Markets vulnerable before US election

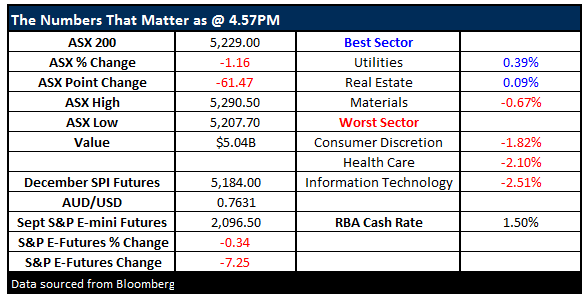

What Mattered Today

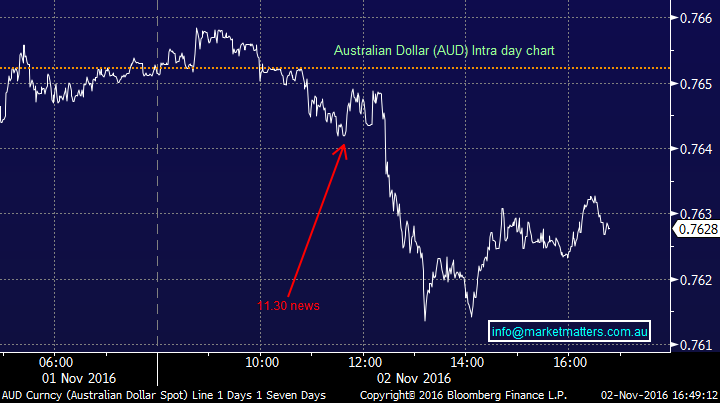

The market opened down this morning, tried to recover between 11 &12 before selling off fairly hard into the afternoon. A late recovery from the 3pm low helped slightly but it was a still pretty average day non-the-less. Weaker than expected building approvals data at 11.30am prompted a decent selloff in the Aussie Dollar while the US FUTURES also tracked lower throughout our session.

Aussie Dollar Today – Building Approvals out at 11.30am were weak

Trump’s resurgence in recent polls has clearly got people scared – and in that environment we see selling first and questions come later. The other clear issue is obviously a lack of buyers, which is understandable. Even though the polls are saying it’s a close race, if we look at the bookies then they still reckon Hillary is a reasonably safe bet as do sites that track the likely outcome in the various States – and they’re saying that Hillary is still a 75% chance BUT, Brexit is fresh in investor minds and the bookies got that one horribly wrong – why would you trust them again?

If Trump wins they’ll be a decent sell off but it probably won’t be a sustained one – more a short sharp reaction followed by realisation that his policies would actually be stimulatory. Anyway, it’s a scary thought, but then again, Hillary is too.

The vote happens on the 8th November so another week of volatility seems likely, however if you look at the post-election stats on the market – as we will do in future morning notes, we usually get a relief rally – to varying degrees depending on the outcome. So, if the market continues to whacked this week we’re likely to step up and spend some of the 21% cash we currently hold.

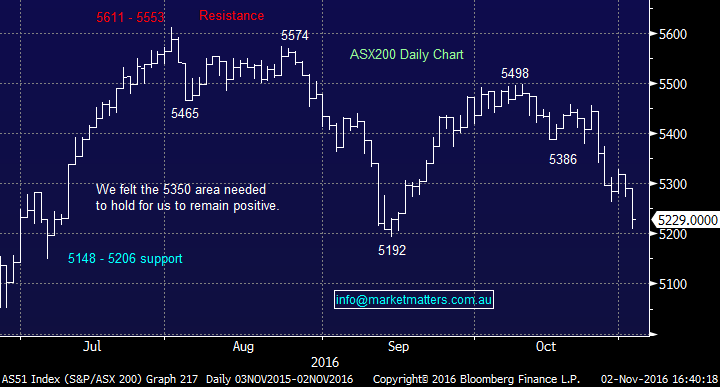

On the market today, we had a range of +/- 75 points, a high of 5282, a low of 5207 and a close of 5229, off -61pts or -1.16%. Volume was OK – $5.04b after a quiet session yesterday.

ASX 200 Intra-Day Chart

ASX 200 daily chart – we turned neutral / bearish on the break below 5350 – raised some cash

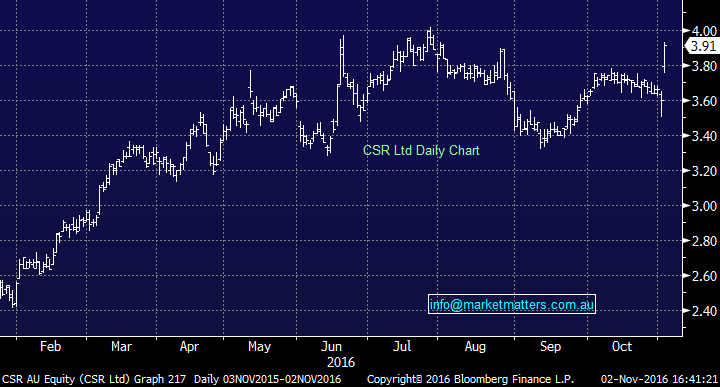

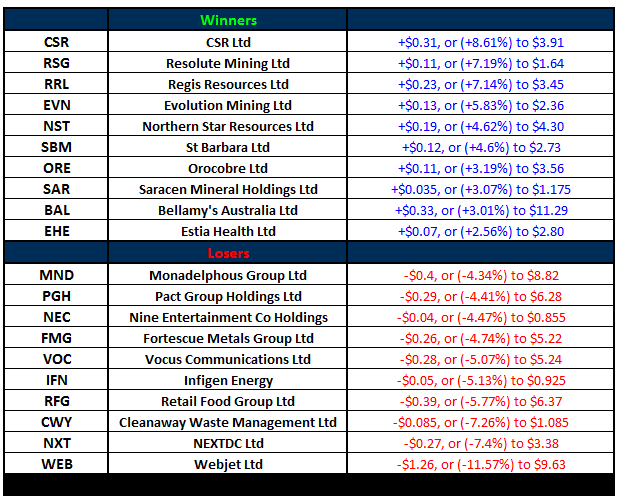

CSR was a bright spot in an otherwise gloomy session after they said earnings would come in at the top of their previously guided range or A$154m to A$184m. It’s a decent upgrade to market expectations + CSR was cheap relative to peers this prompted a decent re-rating of the stock today. Most were negative CSR, it’s under owned, on cheap and is growing earnings at a 12% clip.

CSR Daily Chart

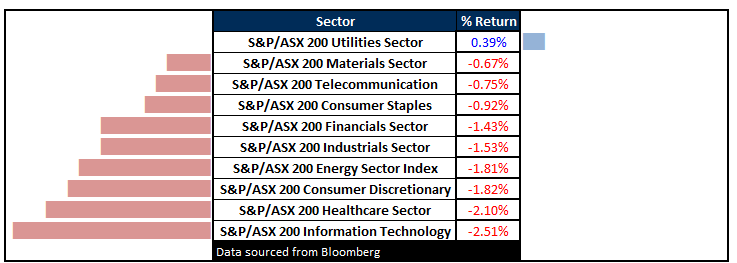

Sectors

ASX 200 Movers

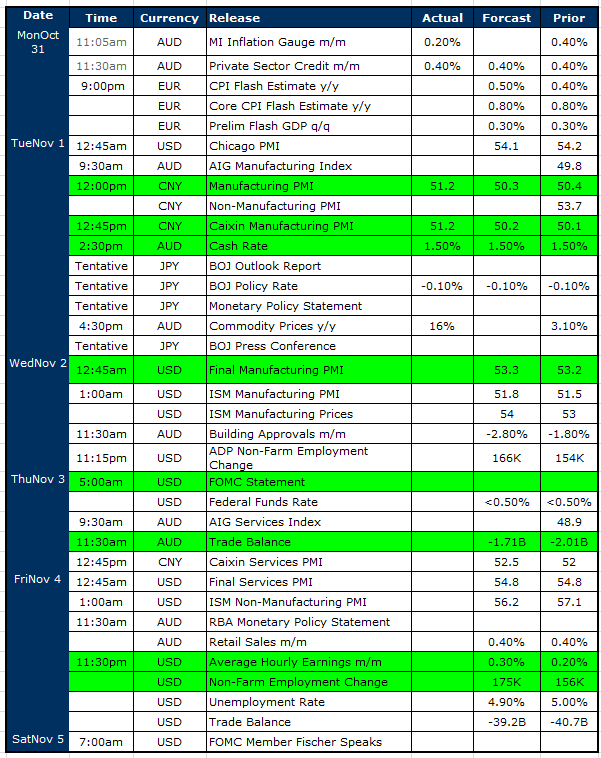

Select Economic Data - Stuff that really Matters in Green

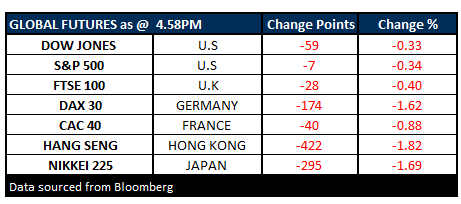

What Matters Overseas

FUTURES lower which hit our market today….

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy.Prices as at 2/11/2016 5.25PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here