Markets trickle higher again ahead of US Fed speech (FMG, ANZ, STO)

WHAT MATTERED TODAY

**A reminder, the income note tomorrow will answer subscriber questions on Listed Investment Companies (LIC’s) in a video. If you have specific questions you would like James to cover, please send them to [email protected] using subject line LIC Question**

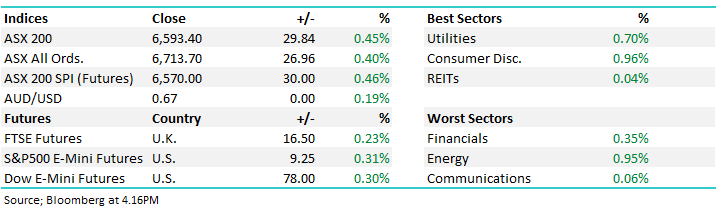

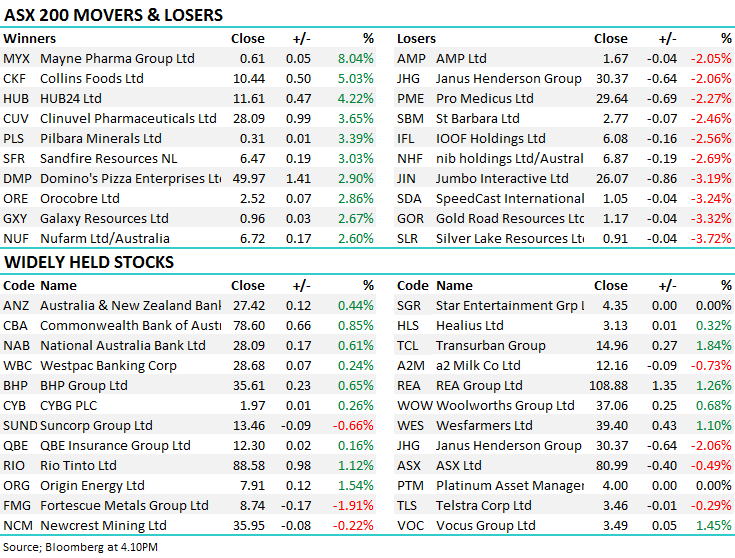

Not a lot happening across markets today, although the ASX did grind higher again on the session defying the negative lead in from the US. Last week the market was sold off fairly aggressively down to a low of 6475 before grinding back to a 6593 close today. While the buying hasn’t been convincing overall, there have been decent pockets of strength in individual stocks - Dominoes (DMP) +2.90%, a position we hold in the Growth Portfolio an example today with sustained buying throughout the session to close at $49.97, approaching our original target. Their US namesake reports Q3 earnings in the tonight – before open with the market looking for EPS of $US2.07). Transurban (TCL) was also strong today adding +1.84% on the session as money comes back into the more traditional yield names on lower interest rates expectations. The theme of lower rates will remain in focus this week with Fed Chair Jerome Powell speaking in the US tonight.

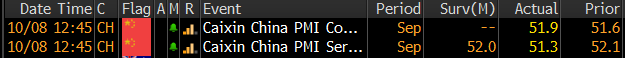

On the economic front today, Chinese data was soft with their services sector expanding, but at a lesser rate than expected + it was down on last month. The Caixin Services PMI adding 51.3 v 52.0 expected v 52.1 the prior month.

US Futures were stronger during our time zone while Asian markets were mostly higher. All sectors on the ASX closed in the black today

Overall, the ASX 200 closed higher today, up 29pts or +0.45% to 6593, Dow Futures are trading up +78pts/+0.30%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

Fortescue (FMG) -1.91%: Was down today v the market and relative to other Iron Ore stocks on news out yesterday they have submitted a bid to develop two blocks in the giant Simandou iron ore deposit in Guinea. Details are light however here’s the rhetoric from the company. “Consistent with our active business development program, Fortescue is interested in global opportunities in iron ore and other commodities which align with our strategy and expertise,” FMG CEO said. Details are confidential however our resource guy Peter O’Connor thinks they’ve thrown their hat in the ring as a blocking move more than anything…more to play out on this.

Fortescue Metals (FMG) Chart

ANZ +0.44; finished higher despite flagging an increase to provisions for customer remediation ahead of their full year result. The bank added $559m to the after-tax charge a week or so after NAB increased theirs by more than $800m. The bulk of the remediation will go towards continuing operations with fees and interest on a number of products heading back to the clients. A smaller portion will go towards the wealth arm which is now considered discontinued given the sale to IOOF which is now less than 10 days from completion.

Remediation reviews continue – not just in NAB or ANZ but in all the banks – however the market knows this and investors will give some wiggle room to the big four if they manage to keep remediation to a level where capital and dividends don’t become an issue.

The harder hit will be the wealth managers like IOOF & AMP

ANZ Chart

Santos (STO) +2.04%; oil names were higher, however Santos led the charge today with some solid results out of their Dorado field development in the waters off Port Headland. Initial results showed the highest potential flow rates in the Caley reservoir and support up to 30k boe/day flow for each well in the shallow reservoir which could add to Santos’ production in early 2020.

Santos (STO) Chart

BROKER MOVES;

· Woolworths Group Rated New Buy at Jefferies; PT A$42.50

· Coles Group Rated New Buy at Jefferies; PT A$17

· Metcash Rated New Hold at Jefferies; PT A$3

· Netwealth Rated New Negative at Evans & Partners; PT A$8.02

· Hub24 Rated New Positive at Evans & Partners; PT A$14.32

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.