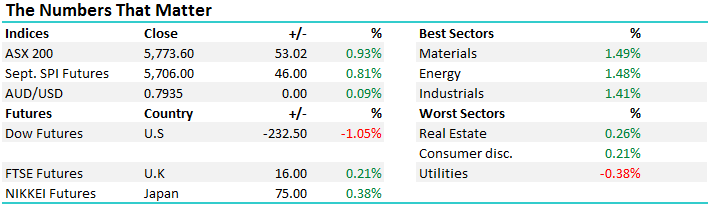

Markets strong on light volume

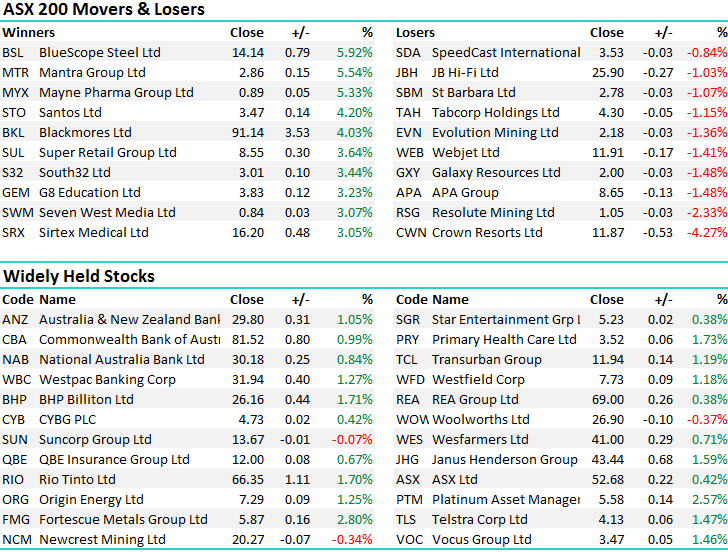

A bank holiday in NSW ensured a day of light volumes with strength early in the resource companies offsetting some decent selling in CBA that traded as low as $80.00 shortly after the open. It looked like one big seller was clambering to get out, driven by the immense media pressure over the weekend from the AUSTRAC investigation. As we suggested last week, $81 is good support for the stock and it didn’t trade for long below that level – snapping back in short succession to close out the day at $81.52 – up +0.99%.

In terms of the potential financial hit (fine) for every $100m this equates to 4c per share – so $500m is 20c, or $1bn is 40cps. Since the news broke, the stock has dropped $3.97 – clearly a big reaction and an example of the markets ability to overcook specific events. We’ve got ‘full’ positions in CBA which in this instance hamstrung us, however as suggested on Friday, we’d normally be buyers of a situation like this.

Commonwealth Bank (CBA) Daily Chart

On the broader market today, the Material sector saw most strength while Utilities dragged, dropping -0.38% to be the only sector in the red - an overall range of +/- 61 points, a high of 5781, a low of 5720 and a close of 5773, up +53pts or +0.93%.

ASX 200 Intra-Day Chart

ASX 200 Daily Chart

Crown (CWN) reported on Friday and we saw a number of broker downgrades today which prompted a -4.27% drop in the stock to close at $11.87. The issues stem from a drop in VIP revenue in their existing casino’s and the mkt concerns that the new VIP facility in Sydney will simply create more exposure to that struggling end of the mkt - VIP volumes down 49% in FY17. The falls stem from a crackdown on marketing efforts targeting high rollers in China and now they also have a higher currency to content with. We have no interest at Crown at current levels.

Crown Daily Chart

Janus Henderson (JHG) – reports half year results tomorrow and this is a stock we’ve been in and out of in recent times (now out of). The stock traded up +1.59% today to close at $43.44 and it’s now looking bullish after a reasonable pullback. We’ll be keenly watching the result tomorrow.

Janus Henderson Daily Chart

Have a great night

The Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 07/08/2017. 5.00PM.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here