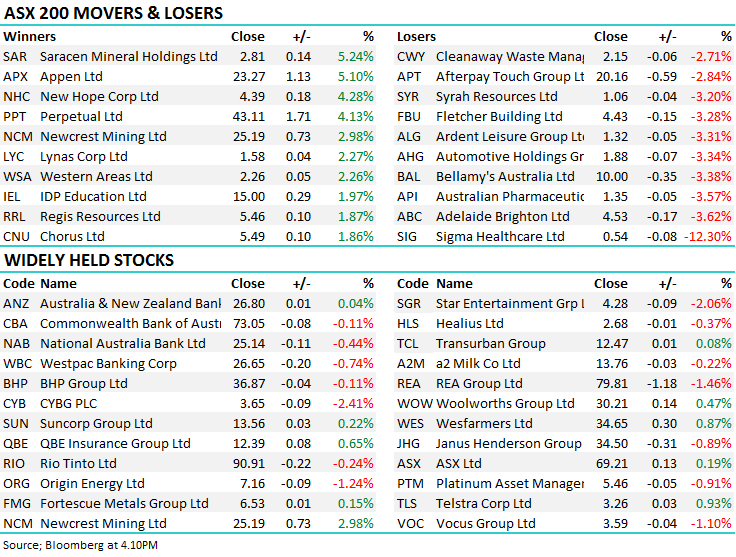

Markets stage a late recovery (SIG, API)

WHAT MATTERED TODAY

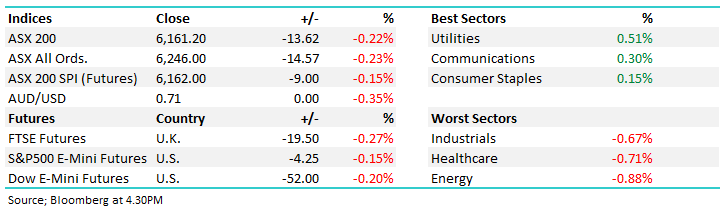

Yesterday’s momentum to the downside certainly continued through to today’s session as the local market opened strongly lower despite the UK & US markets both trading higher overnight. The ASX200 traded to a 2-week low early in the afternoon before staging a decent recovery over the last few hours including a futures led kick in the match which added 9 points.

Winners today were the losers of yesterday – Appen (APX) bounced back after its post capital raising slump to add 5.1%, while Perpetual (PPT) just about clawed back yesterday’s softness putting on over 4% today. Sectors were mixed, Energy the worst off thanks to a UBS note we discuss below.

As a reminder, we discussed three new opportunities in the income report today – click here to read.

If any of these interest you and you wish to seek an allocation please contact James at [email protected] or call (02) 9238 1561.

Overall today, the ASX 200 lost -13 points or -0.22% to 6161. Dow Futures are currently trading down -52pts / -0.20%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

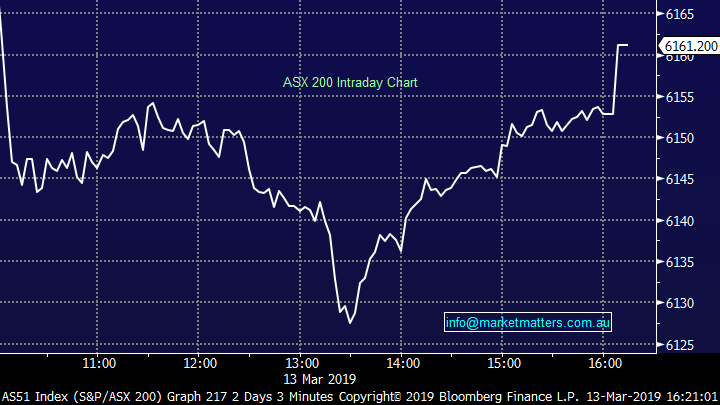

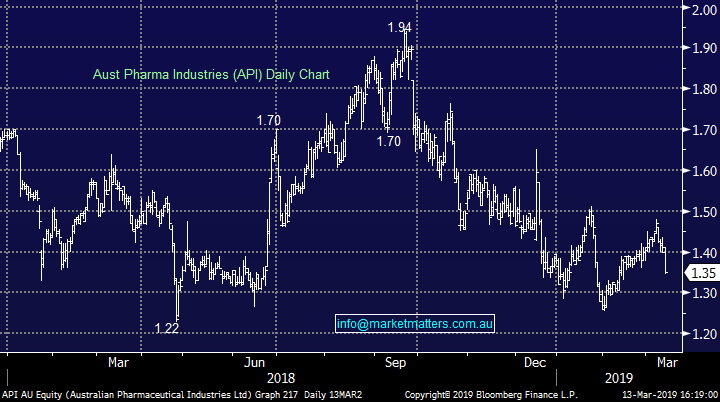

Two of the listed pharmaceutical wholesalers have slumped today following an announcement by the Sigma (SIG) board that they would not recommend the takeover offer by rival Australian Pharmaceuticals (API). Late last year, API offered $0.23 in cash and 0.31 API shares for each Sigma share, which as at yesterday’s close was worth about $0.66, 8% above Sigma’s close price. We wrote about the deal here. Today Sigma fell -12.3%, while API fell 3.57%.

Australian Pharmaceuticals (API) Chart

The deal came at a tough time for Sigma, which had recently lost a big contract with Chemist Warehouse. In the release, the board talks to the business review the company had completed, which noted “cost efficiencies of over $100 million” were identified in its business, compared to the $60m/pa efficiencies from FY22 seen in the merger. Additionally, through transformation, the EBITDA lost from the Chemist Warehouse contract would be replaced by FY23. In rejecting the proposal, the board also noted Sigma may look at corporate deals of their own as they expect “to have a strong balance sheet with minimal debt and will have upside opportunities from acquisitions.”

Sigma Healthcare (SIG) Chart

Major shareholders Allan Gray Investments clearly were disapproving of the board’s decision, the board could have taken the easy route and seen the immediate value uplift for shareholders by accepting the deal. Instead they went with the tougher route. In fairness, the proposal would have seen rigorous regulatory scrutiny and would likely had a number of hurdles to jump. We are cautious.

Broker Moves: UBS spent some time discussing the energy sector today, cutting their oil price deck which resulted in downgrades to Woodside and Santos. The changes were only marginal, revising this year’s assumed price down ~4%, while amending next year ~1% lower. The bank believes oil will largely trade between $US60-80/bbl despite noting economic headwinds, solid US production and a soft demand outlook. In this range, oil producers are not seen as incentivised to drastically change production levels.

· AusNet Downgraded to Hold at Morgans Financial; PT A$1.73

· Woodside Downgraded to Neutral at UBS; PT A$35.25

· Santos Downgraded to Neutral at UBS; PT A$7

· Carnarvon Rated New Buy at Canaccord; PT A$0.50

· Janus Henderson Upgraded to Overweight at JPMorgan; PT $29

OUR CALLS

No changes to either portfolio today.

Have a great night

Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 13/03/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence