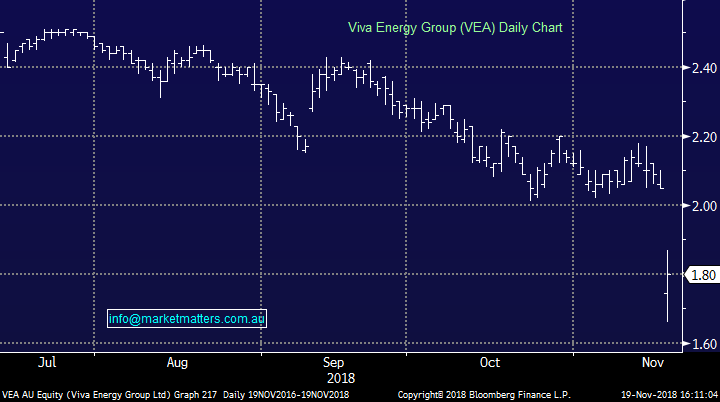

Markets tips below 5700 on a slow news day (MYR, CWY, VEA, MPL)

WHAT MATTERED TODAY

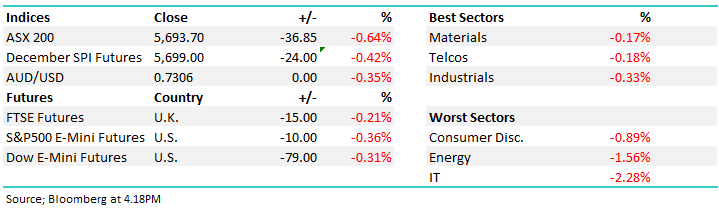

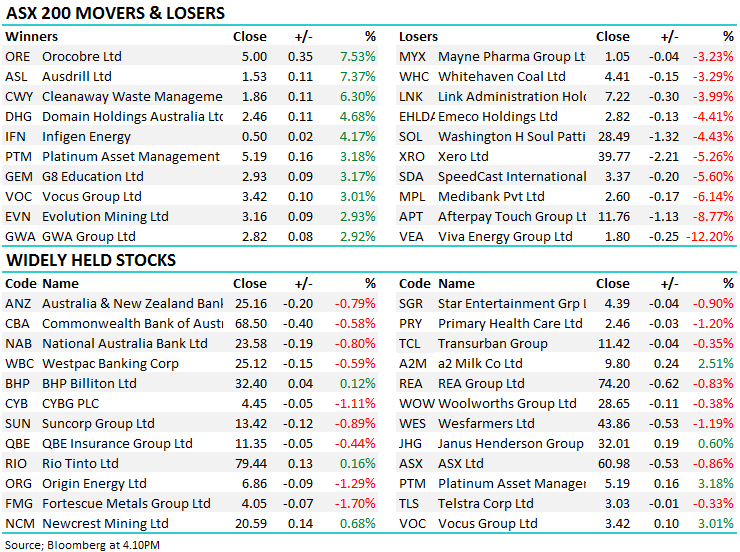

The market held it’s nerve for the first hour of trade this morning before tracking lower for the rest of the session – a particularly savage half hour of selling hit before 4PM before a solid close saw ~10 points recovered late. There wasn’t any particular area of the market that was spared today, with each of the sectors finishing lower – the materials did fare OK, BHP & Rio both finished marginally higher. Tech & energy were the worst with a combination of some poor company specific news and a general sell growth theme hurting the sectors.

There was plenty of company specific news out today… Baby Bunting (ASX: BBN) held their AGM which contained a profit upgrade - clearly not all retailers are feeling the pinch! Fairfax (ASX: FXJ) received a letter from previous Domain (ASX: DHG) CEO Anthony Catalano with some broad stroke ideas that would derail the merger with nine Entertainment (ASX: NEC). Ever the big thinker, Anthony’s proposal was shot down as the board recommended the merger say “there was no actual proposal that could be considered” from Anthony and both Fairfax and Nine popped higher. Healthscope (ASX: HSO) updated the market on the Brookfield takeover, allowing them exclusivity until late December – progress is being made but no binding agreement yet. Below we discuss Myers sales, Viva Energy’s poor start to listed life & Medibank Private’s

Overall, the ASX 200 closed down -36points or -0.64% at 5693. Dow Futures are currently down -79points or -0.31%

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

Broker Moves; Credit Suisse moved on waste management company Cleanaway (ASX: CWY) today, pushing the stock ahead of its investor day on Thursday. The broker moved to the equivalent of a buy, raising the price target almost 8%. The thesis quotes recycled plastic trends and vertical integrating opportunities as reasons for the move. Integration synergies from the Toxfree takeover should also benefit the investor. Cleanaway was the third best today, up 6.3% to $1.855.

Cleanaway (ASX: CWY) Chart

Elswhere...

- Vista Group Rated New Buy at UBS; PT NZ$4.45

- Mayne Pharma Rated New Underperform at Macquarie; PT A$1.05

- G8 Education Upgraded to Overweight at Morgan Stanley; PT A$3.25

- Bega Cheese Rated New Neutral at Goldman; PT A$6.50

- Synlait Milk Reinstated at Goldman With Neutral; PT NZ$10.10

- Cleanaway Upgraded to Outperform at Credit Suisse; PT A$2.05

- SCA Property Cut to Underperform at Credit Suisse; PT A$2.25

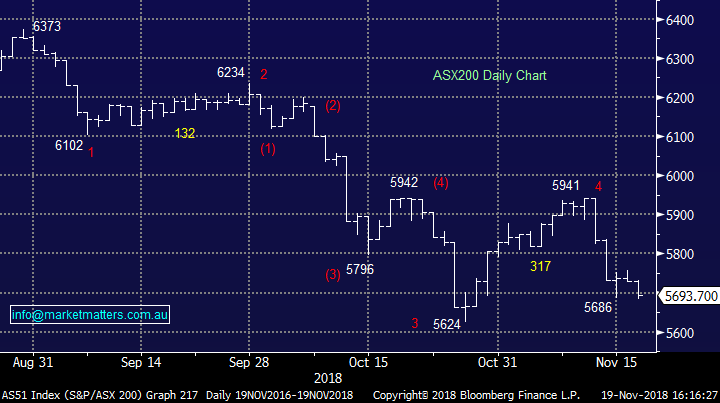

Viva Energy (ASX: VEA) $1.80 / -12.2%; The biggest IPO of 2018 so far (although no contenders have presented themselves with just 6 weeks left) fell today after announcing they expect to miss prospectus estimates for the full year. Viva Energy, which operates over 1,000 Shell petrol stations along with an oil refinery in Geelong, flagged a ~13.5% miss to prospectus profit at for the December year end result with the realized refinery margins being the main driver of the downgrade, as well as weaker than forecasted retail sales. The company noted that margins in general had come under pressure late this year, and a black out in August meant a they lost a week’s production. Expected margins for the year are now $US8/bbl, vs the prospectus looking for $US9.2/bbl.

Also contributing to the downgrades was the higher oil price which saw petrol prices soar, and motorist doing their best to reduce petrol consumption volumes, although as oil prices have fallen Viva did note petrol volumes return. All in all, EBITDA is now expected at $543m & NPAT at $280m vs prospectus estimates at $605.1m & $324.1m respectively – these numbers are all on a replacement cost basis. VEA is currently -28% below its listing price.

Viva Energy (ASX: VEA)Chart

Medibank Private (ASX: MPL) $2.60 / -6.14%; The health insurer stopped trading for a short period this morning to announce to the market that they had lost a key Government contract as the Department of Defence advised that they would not be renewing Medibank as the healthcare provider for the ADF. Since 2012, Medibank had delivered health services to the 80,000+ members of the ADF through Garrison Health Services (GHS). In the FY18 result, the GHS contract added around $30m, or around 5% of the total group pre-tax profit.

The company expects $5m in exit costs, but no longer term impacts following the contract coming to an end in June of next year. It is obviously never nice to lose a client, particularly a big one like this, however the market looks to have overreacted here – a -6% fall on a less than 5% downgrade. Despite this, it’s hard to stay positive MPL as the stock breaks down technically.

Medibank Private (ASX: MPL)Chart

Myer Holding (ASX: MYR) $0.41 / -8.89%; Myer was sent into a trading halt by the ASX late last week as the exchange wished for the company to clarify a number of issues raised by an article in the AFR. The article quoted an internal note that outlined the disastrous sales figures that, and although were overstated, they were on the right track. The company announced sales had fallen -4.8% in the first quarter compared to the same time last year, the article had quoted -5.5%. The market clearly didn’t take kindly to the news however the board stood strong saying they “will not chase unprofitable sales just to hit our top line sales number.” This puts the company in a precarious position – when it seems most others in the market are slashing prices to drive sales, Myer won’t, and a drive to cut costs in the business has resulted in falling marketing spend – so where will the sales come from?

The Christmas period is nearly upon us and it could be the saving grace for Myer in the short term. We are also entering a key part of the year for the listed retail as the late-November / early-December ‘Santa rally’ can turn a bad year into a solid one for the sector. Will this be the Christmas that Amazon takes over?

Myer Holdings (ASX: MYR) Chart

OUR CALLS

No changes to the portfolios today.

Have a great night

James/ Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/11/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.