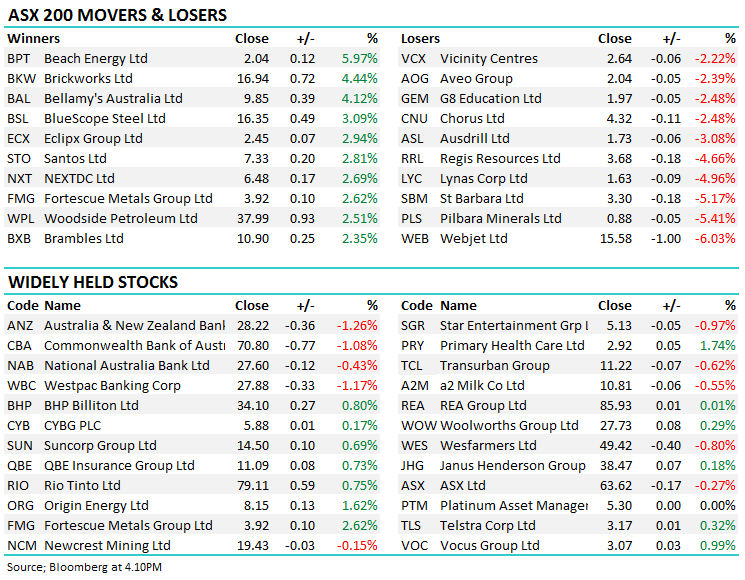

Materials & Energy offset selling amongst the banks (WEB, NUF, BSL, BPT)

WHAT MATTERED TODAY

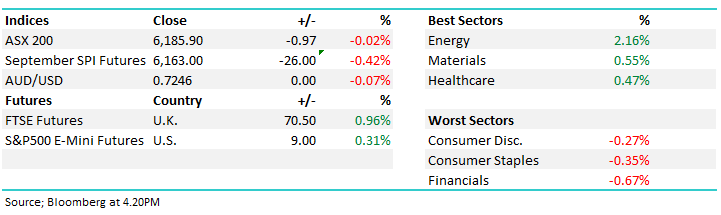

The market was down again today although only by a whisker thanks to strong buying in the energy and materials stocks that added +13index points while the financials detracted -13 index points away from the market – long resources / energy and short banks the play today thanks to higher commodity prices overnight and negative positioning ahead of the draft findings from the Royal Commission due out on Friday. Taking a step back for a moment, between the end of August high on the ASX 200 of 6373 the market then got hit by -271pts / -4.25% in a short sharp decline that lasted just 6 trading days. Since then we’ve taken 12 trading days to recover back to 6185 as we continue to see the market dominated more by sector rotation than outright bullish sentiment. The simple conclusion here is that buyers aren’t in control – the market is edging up on low volume but is far from convincing.

· We still favour a move below 6000 for the ASX 200

Overall, the index closed down -1 point or -0.02% today to 6186. Dow Futures are currently trading up +3pts.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; More activity from brokers today Sims (SGM) splitting opinion. Credit Suisse upgraded while UBS reckon there are more downgrades to come. Morgan Stanley put out a more optimistic piece on the gaming stocks saying that growth in high-roller gambling in Australia is on track, overcoming concerns a slowing Chinese economy is denting traffic. We’ve been looking for levels to buy into Star Entertainment (SGR) and Crown (CWN) and have remained patient given our overall view on the market, however both stocks have come back to interesting areas now.

RATINGS CHANGES:

· Qantas Rated New Neutral at Evans and Partners; PT A$6.17

· Charter Hall Upgraded to Overweight at Morgan Stanley; PT A$7.60

· Folkestone Downgraded to Hold at Shaw and Partners; PT A$2.89

· Vicinity Centres Cut to Underweight at Morgan Stanley; PT A$2.85

· New Hope Downgraded to Neutral at Macquarie; Price Target A$3.80

· Independence Group Cut to Underperform at Macquarie; PT A$4.20

· BHP Downgraded to Equal-weight at Morgan Stanley

· Orocobre Upgraded to Equal-weight at Morgan Stanley; PT A$4.20

· Transurban Resumed Equal-weight at Morgan Stanley; PT A$12.43

· A2 Milk Co Upgraded to Buy at Morningstar

· Sims Metal Upgraded to Outperform at Credit Suisse; PT A$14.45

· Scottish Pacific Downgraded to Neutral at Goldman; PT A$4.34

· Western Areas Upgraded to Buy at Citi; PT A$3.50

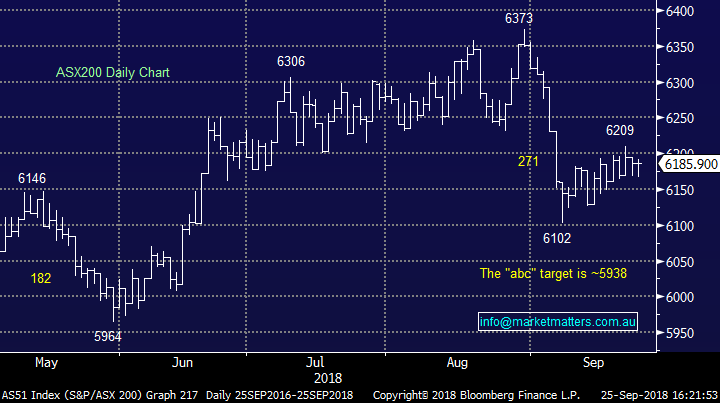

Bluescope (BSL) $16.35 / +3.09%; Up fairly strongly in a lacklustre market and the stock looks good from a technical standpoint – targeting a move back to new highs ~$20. A quick scan of BSL shows its cheap based on expected FY19 numbers, however earnings bump up this year and taper off thereafter. Still, looks bullish at current levels.

Bluescope (BSL) Chart – looks good technically targeting ~$20

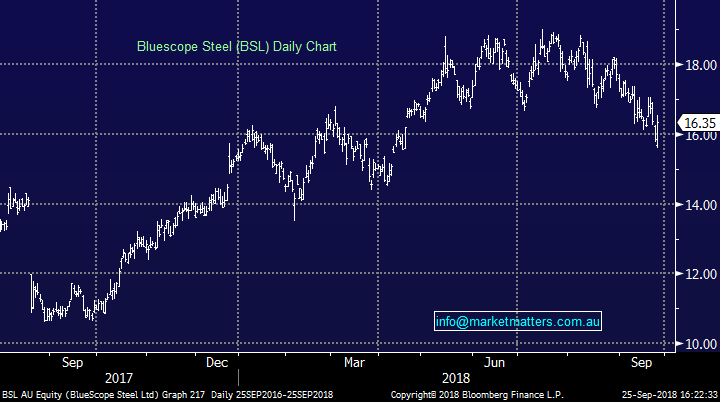

Beach Energy (BPT) $2.04 / +5.97%; another cracking day for the energy stocks thanks to a move up in Crude overnight. OPEC not increasing production in what’s looking like a fairly tight market has traders keen on the energy names. Beach has broken out to new all-time highs today and the stock clearly has strong momentum . We wrote this AM that we like BPT as a short-term play targeting ~$2.10, but the risk / reward will only become attractive if / when we see another test of the $1.60 area. Brokers are negative on BPT with 7 sells versus just 2 buys and a consensus price target ~35c below the current price. Analysts seem to have slow upgrading commodity price decks across the sector – so energy names are come upgrade it would seem based on the exceptionally strong price of Crude.

Beach Energy (BPT) Chart – broken out to new all-time highs today

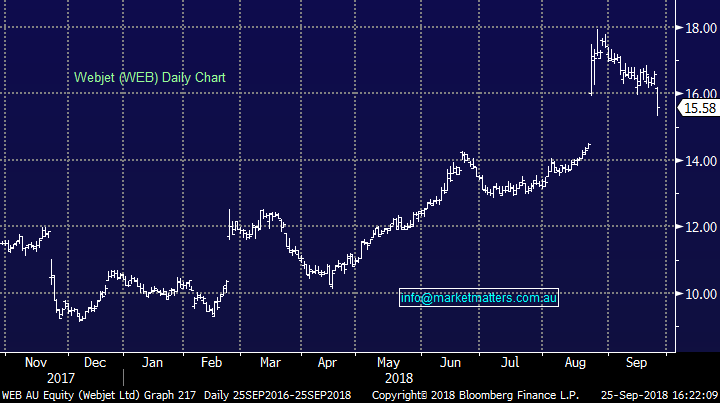

Webjet (WEB) $15.58 / -6.03%; Hit hard today thanks to a downgrade from Thomas Cook in London overnight. Shares in TGC well over 28% after the tour company and airline dropped profit guidance by a whopping 13% to £280m, blaming a hot summer for a fall in demand for holidays across Europe. On the back of that announcement, Sydney Airport is down -1.22%, Flight Centre is off -2.34% while Webjet (WEB) has been hardest hit, trading down -6.15%. WEB has run the majority of Thomas Cook’s wholesale hotels business since 2016. Webjet trades on a reasonable ~24x forward PE which is around a 30% premium to its historical average – we simply think the multiple is too high given the risks around growth in the business. Technically it looks on track to trade back to $14.

Webjet (WEB) Chart

Nufarm (NUF) $6.70 / Trading halt; In a trading halt raising capital today to pay down debt while they’re also due to report FY18 results this week. It’s been a difficult few months for the crop protection company which downgraded guidance back in July and has fallen over 30% from highs back in May. Debt has ballooned out and they company had little choice. Once they raise capital and report results, we’ll have a better handle on NUF. We have previously stated buying agriculture stocks into weather related weakness has merit making the continued weakness in Nufarm a potential buying opportunity.

Nufarm (NUF) Chart

OUR CALLS

We added ALL to the Growth Portfolio at $28 this morning.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 25/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.