Markets sell off into end of quarter (NUF)

WHAT MATTERED TODAY

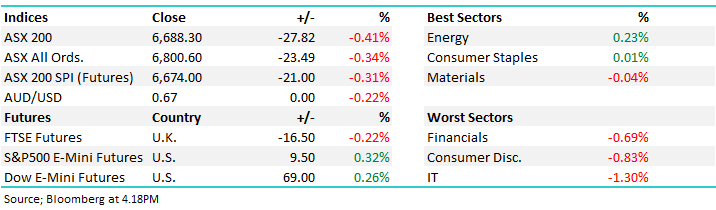

A choppy session for end of month / end of quarter trading with the usual end of period window dressing failing to materialise today. Normally we see big underperformers for the period being cut by fund managers so they don’t need to explain them away in quarterly performance reports, while the winners are often added to, particularly if a fund has held small weightings through the period and they want to show them as being more material…or perhaps I’m being too cynical here?

The market opened lower this morning, but only marginally so before a 1pm high at 6734 was put in. From then on it was all one way traffic with the market selling off for the afternoon, down ~50pts from the earlier highs + on the lows of the session. A very weak close for the quarter on big volume with a lot of market on close portfolios going through + big volume in the futures market (4k lots) which is a big line.

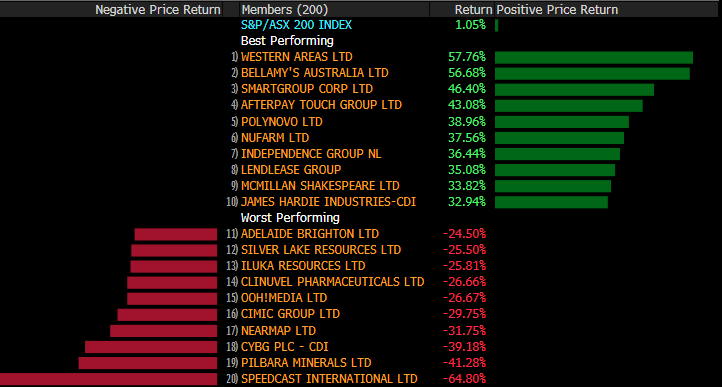

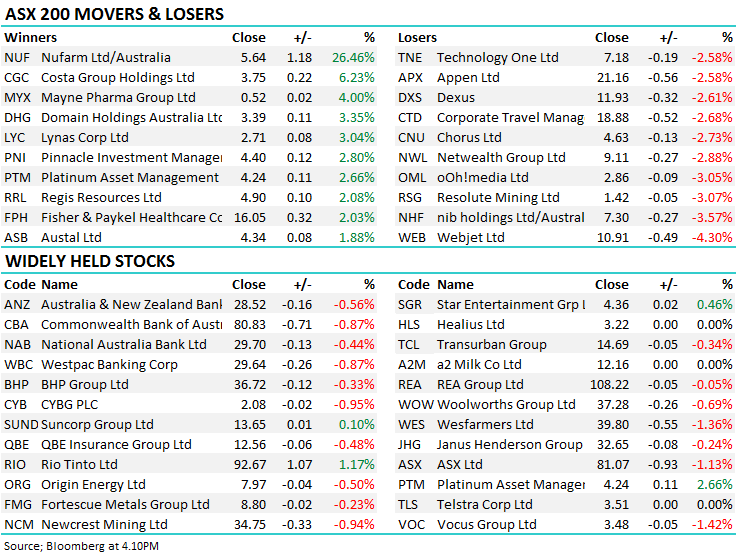

On the stocks / sector side today, Energy was best on ground today led by Woodside (WPL) which was up +1.09% while the IT stocks were weak following on from weakness in US based tech stocks Friday night, Appen (APX) trading back to our targeted ~$21 level, a pullback of more than 30% - bucking the weakness was Z1P Co (Z1P) today which put on +9.41%. Other standouts were Nufarm (NUF) which put on +26%, Harry covers below while Fruit & Veg supplier Costa (CGC) also had a good session up more than 6% today.

Overall, the ASX 200 lost -27pts today or -0.41% to 6688, Dow Futures are trading up +71pts / /+0.26%.

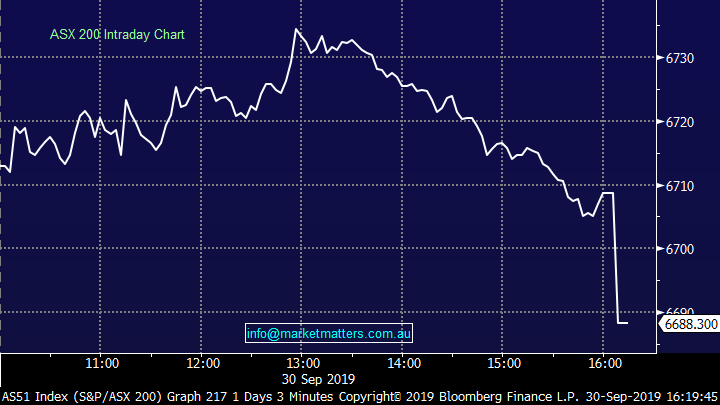

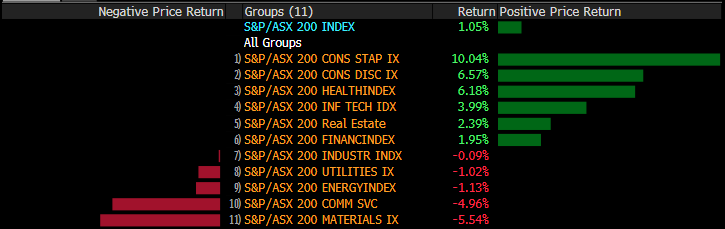

For the month, the ASX 200 added +1.27% while it was up +1.05% for the quarter. Stocks of note during September included Bellamy’s (BAL) which added +73% on a takeover, Premium Investments (PMV) +30% on a good earnings result, IOOF (IFL) +26% on a positive court ruling against APRA, Western Areas (WSA) +25% on Nickel supply issues while Costa Group (CGC) +19% bounced back after a poor result the prior month. On the flipside, Pro Medicus (PNE) was whacked +24% and CYBG (CYB) lost another 18% as the poor trend of performance continued for the UK based bank.

No change to our current view, with the ASX200 trading above the 6700 area, we’re comfortable being relatively defensive, at least for a few weeks / months.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE;

Quarterly Performance: Materials the weakest sector although Western Areas (WSA) was the strongest stock in the period thanks to supply issues in the Nickel market. The defensive staples sector which includes Coles (COL) & Woolies (WOW) had a great 3 months while the Tech stocks were strongest early before a number of them came off the boil. The high growth trade became a lot more stock specific during the period.

In terms of generic index valuations, the S&P/ASX 200 is trading at a price-to-earnings ratio of 19.5 on a trailing basis and 17.2 times estimated earnings of its members for the coming year. The index's dividend yield is 4.6 percent on a trailing 12-month basis

Sectors:

Stocks:

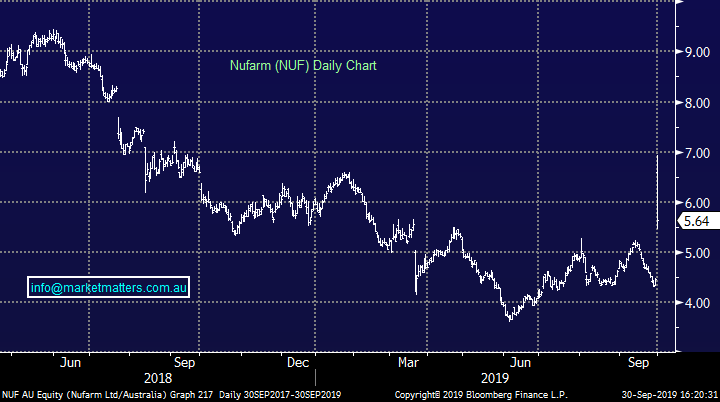

Nufarm (NUF) +26.46%; the crop protection company rocketed higher today on their FY19 results as well as announcing the sale of their South American arm to Japan’s Sumitomo for $1.2bn. The deal will see Nufarm give up around 25% of their profit, valuing the sold business on 10x FY19 EBITDA. The deal will see Nufarm’s stretched balance sheet vastly improve with over $950m from the proceeds to be used to pay down debt and reduce their capital costs by $60-70m/pa . Net debt fall to 0.7x EBITDA, down from 3x, falling back below their targets. The Nufarm board has unanimously recommended the deal if no superior offer comes forward saying the capital release will allow the company to focus on higher margin and stronger growth opportunities.

FY19 results were broadly above analyst forecasts with sales at $3.76b a 7.5% beat and EBITDA of $420m marginally better than expectations. Shares were seen as high as 55% better than Friday’s close before NUF gave up around half of the move as the session rolled on. The volatility today was assisted by the sizable short interest in NUF, which as of Thursday had the highest percentage of short interest in the top 200 at 17.71%.

Nufarm (NUF) Chart

BROKER MOVES; FMG underperformed today thanks to the below downgrade. Iron Ore was up +3% in Asia supporting a good run in RIO which put on +1.17% versus FMG which fell -0.23% to close at $8.80

· Fortescue Downgraded to Underperform at Credit Suisse; PT A$7.50

· Sydney Airport Rated New Underperform at RBC; PT A$7.50

· Westgold Rated New Outperform at Macquarie; PT A$3.50

· Webjet Downgraded to Neutral at Credit Suisse; PT A$11

· Northern Star Upgraded to Neutral at Goldman; PT A$11.20

· Saracen Mineral Raised to Buy at Argonaut Securities; PT A$3.50

OUR CALLS

No changes today.

Major Movers Today

Have a great night

James the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.