Markets split between reporting & the circus in Canberra (WEB, QAN, IRE, STO)

WHAT MATTERED TODAY

Surely not…! It’s now being reported that Tony Abbot may throw his hat into the circus when the Liberals vote on a new leader at high noon tomorrow. Could it be that Tony Abbott has used poor old Peter Dutton as a sacrificial lamb before rising up from the back bench to take back what was rightfully his? This would all be comical if not for the fact these are our political leaders. Sportsbet have the current odds playing out at 4.12pm this afternoon….interesting to see the 12th Man (Simon Birmingham) at $91 and Mark Bouris at $101 - highlights what a joke this is all becoming!

It seems Turnbull has fallen on his sword, however Dutton doesn’t have the numbers by the look of it, even with the added support of his good mate Mathias Cormann. Interestingly, as we alluded to in the am report today, Julie Bishop is now looking for support and may have a crack at the title along with Scott Morrison. These two were firmly on Team Turnbull and a victory by either would be seen as a slight consolation prize for the outgoing PM. More to play out tonight, and again tomorrow. I’ve had more than enough already, however Julie Bishop as PM would certainly throw a spanner in the works for Labor.

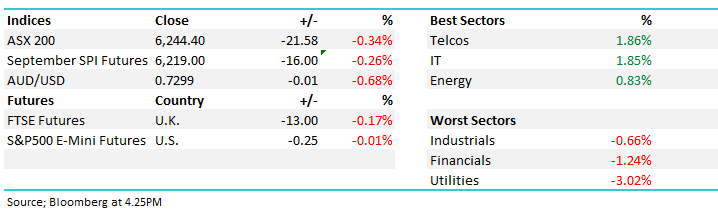

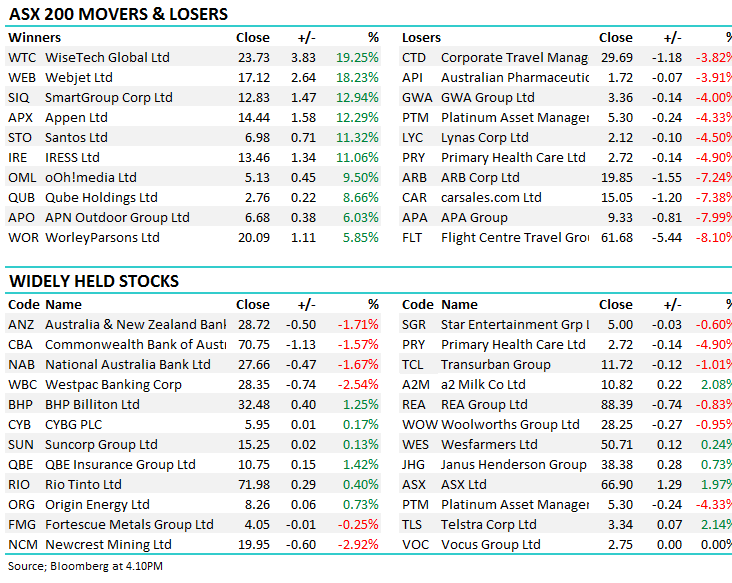

The market today was partly driven by the political circus in Canberra which prompted decent selling within the banking stocks. A combination of Labor’s policies around negative gearing (which is bad for property) and the abolition of cash franking credits put pressure on the financial sector, CBA down -1.57% to $70.75, NAB off -1.67% to $27.66, ANZ down -1.71% to $28.72 while WBC was hit by -2.54%. The big four took ~24points off the index.

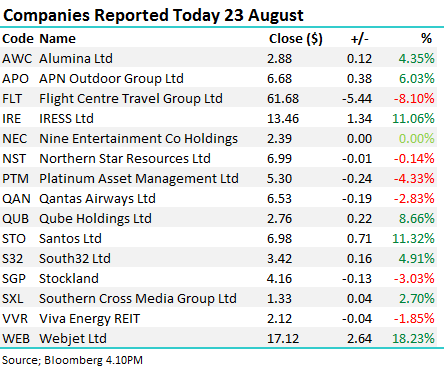

Elsewhere, reporting was in focus and again, there were some strong moves in both directions, but more so on the upside today. We owned IRESS (IRE) in the Growth Portfolio leading into today and took a ~17% profit following a good set of first half numbers. Webjet (WEB) had an exceptional move rallying +18% on results and guidance while there was some significant volatility from Qantas (QAN) after they booked a record profit today. More on these below.

Overall, the ASX200 found it hard going today with the index down -21 points today or -0.34% to close at 6244– Dow Futures are currently trading flat.

Reporting hit its peak today and peters off somewhat tomorrow with the following companies out; BXB, CHC, MPL, MYX, SCG, SGM, SGR, WPP . For a full list of company reporting dates – click here

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

Broker Moves; I’ve seen a lot of positive commentary out today on Santos (STO) as they rose to the highest in more than three years. They announced first dividend since 2016, less than a day after announcing a $2.15 billion purchase of fellow Australian oil and gas producer Quadrant Energy. The Quadrant deal will raise Santos’ reserves by more than a quarter and annual production by nearly one-third. Here’s what Shaw’s Analyst (Stuart Baker) penned today… After three years of asset sales, capex reduction and balance sheet repair, Santos is back on the front foot. Growth requires capital investment and this deal looks very good.

The first half result is overshadowed by the announced acquisition of WA gas and oil producer, Quadrant Energy for US$2.15B, plus bonus & incentive payments. Financially and strategically, this appears to be a very good transaction and addresses at least 4 critical E&P metrics (1) 2P reserves increased 220 MMboe, up 26% (2) Production increase +19 MMboe, up 32% (3) reduction in opex and break-even due to a lower cost base in the acquired assets compared to Santos current average. STO claims a $4/bbl reduction. In 2017 the Quadrant EBITDAX margin was 75%, higher than STO’s average of 50% in the same year (4) significant earnings and cash flow accretion. The deal is funded from existing cash & debt, and due to strong profitability and cash generation, the accretion is material. He’s been negative on STO (and very wrong for some time) and is now changing tact it would seem! The stock closed today up 11.32% to $6.98

Elsewhere;

· St Barbara Upgraded to Hold at Deutsche Bank; PT Set to A$4.20

· St Barbara Upgraded to Outperform at Macquarie; Price Target A$5

· St Barbara Raised to Overweight at JPMorgan; Price Target A$4.60

· St Barbara Upgraded to Hold at Canaccord; Price Target A$4.35

· Corporate Travel Downgraded to Neutral at UBS; PT A$32.20

· Corporate Travel Cut to Hold at Morgans Financial; PT A$32

· Cleanaway Downgraded to Neutral at UBS; PT A$2.15

· Altium Upgraded to Neutral at UBS; PT A$22

· Coca-Cola Amatil Downgraded to Sell at UBS; PT A$8.30

· Coca-Cola Amatil Cut to Neutral at Credit Suisse; PT A$9.80

· Coca-Cola Amatil Raised to Equal-weight at Morgan Stanley

· Inghams Downgraded to Underweight at Morgan Stanley; PT A$3.40

· Inghams Downgraded to Neutral at Goldman; PT A$4.20

· Trade Me Upgraded to Neutral at Macquarie; PT NZ$4.91

· Adelaide Brighton Downgraded to Neutral at Macquarie; PT A$6.45

· SmartGroup Upgraded to Outperform at Credit Suisse; PT A$12.10

· WorleyParsons Cut to Equal-weight at Morgan Stanley; PT A$20.13

· Reject Shop Upgraded to Buy at Goldman; PT A$6.70

· Charter Hall Cut to Neutral at JPMorgan; Price Target A$6.90

· Western Areas Upgraded to Overweight at JPMorgan; PT A$3.60

· Imdex Downgraded to Accumulate at Hartleys Ltd; PT A$1.36

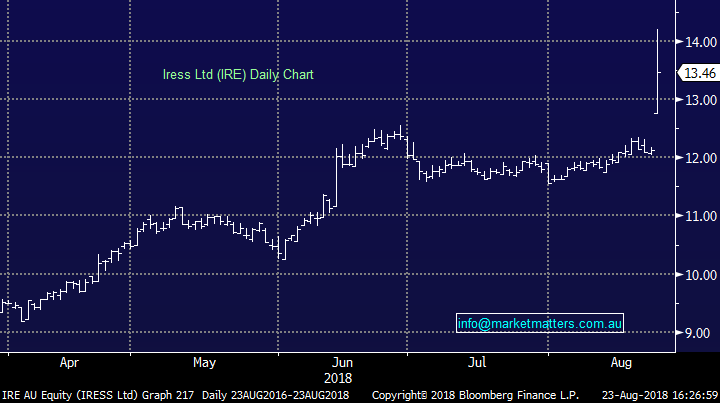

IRESS (IRE) $13.46 / +11.06%; IRESS (IRE) was out with their first half 2018 result today and the market sent the stock sharply higher in early trade (+14%). While consensus numbers are brief given it was only a half yearly result, they have produced a very strong outcome in the first 6 months which would imply that the market is now too conservative on full year estimations. For the half, profit was up 8% at $32m.

In terms of the outlook, they maintained their current guidance of 3-7% segment profit growth despite the strong first half, however we’d expect some upgrades to full year numbers to flow through on the back of today’s results.

IRESS (IRE) Chart

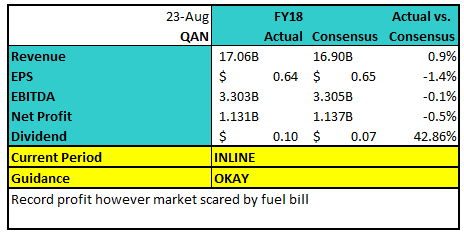

Qantas (QAN) $6.53 / -2.53%; A volatile day for QAN after they released full year earnings this morning – the stock trading in a ~10% range. An early sell off but some strong buying into the weakness as CEO Alan Joyce allayed concerns around higher fuel costs, saying they should be able to “more than cover” higher fuel costs in the domestic market! He didn’t match that pledge for the more competitive international market, saying only that Qantas will “substantially recover” the higher cost of jet fuel on those routes.

In terms of earnings, it was a record full year profit for QAN at $1.13b which was broadly in line with market expectations while the dividend was stronger than expected. Clearly this is a good result for QAN however the stock has run hard into it, plus they’ve now got the added headwind of higher fuel costs. To give some context here, QAN will spend around $3.92bn on fuel in FY19, which is up by about A$690 million on FY18.

QANTAS (QAN) Chart

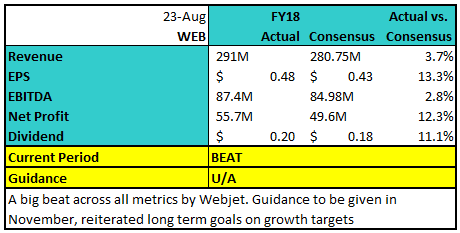

Webjet (WEB) $17.12 / +18.23%; FY18 earnings from Webjet hit the ticker this morning with a big beat to analysts’ estimates across the board. There is a lot of optimism built into Webjet at the moment however the online bookings company continues to meet and beat the markets lofty expectations. EBITDA grew 71% for the year and margins continue to expand as the company increases its offerings and drives growth.

Flight booking volume grew 10%, while hotel transactions more than doubled over the year. Cars & motorhome bookings also saw numbers rise while cruise was the only segment where bookings fell due to the slowdown in the cruise market. Margins across the group continued to rise despite the introduction of the ‘Netflix tax’ with GST charges for online services.

Webjet (WEB) Chart

OUR CALLS

We took a ~17% profit in IRESS (IRE) today in the Growth Portfolio

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 23/08/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here