazingly, the real estate sector has found a way to trade through COVID, and given the listings volume in evidence and given forward option bookings, there’s nothing to suggest at the moment that’s going to wane significantly. It might wane partially, but the expectation is that it will be replaced post-COVID.” Shares were trading 3.77% higher nearing the close.